Profit Declines Despite Revenue Growth

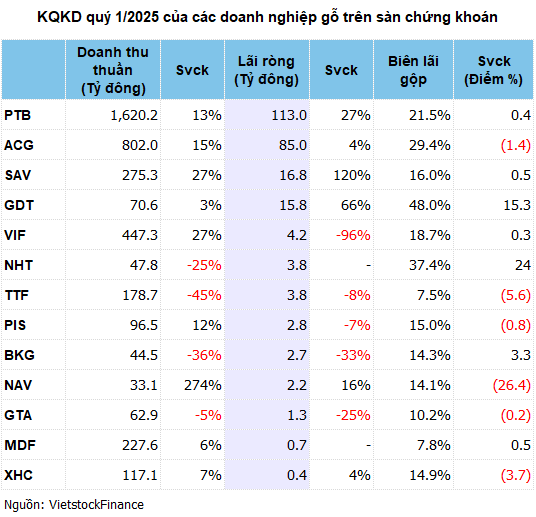

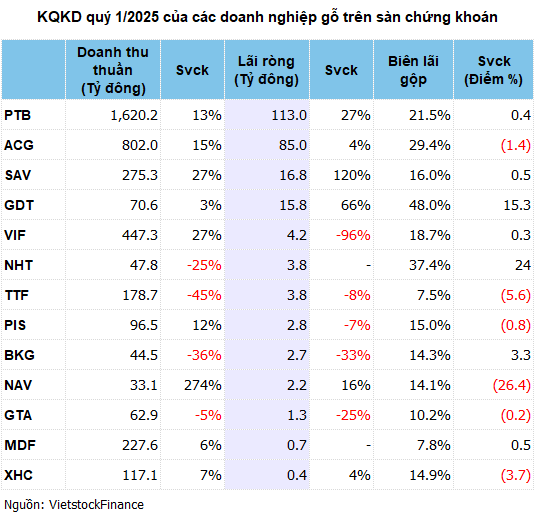

Data from VietstockFinance reveals that the combined revenue of 13 timber companies listed on the stock exchange reached VND 4,023 billion in Q1 2025, an 8% increase compared to the same period last year. While the average gross profit margin slightly improved by 0.6 percentage points to nearly 21%, net profit declined by 18%, amounting to VND 252.5 billion.

|

Vinafor (VIF) was the main factor behind the industry’s profit decline, as its net profit plunged by 96%, from VND 117 billion to a record low of VND 4 billion; while revenue increased by 27% to over VND 447 billion, and the gross profit margin inched up to 18.7%. VIF attributed this to losses of VND 35.4 billion from joint venture and associated companies, contrasting a profit of VND 82 billion in the same period of 2024, along with surging sales and management expenses.

Several other businesses also faced challenges. BKG, GTA, TTF, and PIS experienced profit declines ranging from 7% to 33%, coupled with decreasing revenue. BKG mentioned that some orders were not yet completed for delivery. GTA was impacted by labor fluctuations, rising ocean freight costs, and changes in customer shipment schedules.

TTF narrowly avoided making a loss, thanks to an unexpected surge in other income of nearly VND 54 billion. Its net revenue in the quarter dropped by 45% to just VND 179 billion, and the gross profit margin also shrank by 5.6 percentage points to 7.5%. After deducting expenses, the company incurred a net loss of over VND 52 billion. However, the aforementioned other income turned the loss into a slim profit of nearly VND 4 billion (down 8%). As of the end of March 2025, TTF still had accumulated losses of VND 3,242 billion.

Bright Spots: Businesses Recovering Profits

In Q1, two companies turned around from losses to profits: NHT and MDF, with profits of VND 3.8 billion and VND 662 million, respectively. NHT benefited from the growth of its parent company and rental income from factory leasing. MDF improved due to a focus on high-quality products, a 15.6% increase in selling prices, and a 41% reduction in interest expenses. MDF still had accumulated losses of over VND 18 billion as of the end of March.

Out of the 13 companies, 6 reported higher profits. SAV achieved the highest increase, with a profit of VND 17 billion, up 120% year-on-year, thanks to a 27% rise in revenue, effective cost management, and dividends received from its investment in Thanh Cong Textile Garment Investment Trading Joint Stock Company (TCM).

GDT ranked second with a 66% profit increase to nearly VND 16 billion. Its revenue slightly grew by 3% to nearly VND 71 billion, but the gross profit margin surged to 48% from 32.6% in the same period last year due to a 21% decrease in cost of goods sold and production improvements, consolidating 3 factories into 1 to reduce operating costs and leasing out factory space.

In absolute terms, Phu Tai (PTB) remained the most profitable company, with a net profit of VND 113 billion, up 27% year-on-year. Its revenue increased by 13% to VND 1,620 billion, and the gross profit margin slightly improved to 21.5%.

The positive results were attributed to increased output in all three segments – timber, real estate, and automobiles; well-controlled financial expenses and exchange rate impacts. The revenue from the timber segment accounted for 64% of the total revenue, amounting to over VND 1,022 billion, a 13% increase, with a gross profit margin of 21.7%.

Other companies, such as NAV, XHC, and ACG, reported profit increases ranging from 4% to 16%. ACG faced a 1.4 percentage point decline in its gross profit margin compared to the previous year due to fluctuations in orders.

Looming US Tariff Threat: Businesses Pivot

Overall, while the revenue of timber companies rebounded in the first quarter, profits remained under significant pressure from production costs, market fluctuations, and a lackluster recovery in exports.

The recovery of the timber industry faces many challenges – Illustration

|

According to data from the General Department of Customs, Vietnam’s timber industry maintained its export prowess, with a Q1/2025 export turnover of $3.93 billion, an increase of 11.1% over the same period last year. The United States remained the main export market, accounting for an estimated $2 billion worth of timber and timber products. However, this heavy reliance on the US market makes the Vietnamese timber industry vulnerable to trade policy changes, such as the recently announced 46% countervailing duty in April 2025 (which has been temporarily delayed for 90 days from April 10th).

In an earlier interview with the press, Mr. Ngo Sy Hoai, Vice Chairman of the Vietnam Timber and Forest Products Association, stated that the tariff delay provides a “breathing room,” but the threat of tariffs after 90 days remains. Many businesses reported that their US partners have temporarily halted orders. If the tariffs are imposed, exports to the US could drop by 20-30% in Q2/2025.

An updated report by FPT Securities (FPTS) forecasts that export revenue from Q3/2025 onwards will be highly polarized. Additionally, due to the nature of processing orders, profit margins for companies in the industry are expected to narrow as buyers have to bear the significant additional tax costs.

The new US tariff policy has been a topic of concern for shareholders at the 2025 Annual General Meeting of timber companies. At ACG, Chairman Le Duc Nghia acknowledged that the industry is facing significant pressure from trade barriers but affirmed that the company will maintain its production and business plan and expedite deliveries during the tariff delay period.

According to Mr. Nghia, the US market currently accounts for only about 12% of ACG‘s total revenue, so the company can pivot to other markets if the worst-case scenario unfolds. He expressed optimism about the ongoing negotiations between Vietnam and the US and advised shareholders not to worry excessively.

Meanwhile, Chairwoman of GDT Le Hai Lieu shared her perspective: “When Mr. Trump’s policies were enacted, many businesses were in turmoil due to their dependence on the US market, but we remained calm.” GDT is not reliant on any single customer or market. However, she admitted that the current context is highly unpredictable, as the positive results in Q1 were mainly due to previous orders, and from Q2 onwards, “it’s very exciting, and we can’t predict”.

According to Ms. Lieu, some US customers have recently requested GDT to prioritize production to ensure delivery within the 90-day tariff negotiation period. While GDT‘s business plan for 2025 was developed beforehand, the company decided not to adjust its targets, with the stance of “not blaming the circumstances for downward adjustments.”

– 09:16 30/05/2025

The Ultimate Guide to Crafting Compelling Copy: “Unveiling Nam Long’s Dividend Distribution: A Whopping $190 Million Payout”

The Board of Directors of Nam Long Investment Corporation (HOSE: NLG) has approved a cash dividend payout for the fiscal year 2024 with a ratio of 4.99% (VND 499 per share). The ex-dividend date is set for June 5th, and the expected payment date is June 30th, 2025.

The Textile Industry Navigates Turbulent Waters: Riding the Wave or Drowning in Tariff Troubles?

The textile industry witnessed a remarkable rebound in the first quarter of 2025, attributed to improved profit margins and steady orders. Despite this positive trajectory, the industry faces a significant headwind in the form of looming 46% tariffs from the United States, which, although postponed for 90 days, necessitates a swift strategic shift to sustain this growth momentum.

“Tasco’s 2025 Shareholders’ Meeting: Integrating Vertically, Connecting the ‘One Tasco’ System and Partners to Serve Customers a Full Product and Service Lifecycle.”

On May 26, Tasco Joint Stock Company (coded HUT on HNX) successfully held its 2025 Annual General Meeting of Shareholders in Hanoi. The meeting acknowledged the company’s 2024 business results and agreed on development orientations for 2025, with automotive services remaining a key and strategic focus for the company’s ecosystem.

“Rapid Retail Expansion: MWG’s Impressive Growth with 359 New Stores in 4 Months, Achieving 32% of Revenue Target”

In April 2025, the combined revenue of TGDĐ and ĐMX reached an impressive VND 8.3 trillion, marking a 13% increase from the previous month and a 3% growth compared to the same period last year.