Selling pressure soared in the final session of the week, with both blue-chips and speculative stocks mostly trading lower. While VIC and VHM attempted to support the VN-Index, resulting in a 0.69% decline, over 41% of the stocks on this exchange lost more than 1% of their value. Foreign investors offloaded a net amount of over VND 1,000 billion for the second time this week.

The market turned sour early on, with red dominating the screens in the latter half of the morning session. The large caps managed to hold their ground, allowing the VN-Index to hover around the flatline, slightly in the negative territory. In the afternoon, selling pressure intensified, narrowing the breadth and pushing the index further down. While the Midcap and Smallcap segments dropped 1.12% and 0.82%, respectively, the VN30 managed to limit its loss to 0.55%, and the VN-Index fell by 0.69%.

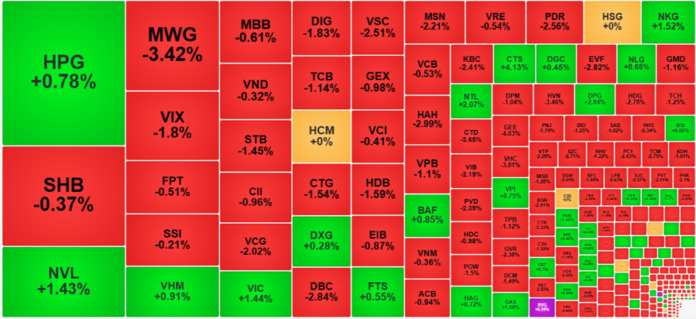

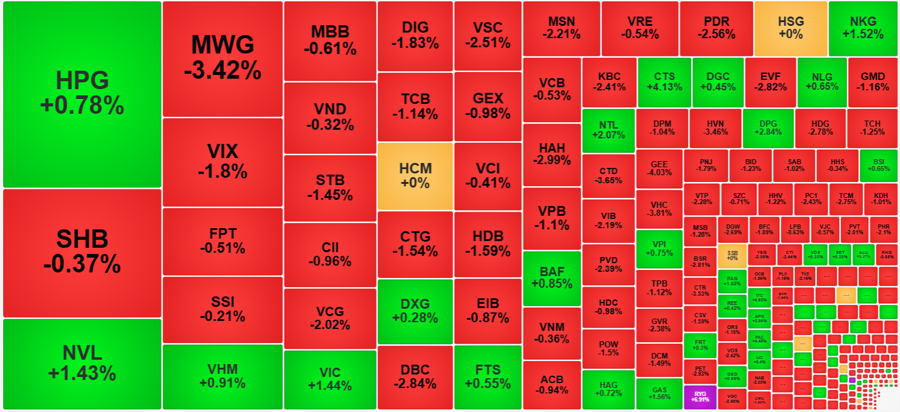

VIC, VHM, and GAS, with gains of 1.44%, 0.91%, and 1.56%, respectively, were the large caps that contributed positively to the index today. However, the overall performance of the blue-chip basket was disappointing, with 25 decliners out of 30 stocks. Moreover, half of these stocks (15) lost more than 1%. Under such circumstances, despite the modest decline in the index, investors faced significant losses. MWG, MSN, and VIB were among the heavily sold-off blue chips, plunging 3.42%, 2.21%, and 2.19%, respectively, with substantial liquidity. Other stocks that declined by over 2% include BCM, GVR, and VIB.

Foreign investors offloaded a net amount of VND 637 billion worth of stocks in the VN30 basket, with significant outflows observed in MWG (-VND 171.6 billion), HPG (-VND 158 billion), STB (-VND 117.9 billion), CTG (-83.9 billion), HDB (-VND 46.5 billion), VRE (-VND 40.6 billion), MSN (-VND 39.6 billion), and SAB (-VND 38 billion). Among these, only HPG managed to buck the trend, climbing by 0.78%. For the decliners, most stocks closed at their intraday lows or just a notch above.

The situation in the broader market was not much better. The narrow breadth reflected the predominantly negative price action. With 155 stocks losing more than 1%, today was a fairly damaging day for investors. Notably, several mid and small-cap stocks witnessed aggressive selling, resulting in sharp declines; VCG fell by 2.02%, DIG by 1.83%, DBC by 2.84%, VSC by 2.51%, PDR by 2.56%, HAH by 2.99%, KBC by 2.41%, EVF by 2.82%, CTD by 3.65%, HVN by 3.46%, and HDG by 2.78%. These stocks witnessed substantial liquidity, indicating proactive selling by market participants, who were eager to offload their positions at lower prices.

A glimmer of hope remained in the contrarian group, where, out of 97 gainers, only about 15 stocks managed to record decent liquidity of VND 10 billion or more while also climbing by more than 1%. NVL stood out with its impressive performance, maintaining its upward trajectory for the 35th consecutive session, with a cumulative gain of approximately 75%. Today, it briefly dipped towards the reference price before rebounding strongly. NVL witnessed substantial trading activity, with a turnover of VND 832.7 billion, and closed 1.43% higher. DPG also displayed a remarkable performance, surging by 2.84% after two days of mild corrections. Its uptrend has spanned 35 sessions, with a cumulative gain of nearly 63%. Other actively traded stocks included NKG, with a turnover of VND 224.4 billion and a gain of 1.52%; CTS, with a turnover of VND 158.4 billion and a gain of 4.13%; and NTL, with a turnover of VND 138.7 billion and a gain of 2.07%. Stocks with smaller liquidity that recorded notable gains included PAN (+1.68%), AGG (+2.37%), ITC (+4.63%), APG (+2.54%), PAC (+4.49%), and ELC (+1.35%).

Undoubtedly, there will always be contrarian stocks in any market environment. However, the challenge lies in their scarcity, limiting investors’ options. Moreover, a portfolio typically comprises multiple stocks, and a single gainer may not offset the losses incurred by the rest. Today’s total trading volume across the two exchanges witnessed a slight increase of 4.3% compared to the previous day, amounting to VND 22,427 billion in matched transactions. Nonetheless, the breadth deteriorated significantly. Yesterday, the market displayed a relatively balanced performance, with one gainer for every decliner (1.01), whereas today, there were only 0.42 gainers for every declining stock.

Another notable aspect today was the substantial net selling by foreign investors, amounting to VND 1,083 billion on the HoSE. This was the second instance of net selling exceeding VND 1,000 billion within this week, following a similar occurrence on May 27, when net selling reached VND 1,126 billion. This indicates that foreign investors are also engaging in short-term trading strategies. In addition to the heavy outflows from blue chips, notable net selling was observed in DIG (-VND 74.6 billion), PDR (-VND 73.1 billion), DPM (-VND 67.6 billion), DGC (-VND 62.5 billion), HAH (-62.2 billion), PVD (-VND 54.9 billion), VHC (-VND 47.8 billion), HSG (-VND 46.6 billion), and KBC (-VND 45 billion).

The Stock Market Slump: VN-Index Stumbles at the Peak Once Again

Today, the market witnessed a potential breakthrough as the VN-Index surged past 1,348.31 points, marking an impressive intraday gain of approximately 6.4 points and briefly touching yesterday’s peak. However, the inability of blue-chip stocks to sustain their prices dampened the momentum, resulting in a prolonged downward slide for the index during the majority of the morning session.

Stock Market Blog: Hot Stocks Take a Tumble

A significant profit-taking event occurred in the mid and small-cap stock categories early today, intensifying as the day progressed. Although the VNI remained relatively stable, propped up by heavyweights like VIC, VHM, and GAS, limiting the decline, hundreds of stocks plummeted by over 1%, facing substantial selling pressure.