PetroVietnam’s 2024 Audited Consolidated Financial Statements Revealed

PetroVietnam’s financial overview

Vietnam National Oil and Gas Group (PetroVietnam or PVN) has released its 2024 audited consolidated financial statements, offering insights into the state-owned enterprise’s performance.

The group’s consolidated net revenue for 2024 reached nearly VND 558,602 billion, an increase of 8.1% compared to 2023. However, gross profit decreased by 7.6% to over VND 54,719 billion.

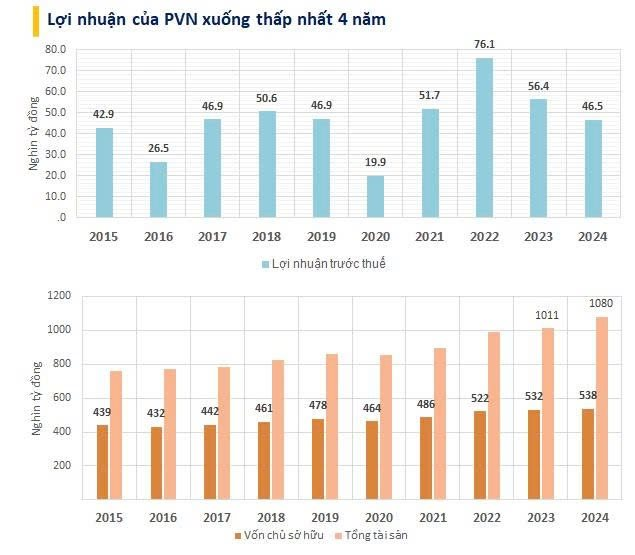

PVN’s consolidated pre-tax accounting profit was VND 46,496 billion, a decrease of approximately 17.5% from the previous year, marking the lowest profit in four years. The group’s net profit after tax reached VND 32,674 billion, a decline of nearly 19% year-on-year.

Breakdown of PVN’s financial position

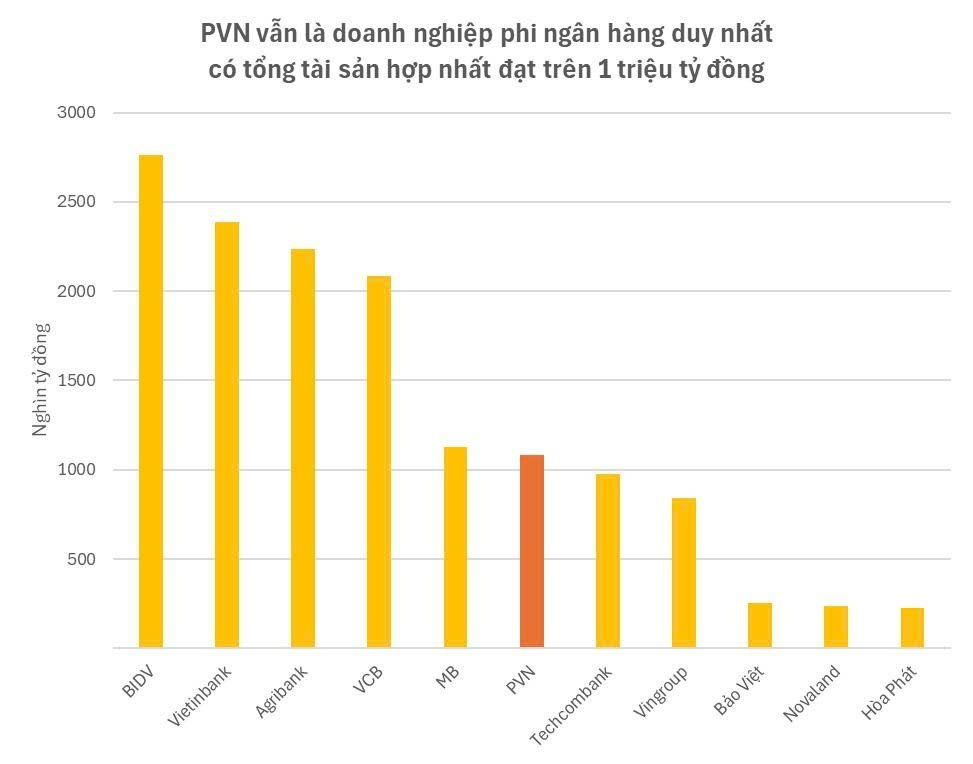

As of December 31, 2024, PVN’s total assets exceeded VND 1,080,000 billion, an increase of more than VND 69,000 billion from the beginning of the year. Cash and cash equivalents surged by nearly 59% to VND 136,381 billion, while the group also held nearly VND 280,000 billion in term deposits. Of this, over VND 88,000 billion was retained for the mine cleanup fund held on behalf of contractors.

The group’s total liabilities at the end of the year stood at approximately VND 542,456 billion, including loans totaling more than VND 290,000 billion. Consolidated owner’s equity reached VND 537,627 billion.

Deloitte Vietnam, the auditing firm, provided a qualified opinion on PVN’s consolidated financial statements, citing limitations on the scope of their audit related to specific subsidiaries and investments.

Key Subsidiaries and Financial Considerations

PVcomBank: PVcomBank, a subsidiary of PVN, is in the process of financial restructuring and implementing unique accounting policies as part of its debt resolution plan until 2030. The updated plan is currently under review by relevant authorities. The available information did not provide adequate audit evidence to determine the impact on PVcomBank’s 2024 financial data used in PVN’s consolidated financial statements.

PVEP’s Investment in Petromacareo: PVEP, a state-owned company under PVN, recorded an investment in Petromacareo at its original cost of VND 1,583 billion and made a full allowance of the same amount (unchanged from 2023). The auditor lacked sufficient evidence regarding Petromacareo’s financial position and operations as of December 31, 2024, to assess the impairment of this long-term financial investment.

VNPoly and PetroCons: These two financially distressed subsidiaries are working with relevant parties to assess their asset values and liabilities. The auditor was unable to obtain sufficient evidence regarding their recorded asset values, liabilities, and business results.

PVN consolidated the 2024 financial statements of these subsidiaries, prepared on a historical cost basis, with total assets of VND 8,909 billion, total liabilities of VND 13,304 billion, and a pre-tax accounting loss of VND 700 billion. As of December 31, 2024, VNPoly and PetroCons had accumulated losses of VND 7,184 billion and VND 3,998 billion, respectively.

DQS: PVN is working with stakeholders to implement policies under the DQS restructuring plan for 2026-2040, including financial arrangements and unique accounting policies. The auditor lacked sufficient evidence to determine the impact on DQS’s financial data, which reported a pre-tax loss of VND 150 billion.

Additionally, the auditor emphasized potential contingent liabilities related to domestic and overseas oil and gas activities, contract agreements with related parties, unresolved disputes, and the handling of conclusions from competent authorities regarding certain investment projects involving PVN’s subsidiaries.

What’s the Story Behind SMC’s Owed Receivables of Over VND 1,100 Billion from Novagroup?

The Ho Chi Minh City Stock Exchange (HoSE)-listed SMC Trading Investment JSC (SMC) has submitted a document to the HoSE to explain the emphasis of matter in its 2024 audited financial statements.

“Novaland’s Receivables and Going Concern: SMC’s Response to the Audit Emphasis”

“Following the independent auditor’s report from Moore AISC, which included emphasis-of-matter paragraphs regarding trade receivables from the Novaland Group and going concern in the 2024 audited financial statements, CTCP Trade and Investment SMC (HOSE: SMC) submitted an explanatory letter to the Ho Chi Minh Stock Exchange (HOSE) on May 20, 2025. In the letter, the company also addressed its plan to rectify consecutive years of losses.”

“Thuduc House Faces Tax Enforcement of Over 88.9 Billion VND”

Thuduc House, a prominent real estate company, faced consequences for delinquent tax payments. With taxes overdue by more than 90 days past the deadline, the company was subject to enforcement measures. The authorities imposed a halt on their usage of invoices, with the enforced tax amount totaling over 88.9 billion VND.