The Hanoi Stock Exchange (HNX) has announced the delisting of nearly 62 million SCY shares of Song Cam Shipbuilding Joint Stock Company from the UPCoM market. The last trading day was June 19, and the official delisting date was June 20.

The delisting occurs because SCY no longer meets the requirements of a public company. According to a document dated May 21, 2025, from the State Securities Commission of Vietnam (SSC), SCY falls under the category of public companies with an overly concentrated shareholder structure. Specifically, as of March 31, 2025, data provided by VSDC showed that the company had only 363 minor shareholders, holding 2.38% of the voting shares, while two major organizational shareholders owned almost the remaining shares. The Shipbuilding Industry Corporation (SBIC) held 90.08% of the capital, and Bach Dang Shipbuilding One-Member Limited Company owned 7.54%.

The cancellation of SCY’s public company status was approved at the 2025 Annual General Meeting of Shareholders, as per the resolution dated April 25.

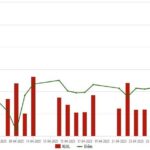

SCY shares plunged over 30% before departing UPCoM

SCY, a subsidiary of SBIC with a charter capital of nearly VND 620 billion, was formerly known as “Hai Phong Mechanical” established in 1959. After equitization, SCY operated as a joint-stock company from April 2008 and officially traded on UPCoM from October 2017. For over five years, SCY shares saw negligible trading activity until late November 2022, when liquidity and volatility surged.

The stock once hit a bottom of VND 5,500/share in early December 2022, losing more than half of its market price within a few weeks. Subsequently, SCY soared vertically to an all-time high of over VND 18,500/share in late June 2023, followed by a sharp plunge and abnormal fluctuations until now.

SCY share price movement on the stock exchange – Source: VietstockFinance

|

This week, SCY declined for four consecutive sessions, falling from VND 14,500/share to VND 10,000/share in the morning session of May 31, a drop of 31%, returning to the price range of late November 2024. However, liquidity remained low, with only about 2,300 shares traded per session over the past year due to concentrated ownership.

The enterprise maintains cash reserves, consistent profitability, and zero financial debt

In contrast to the prolonged losses of its parent company, SBIC, SCY has demonstrated stable operations and sustained growth over the years. Revenue consistently increased, peaking at VND 1,036 billion in 2024, more than doubling in four years. Net profit in 2024 reached a record VND 81 billion, increasing sixfold in six years. This positive performance resulted from rising revenue and significant reductions in financial and selling expenses.

| SCY’s Annual Business Results |

A critical factor in SCY’s sustained growth has been its strategic partnership with Damen Group (the Netherlands). From 2002 to the present, SCY has delivered a total of 350 specialized vessels to Damen for export orders.

The first quarter of 2025 continued this growth trajectory, with revenue of VND 311 billion and pre-tax profit of over VND 25.5 billion, increases of 9% and 24%, respectively, compared to the same period last year. This performance fulfilled 32% of the revenue target and 47% of the profit plan for the year. Net profit reached VND 20.4 billion, a 24% increase.

SCY has also consistently paid cash dividends for three consecutive years, with rates of 5.2%, 3.8%, and 5% for 2022, 2023, and 2024, respectively. For 2025, the company plans to distribute a minimum dividend of 2%.

As of March 31, 2025, SCY’s total assets amounted to VND 1,681 billion, including over VND 657 billion in cash and bank deposits, accounting for 39% of total assets. Retained earnings after tax reached over VND 157 billion. Notably, the company had no financial debt.

Regarding SBIC, SCY’s parent company, at the end of 2023, the government announced a plan to handle it by allowing SBIC and seven of its subsidiaries to go bankrupt. However, Song Cam Shipbuilding was excluded from this plan and will be handled by recovering state capital without being subject to bankruptcy.

Meanwhile, another SBIC subsidiary, Vinashin Ocean Shipping Joint Stock Company (Vinashinlines), ceased operations on May 5, 2025, due to insolvency.

Vinashinlines officially bankrupt

“Defying the ‘Sell in May’ Adage, Bank Stocks Remain Attractive in May”

Contrary to the usual “Sell in May” sentiment that often makes investors hesitant, the Vietnamese stock market in May 2025 witnessed a positive performance from bank stocks. As the market leaders, bank tickers not only steered the VN-Index but also demonstrated enduring allure amid market fluctuations.

“Harec Building Owner Locks in 30.5% Dividend Yield.”

The Harec Investment and Trading JSC (UPCoM: HRB), owner and operator of the prestigious Harec Building in Hanoi, has announced the record date for shareholders to receive cash dividends for the year 2024. Shareholders on record as of May 21st, 2025, will be eligible to receive this dividend payment.

What were the Most Purchased Stocks by Foreign Investors on HNX in April?

In April 2025, foreign investors continued their net-selling trend in both the listed and UPCoM stock markets. However, a select few stocks remained attractive to foreign investors, bucking the overall outflow trend.