In recent weeks, MSH has made a strong recovery since its April lows, outperforming the market and returning to pre-tariff shock levels. As of the latest trading session (May 29), MSH traded at 57,000 VND per share, reflecting a 10% increase since the start of 2025 and nearing its all-time high.

At this price level, FPTS is estimated to generate approximately 68 billion VND from the sale of MSH shares.

| MSH rebounds swiftly after tariff shock |

According to FPTS’ announcement, the purpose of the transaction is to conduct proprietary trading. The last time the securities company sold MSH shares was from April to May 2022, executing nearly 90,000 shares out of the registered 883,000 shares.

The investment in MSH has long been known as an extremely profitable venture for FPTS. As of March 31, 2025, the investment value in MSH shares reached nearly 572 billion VND, 42 times the purchase price.

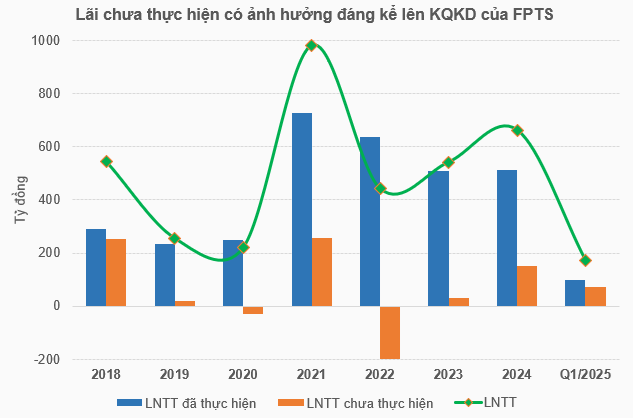

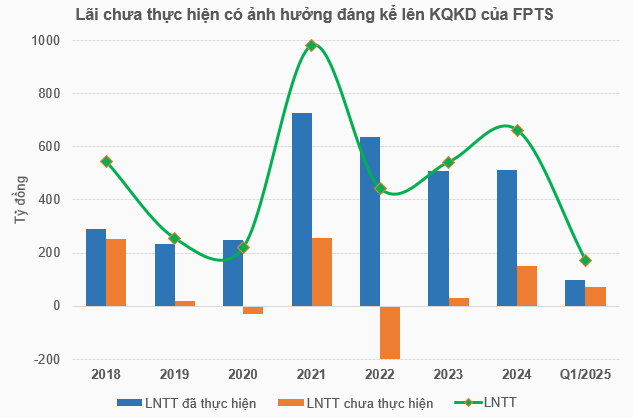

This particular investment has, on numerous occasions, been a significant factor in FPTS’ quarterly and annual profit fluctuations, as evident through the unrealized profit portion.

Source: VietstockFinance

|

FPTS’ announcement to sell nearly 1.2 million MSH shares came not long after its CEO, Nguyen Diep Tung, made notable remarks about this investment at the 2025 Annual General Meeting held on April 1. In response to a shareholder’s question regarding the timing of profit-taking on MSH, Mr. Tung stated that FPTS had no such intention.

“FPTS does not focus on proprietary trading on the exchange, as it would conflict with the interests of our clients. We only engage in direct investments in unlisted companies and accompany them, as in the case of MSH. FPTS has been with MSH for over a decade and has no plans to leave as long as the partnership remains beneficial to our shareholders.”

“However, I cannot affirm that we won’t take profits in 2025 because if anything changes, we must adapt and take action rather than remain stagnant”, he added.

In addition to the investment relationship, FPTS’ Director of Corporate Finance Advisory, Ms. Nguyen Thi Hanh, currently serves as a member of MSH‘s Board of Directors.

Maintaining a positive outlook on the textile industry

In FPTS’ thematic report “Impact of US-China Trade Negotiations” updated on May 20, focusing on the current tariff scenario with Vietnam (and most other countries) at 10% and China at 30%, the analytics team maintained a positive outlook on export-oriented industries, including textiles.

“Garment exports increased by 2.3% year-over-year, a decrease of 0.7 percentage points from the report on April 11, as Vietnam’s additional tariffs are now only 25 percentage points lower than China’s (down from approximately 115 percentage points) assuming current tariff rates remain through 2025” – FPTS commented.

According to FPTS, the outcome of the US-China trade negotiations will impact the listed garment companies in Vietnam from the second half of June 2025 due to the typical sea freight time of 30-45 days from Vietnam to the US.

To meet the deadline for garment orders arriving in the US before July 9, 2025, Vietnamese garment companies must place orders in the first half of June 2025. For most of the second quarter of 2025, Vietnam’s garment industry enjoyed significantly lower tariffs compared to China and on par with South Asian garment-producing countries.

The report also cited statements from MSH and two other companies, HTG and TNG: In the second quarter, orders from US customers were not canceled, and they requested expedited delivery to take advantage of the 90-day tariff suspension.

Additionally, as China faces higher tariffs, it has created opportunities for these companies to receive some small orders diverted from China. However, unit prices for garment processing tend to decrease by about 1-2% compared to previously signed prices, potentially impacting the gross profit margin of listed garment companies in the second quarter.

– 13:53 30/05/2025

US-Bound Export Sector Soars: Trump’s Statement Spurs Sector-Wide Rally

Let me know if you would like me to tweak it further or provide additional variations.

“Previously, at the May seminar organized by the Vietnam Textile Group (Vinatex), Dr. Le Tien Truong, Chairman of Vinatex’s Board of Directors, shared his insights on the industry’s market opportunities. He stated that the textile industry would witness an abundance of orders in the first half of the year, with the potential for this trend to extend through the third quarter of 2025.”

“FPTS Boosts Charter Capital to VND 3,365 Billion After Bonus Share Issuance”

On May 15th, FPTS successfully issued 30.59 million bonus shares to its 18,105 shareholders, thereby increasing its charter capital to VND 3,365 billion.

Legamex: A Legacy of Saigon’s Textile Industry Fades Away

Once a leading garment manufacturer in Vietnam, Legamex is now embroiled in a financial crisis, with cumulative losses surpassing VND 166 billion and negative equity. The company has been compelled to halt its core contract manufacturing operations and revise its plans for utilizing capital raised through equity offerings to repay its financial obligations.

The Trade Tensions Weave Uncertainty for Vietnam’s Textile Industry

In light of the US-China trade truce, while Vietnam is still in negotiations, Vinatex forecasts a stable order volume for Q3 due to low US inventory levels. However, the company predicts a potential 10% decline in orders for Q4 as purchasing power may weaken. Chairman Le Tien Truong emphasizes the industry’s need to seize the negotiation “lull” to proactively adapt and stay resilient.