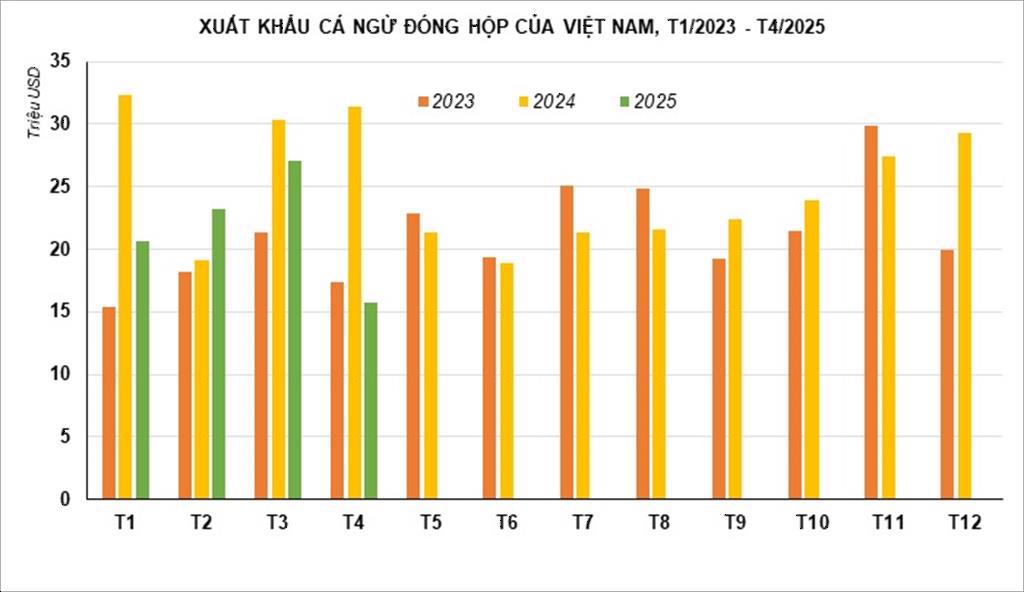

The Vietnam Association of Seafood Exporters and Producers (VASEP) reported that in April 2025, Vietnam’s tuna exports reached just over $86 million, a decrease of nearly 1% compared to the same period in 2024. Among Vietnam’s tuna export products, there has been a significant downward trend in canned tuna exports, which have almost bottomed out in the past two years.

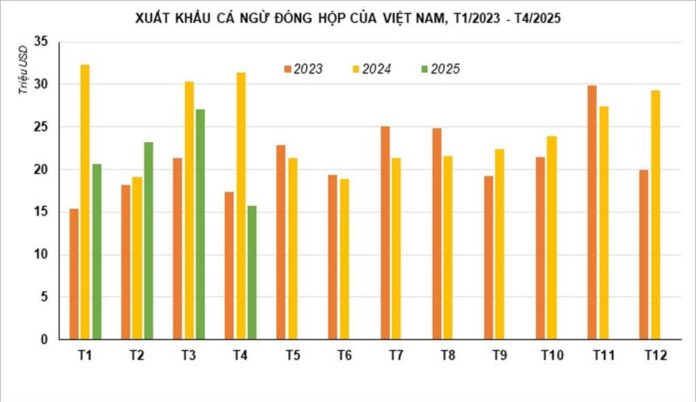

According to Vietnam Customs statistics, the export value of Vietnam’s canned tuna in April 2025 was only $15.8 million, a 50% decrease compared to the same period in 2024. This is the lowest it has been since January 2023.

Businesses attribute this decline to significant challenges posed by regulations on minimum allowable catch sizes and the prohibition of mixing imported seafood with domestically sourced seafood in the same export batch, as stipulated in Decree 37/2024/ND-CP. These regulations are particularly impacting the tuna fishing and export industries, especially for canned tuna.

In contrast, exports of other tuna products increased during this month. Notably, other processed tuna products under HS code 16, mainly frozen steamed tuna loin, surged by 62% year-on-year. Additionally, frozen tuna meat/loin exports rose by 15%.

Exports to major markets experience fluctuations

Exports of tuna to key markets in April 2025 also witnessed a decline.

In the US market, although tuna exports in April reached nearly $36 million, a 3% increase from the previous year due to the positive impact of the 90-day postponement of the 46% countervailing duty, this growth is slowing down. After taking advantage of this opportunity, businesses are now facing challenges in maintaining their growth trajectory.

Exports to the EU market are also slowing down, with a mere 11% year-on-year increase in April, reaching nearly $21 million. The Netherlands, Italy, and Germany remain the top three importers of Vietnamese tuna in the EU market. While exports to the Netherlands and Italy continue to grow, exports to Germany have decreased compared to the previous year.

The unstable situation in the Middle East region significantly impacts export activities. Tuna exports to Israel continued to plummet, decreasing by 57% in April, and by 62% in the first four months of the year. In Saudi Arabia, exports also dropped by 35%.

Meanwhile, the Canadian market, after two months of strong growth, unexpectedly reversed, with a turnover of just $3 million, a 27% decrease compared to the same period.

VASEP forecasts that, given the current challenges in sourcing domestic raw materials, coupled with geopolitical instability and changing trade policies in key markets, Vietnam’s tuna exports are likely to face a further significant decline.