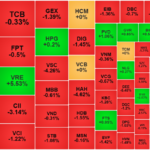

Profit-taking pressure at the peak pushed the market into a tug-of-war state. The VN-Index was pushed below the reference point at times. The VN30 basket had up to 15 declining stocks, while only 10 codes increased. If it weren’t for the Vingroup’s support, the VN-Index would have been adjusted.

Red dominated the VN30 group.

Once again, the driving force that pulled the main index back to green was the Vingroup. VIC, VHM, and VRE contributed up to 4.5 points, with VRE rising 5.5% to 26,700 VND/unit. Next was VIC, up 2.65% to VND 97,000 per share. These are also the two codes with the strongest increases in the VN30 basket. VHM and VPL rose by about 1%.

In addition, support from oil and gas stocks also contributed to the market’s push. BSR, PLX, and GAS were among the leading indices. PVD, PVS, PVC, and OIL were all in the green.

After 4 consecutive gaining sessions of the VN-Index, many industries and stocks faced profit-taking pressure. Red dominated in banking groups, with TCB, MBB, VPB, HDB, and EIB falling simultaneously. However, the decline was only around the 1% threshold, so the impact on the market was not significant. Industries such as technology, retail, and insurance were in a similar state.

Foreigners continued to sell, putting certain pressure on the market. According to experts, the VN-Index is heading towards the resistance area around 1,343 points. If it surpasses this threshold, the index may continue to rise in the short term. However, investors need to be cautious about the possibility of technical adjustments after a strong rally.

At the end of the trading session, the VN-Index rose slightly by 2.06 points (0.15%) to 1,341 points. The HNX-Index increased by 1.77 points (0.8%) to 223.56 points. The UPCoM-Index closed up slightly by 0.45 points (+0.46%) to 98.59 points.

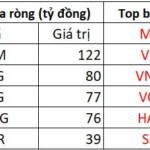

Liquidity decreased slightly, with a trading value of more than VND 22,284 billion. Foreigners continued to net sell VND 211 billion, focusing on VCI, VNM, and VCB…

The Foreign Sell-Off Continues: Over $200 Billion Sold and a Major Securities Stock Dumped

The top stocks that witnessed net foreign selling in the tens of billions of VND include VNM (-82 billion VND), VCB (-62 billion VND), and HAH (-59 billion VND).

Profits Pressure Mounts, Blue-Chip Stocks Keep Index in the Green

The market took a significant turn for the worse in the afternoon session as bottom-fishing stocks from the volatile May 26 session flowed into accounts. It wasn’t just the weakness in blue-chips that pushed the VN-Index below reference levels; the contraction in breadth also indicated a widespread decline in stock prices.

The Powerhouse Stocks Push VN-Index to New Heights, but Trading Volume Takes a Surprising Dip

The HoSE saw three of its top 10 large-cap stocks surge by over 1% this morning, providing a significant boost to the VN-Index, which climbed to 1345.86, a 0.45% increase. With this rise, the index has surpassed its 36-month peak witnessed in mid-March. However, the market enthusiasm was muted, with HoSE’s matching liquidity dropping by 18% compared to yesterday’s morning session.