From Bitcoin Critic to Crypto Promoter

Trump’s inaugural weekend featured a lavish crypto party, where he convened cabinet members and “high IQ individuals” for the first White House crypto summit, established a national Bitcoin reserve, and appointed a “crypto czar.” The value of cryptocurrencies also directly impacted Trump’s net worth.

He owns a memecoin, promotes a crypto platform co-founded by one of his close envoys, and his social media company announced plans to sell crypto-based investment products. These are the Trump family businesses poised to profit as he transforms America into the “crypto capital of the world.”

World Liberty Financial

Linked to the Trump brand through: Donald Trump, Donald Trump Jr., Eric Trump, and Barron Trump

Partners: Steve Witkoff, Zach Witkoff, and Alex Witkoff

Revenue: $550 million

Project Announcement: September 2024

In Delaware: The token endorsed by Trump and his three sons was offered just weeks before the 2024 election, primarily targeting foreign investors. After the election, crypto entrepreneur Justin Sun invested $75 million in World Liberty Financial while facing a civil fraud lawsuit in the US, which he deemed baseless. The lawsuit has since been put on hold.

Special envoy Steve Witkoff, who has met with global leaders such as Russian President Vladimir Putin, also profited from the project, with his sons Alex and Zach as co-founders. However, the Trump family received approximately 75% of certain net revenues from this project.

Company representatives asserted that this was not a political project, the leaders were not government officials, there was no conflict of interest, and Witkoff was “actively divesting.” He referred to Sun as an early investor and dismissed any allegations of policy bias toward World Liberty as irrational.

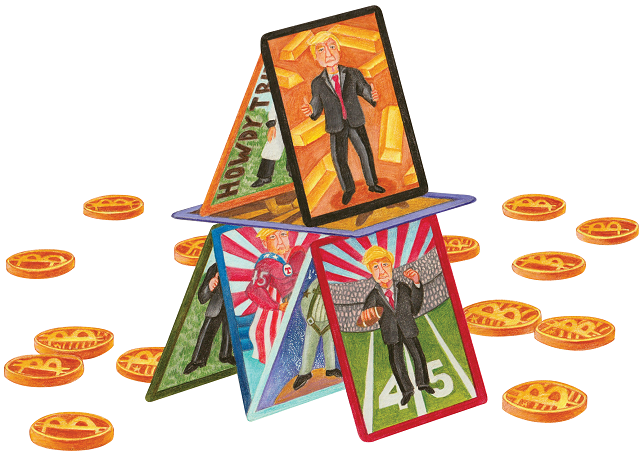

Trump Digital Trading Cards

Linked to the Trump brand through: Donald Trump

Partner: Bill Zanker

Revenue: $7.2 million

First Sale: December 2022

In Park City, Utah: As the NFT trend started to cool down, Trump still licensed the release of a digital collection featuring his image as a muscle-bound superhero, sky cowboy, golden statue, and cyborg. The idea for Trump Digital Trading Cards originated from Bill Zanker, Trump’s close friend and founder of The Learning Annex, who stated that Trump loved the crypto community for its “youthful, ambitious, uncontrolled” nature. Trump’s endorsement earned him political support from billionaires in the industry.

Memecoin $TRUMP and $MELANIA

Linked to the Trump brand through: Donald Trump and Melania Trump

Transaction Fees and Other Revenue: $350 million

First Sale: January 2025

In Delaware: Memecoins typically have no practical purpose other than attracting attention to make money; these highly volatile and satirical coins have no specific underlying asset, which suits a reality TV star like Trump.

Nonetheless, Democratic officials and crypto veterans alike criticized the coins that Trump and his wife launched just before taking office. By April, when Trump announced a private dinner for the biggest holders of these coins—mostly using foreign exchanges, indicating they were overseas—the coins had lost much of their earlier peak value.

Democratic Senator Chris Murphy called this “the most blatant corrupt action a President has ever taken.” (The White House spokesperson affirmed that Trump complied with conflict-of-interest laws.)

Previously, regulators considered whether memecoins should be deemed securities, which would entail tighter regulations. About a month after $TRUMP and $MELANIA launched, the U.S. Securities and Exchange Commission (SEC) ruled: No, memecoins are not securities but rather “collectibles” and will be regulated as such.

Metaplanet

Linked to the Trump brand through: Eric Trump

Stock Price: Increased by over 17%

Announcement: March 2025

In Tokyo, Japan: In March, Eric Trump joined the new strategic advisory board of Metaplanet, a Tokyo-based hotel business that pivoted to Bitcoin accumulation after closing most of its hotels.

Eric Trump appeared with a Metaplanet orange hat, calling the collaboration a “great honor.” The company’s stock rose over 17% on the announcement day, even though Metaplanet had already been the best-performing stock on the Japanese market due to its crypto shift. Weeks earlier, Trump had signed an executive order establishing a national Bitcoin reserve for the U.S. government.

American Bitcoin

Linked to the Trump brand through: Donald Trump Jr. and Eric Trump

Partners: Dominari and Hut 8

Trump Family and Partner Ownership: 20%

Announcement: March 2025

In Miami, Florida: The relationship between this Bitcoin mining company, the Trump family, and their new strategic venture is intricate. After the inauguration, the president’s two eldest sons established American Data Centers, partnering with Dominari, an investment bank headquartered in Trump Tower, where the brothers became advisors.

Eric Trump called the new data project “crucial for AI infrastructure development,” despite a lack of significant activity. About a month later, the fledgling company agreed to transfer most of its shares to Hut 8, a Bitcoin mining firm. The Trump brothers and their partners hold a 20% stake in the joint venture, now named American Bitcoin, which is expected to go public this year.

Trump Family’s Money-Making Machines (Part 1): Selling the Family Name and Real Estate

Quoc An (according to Bloomberg)

– 10:00 29/05/2025

The Soaring Price of Bitcoin Entices Companies to Join the Fray.

The number of public companies holding bitcoin globally has surged, with a notable increase from 89 in early April to 113 by the end of May. What’s even more remarkable is that the top holder among these companies boasts an impressive stash of 580,000 bitcoins. This significant rise in corporate adoption underscores the growing acceptance of bitcoin as a legitimate and valuable asset.

Trump Threatens to Make Apple and Samsung ‘Uneasy’

According to the Korea Herald, President Donald Trump’s threat of a 25% tariff on Apple and Samsung Electronics has sent shockwaves through the two leading smartphone manufacturers and their partner companies. This decision could potentially disrupt supply chains and drive up phone prices in the crucial US market.

The American-Made iPhone: A Pricey Surprise

The iPhone is an iconic smartphone brand, but what would happen if its production moved back to the USA? The cost of manufacturing in the States is significantly higher than in other countries, and this would have a huge impact on the final price tag. A potential price of $3,500 per unit is not out of the question, a stark contrast to the current pricing strategy and a huge barrier for consumers.