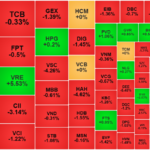

The VN-Index has recovered nearly 250 points (almost a 23% gain) since its low in early April, following the tariff shock (1,094 points). Today, it stands at just under 1,300 points, with some volatility as it nears its previous peak. While the large-cap VN30 stocks exerted downward pressure at times, today’s gains were not heavily reliant on these anchors, as the VN30 index showed some diversification, with 11 stocks declining.

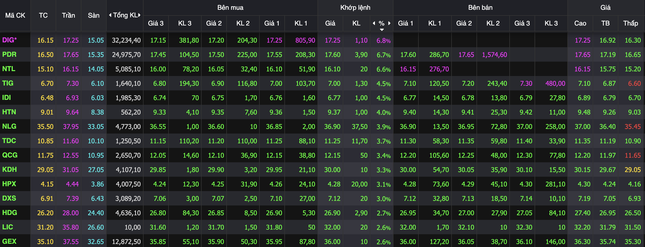

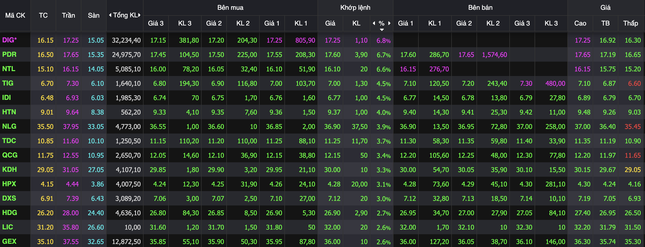

A bright spot in today’s peak-setting session was the maritime transportation group. HAH and GMD soared, reaching their daily limit-up levels. Other stocks in the sector, including PHP, SGP, VSC, DXP, VOS, and MVN, also witnessed robust buying interest. The US-China trade truce has investors optimistic about this sector, anticipating a boost in international trade and, consequently, a surge in cargo transportation demand.

Notably, the group of shareholders of Viconship (VSC) has been actively purchasing HAH stocks ahead of the upcoming shareholder meeting of Hai An Transport and Stevedoring Joint Stock Company (HAH). From May 20 to 22, the VSC group, including its two subsidiaries, acquired over 2 million shares, raising their total holdings to more than 17.1 million shares (13.2%). In just one month, HAH has climbed nearly 60% and is currently trading at VND 84,400 per share.

Real estate group continues to attract investment capital.

Investment capital also flowed into the real estate stock sector, with DIG reaching its daily limit-up level. Stocks such as DXG, NVL, PDR, CII, and GEX witnessed price increases alongside high trading volumes. VHM rose by more than 1%, while other Vingroup stocks showed lackluster performance.

VPL, the Vinpearl stock, was the biggest drag on the market today. It has been on a downward trajectory for five consecutive sessions. Previously, after its debut on the stock exchange in May, VPL had a notable upward trend, briefly pushing its market price above the VND 100,000 per share mark. However, in just one week, it has dropped by 12% and is currently trading around VND 87,200 per share.

At the end of the trading session, the VN-Index climbed 7.3 points (0.55%) to 1,339.81 points. The HNX-Index rose 2.38 points (1.08%) to 221.79 points, while the UPCoM-Index gained 1.41 points (1.46%) to reach 98.14 points. Market liquidity increased, with the trading value on HoSE exceeding VND 24,920 billion.

Meanwhile, foreign investors net sold over VND 1,175 billion, focusing on stocks like HPG, VIX, VIC, VCB, and NVL.

Profits Pressure Mounts, Blue-Chip Stocks Keep Index in the Green

The market took a significant turn for the worse in the afternoon session as bottom-fishing stocks from the volatile May 26 session flowed into accounts. It wasn’t just the weakness in blue-chips that pushed the VN-Index below reference levels; the contraction in breadth also indicated a widespread decline in stock prices.

The Powerhouse Stocks Push VN-Index to New Heights, but Trading Volume Takes a Surprising Dip

The HoSE saw three of its top 10 large-cap stocks surge by over 1% this morning, providing a significant boost to the VN-Index, which climbed to 1345.86, a 0.45% increase. With this rise, the index has surpassed its 36-month peak witnessed in mid-March. However, the market enthusiasm was muted, with HoSE’s matching liquidity dropping by 18% compared to yesterday’s morning session.