The VN-Index hovered above the 1340-point mark for the second consecutive session, but lacked decisive momentum. The index struggled to gain traction in the morning session, with the highest increase being a mere 6 points, before gradually sliding and closing 0.01 points lower, effectively erasing the previous gains.

Today’s performance was a step back from the previous session, as the large-cap stocks failed to keep the index in positive territory, despite some back-and-forth movements. Among the top 10 largest market capitalization stocks on the VN-Index, VHM rose 1.59%, TCB gained 0.98%, and VPL increased by 0.57%. VHM managed a slight 0.4% increase before the closing auction, but ultimately surged higher. TCB followed a similar pattern, ending the regular trading session at the reference price. VHM alone contributed nearly 1.2 points to the index, keeping the loss negligible.

Meanwhile, the blue-chip stocks in the VN30 index appeared lackluster, with only 8 stocks posting gains against 21 decliners. Some stocks witnessed notable declines, such as PLX falling 1.69%, CTG dropping 1.64%, BVH down 1.53%, and SHB decreasing by 1.45%. However, the impact of these blue chips on the broader market remained limited. The HOSE exchange still witnessed a relatively balanced market breadth, with 157 gainers and 161 losers. Active trading continued in select stocks that could attract cash flow.

NVL hit the ceiling price, joined by NTL and HVH. NVL also ranked second in market liquidity, with a trading value of nearly VND 864 billion. EIB, PDR, NLG, HDC, TCH, PNJ, EVF, and VPI, mid-cap stocks, witnessed robust trading with gains of over 1% and liquidity exceeding VND 100 billion.

On the flip side, several hot stocks faced profit-taking pressure and turned downward. VSC plunged to the floor price after a 4.3% drop in the previous session. This stock had surged nearly 77% before peaking. VND, DIG, VCI, HCM, HVN, FTS, and DGC were other stocks that plummeted with high liquidity.

The VN-Index’s indecisive performance within the peak region resulted from the tug-of-war among large-cap stocks and the speculative nature of mid- and small-cap stocks.

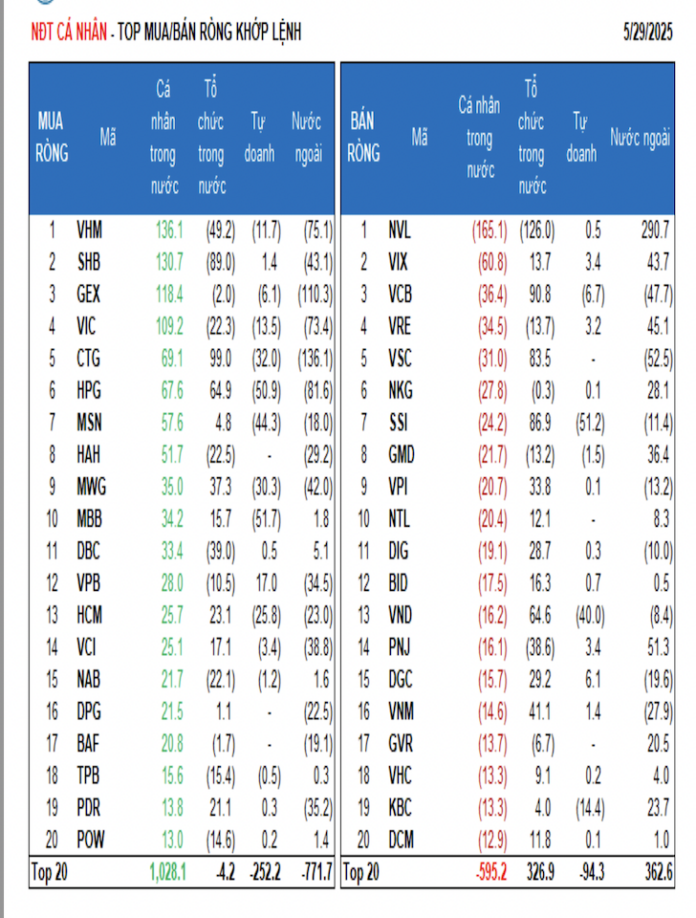

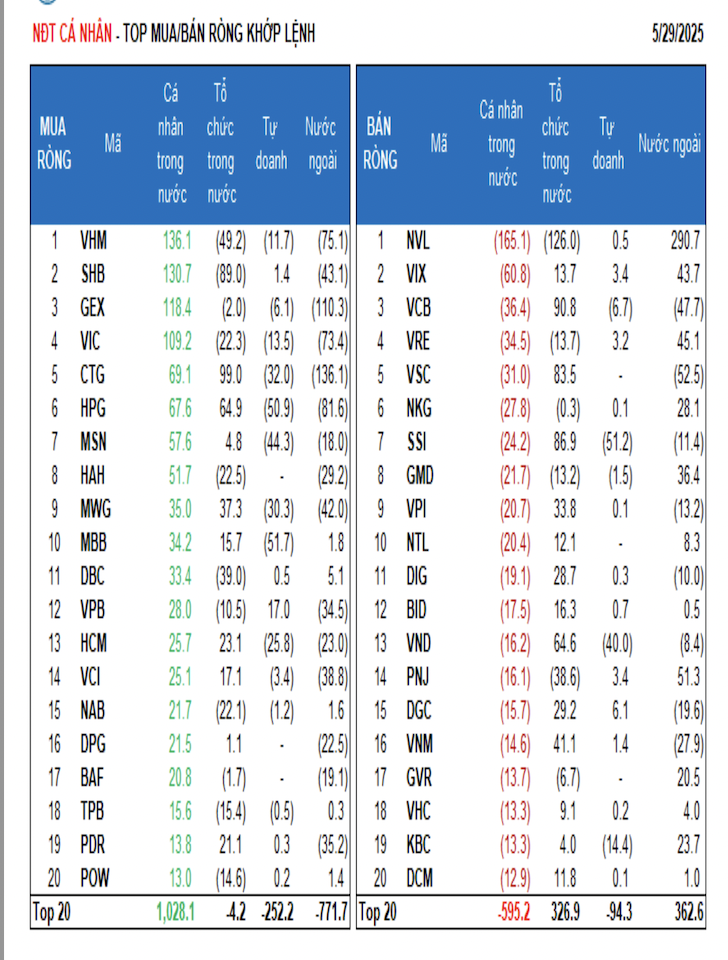

The combined trading volume of the three exchanges reached nearly VND 23,000 billion. Foreign investors net sold VND 304.6 billion, with a net sell of VND 341.4 billion in matched orders. Their net buy in matched orders focused on the real estate, personal and household goods sectors. The top net bought stocks by foreign investors in matched orders included NVL, NLG, EIB, PNJ, VRE, VIX, VCG, GMD, NKG, and CII.

On the selling side, foreign investors net sold the banking sector in matched orders, with the top stocks being CTG, GEX, HPG, VHM, VIC, STB, VCB, SHB, and MWG.

Individual investors net bought VND 471.2 billion, with a net buy of VND 547.4 billion in matched orders. In matched orders, they net bought 11 out of 18 sectors, mainly focusing on the banking sector. Their top net bought stocks included VHM, SHB, GEX, VIC, CTG, HPG, MSN, HAH, MWG, and MBB.

In terms of net selling, they net sold 7 out of 18 sectors in matched orders, primarily in the financial services and chemicals sectors. The top net sold stocks included NVL, VIX, VCB, VRE, VSC, NKG, GMD, VPI, and NTL.

Proprietary trading arms of securities firms net sold VND 610.3 billion, with a net sell of VND 611.0 billion in matched orders.

In matched orders, proprietary trading arms net bought 4 out of 18 sectors. The top net bought sectors were chemicals, automobiles and components. The top net bought stocks by proprietary trading arms today included VPB, FUEVFVND, DGC, STB, DRC, VIX, PNJ, VRE, DPM, and VNM. On the selling side, they focused on the banking sector, with the top net sold stocks being TCB, MBB, SSI, HPG, MSN, ACB, VND, DXG, FPT, and KDH.

Domestic institutional investors net bought VND 399.1 billion, with a net buy of VND 405.0 billion in matched orders. In matched orders, domestic institutions net sold 6 out of 18 sectors, with the largest net sell being in the real estate sector. The top net sold stocks included NVL, SHB, NLG, EIB, VHM, DBC, PNJ, PHR, HAH, and CII. On the buying side, they focused on the financial services sector, with the top net bought stocks being CTG, VCB, SSI, VSC, TCB, HPG, VND, FPT, STB, and VNM.

The value of negotiated transactions today reached VND 918.7 billion, down 47.4% from the previous session, contributing 4.0% to the total trading value. Notable transactions were seen in TCB, with over 4.7 million shares worth VND 154.8 billion traded between foreign institutions.

The money flow allocation increased in real estate, banking, steel, electrical equipment, and personal goods sectors, while decreasing in securities, chemicals, agricultural and marine products, food, retail, oil and gas, software, mining, and electricity production and distribution sectors.

In terms of matched orders, the money flow allocation increased in the large-cap VN30 and mid-cap VNMID groups, while decreasing in the small-cap VNSM group.

The Hot Stock Divide: VN-Index’s “Quirky” Rise

The mounting pressure on blue-chip stocks dragged the VN-Index down for most of today’s afternoon session. It would have dipped further than 0.01 points if it weren’t for the sudden boost to VHM in the final trading phase. A divergence is emerging, with sell-offs in previously hot stocks while others are being aggressively pushed up.

The Red Sea of Stocks: Foreign Investors Sell-Off Billions

The selling pressure soared on the last trading day of the week, with most stocks, blue-chips, and speculative plays, ending in the red. Although VIC and VHM attempted to prop up the VN-Index, which closed down only 0.69%, over 41% of stocks on this exchange lost more than 1% of their value. Foreign investors offloaded a net sell of over VND1,000 billion for the second time this week.

The Foreigners’ Frenzy: A $50 Million Sell-Off in the Week’s Final Session

Today’s liquidity across the three exchanges remained high, with a matching value of VND 24.5 trillion, of which foreign investors net sold VND 1,123.6 billion, and net sold VND 1,085.9 billion in matched orders alone.

The Stock Market Slump: VN-Index Stumbles at the Peak Once Again

Today, the market witnessed a potential breakthrough as the VN-Index surged past 1,348.31 points, marking an impressive intraday gain of approximately 6.4 points and briefly touching yesterday’s peak. However, the inability of blue-chip stocks to sustain their prices dampened the momentum, resulting in a prolonged downward slide for the index during the majority of the morning session.