Gold prices tumbled on Friday, May 30, as a stronger US dollar weighed on the precious metal, despite escalating trade tensions and weaker-than-expected US inflation data increasing the likelihood of an early Federal Reserve rate cut. With this decline, gold prices ended the week lower, capping off a largely stagnant month, despite continued support from uncertainties surrounding President Donald Trump’s tariff policies.

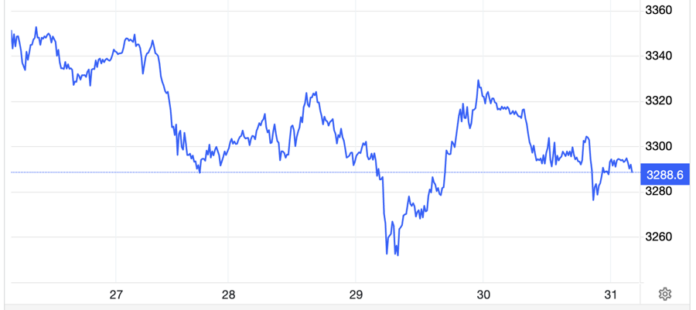

At the close of trading in New York, spot gold fell by $28.9/oz, or 0.87%, to settle at $3,290.3/oz, according to Kitco exchange data. Converted at Vietcombank’s selling rate, this price is equivalent to about VND 103.9 million per tael, a decrease of VND 900,000 per tael compared to yesterday’s morning session.

Vietcombank quoted the USD at VND 25,810 (buying rate) and VND 26,200 (selling rate) at the week’s close, up VND 10 at each price point compared to Friday morning. For the week, Vietcombank’s USD rates increased by VND 70 on both buying and selling sides.

On COMEX, gold futures for July delivery fell by 0.9% to close Friday’s session at $3,315.4/oz.

Gold prices declined by about 1.9% for the week, but the monthly close for May remained largely unchanged from April’s settlement price.

The US Dollar Index, which measures the greenback’s strength against a basket of six major currencies, rose by 0.16% on Friday, settling at 99.44. For the week, the index gained 0.33%, according to MarketWatch data. However, the Dollar Index posted a monthly loss of 0.59% for May.

Investors had a lot to digest during Friday’s trading session.

Data released by the US Commerce Department showed that the Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred inflation measure, rose 2.1% year-over-year in April, the smallest increase in four years. This indicates that inflationary pressures in the US economy continue to ease despite some of Trump’s tariff plans taking effect.

Softer inflation could pave the way for the Fed to cut interest rates sooner, creating a favorable environment for gold prices. Markets continue to predict a rate cut by September. However, Fed officials remain cautious, expressing concerns about the unpredictability of future inflation risks.

President Donald Trump stated in a social media post that China was “breaking the trade deal” they had with the US. Subsequently, Bloomberg News reported that the White House was considering extending restrictions on Chinese technology firms. On Thursday, US Treasury Secretary Scott Bessent told Fox News that US-China trade negotiations were “stalling a bit.”

The ongoing trade tensions continue to fuel safe-haven demand for gold. However, glimmers of hope for a potential trade deal remain a restraining factor for gold’s upside potential.

“Gold prices are pulling back from recent highs, undergoing a period of consolidation,” said David Meger, a senior analyst at High Ridge Futures, in an interview with Reuters. “Gold is facing some mild pressure, and we will likely see a reduction in safe-haven demand. But the potential for trade tensions to flare up again means that gold will likely find support.”

The world’s largest gold-backed ETF, SPDR Gold Trust, reported no net changes in its holdings on Friday, maintaining its gold reserves at 930.2 tons. For the week, the ETF purchased nearly 8 tons of gold. However, SPDR Gold Trust offloaded 14 tons of gold during May, indicating a monthly net sale.

Gold Prices Plummet as Trump’s Tariffs are Blocked

The direct cause of the sharp drop in gold prices during the Asian session this morning was the news of legal hurdles facing Trump’s retaliatory tariff plans.

Gold, Oil, Rubber, and Iron Ore Markets: A Day of Declines

The commodities market witnessed a broad-based decline with gold prices dipping for the second straight session, iron ore and wheat slipping for the third consecutive session, and cacao falling for the fifth session in a row. This downward trend comes on the back of the US tariff reprieve for EU goods and a stronger US dollar.

Silver Prices Today, May 26th: Steady After a Week of Strong Gains

The silver market, both domestically and globally, experienced a buoyant week as capital continued to flow into precious metals.