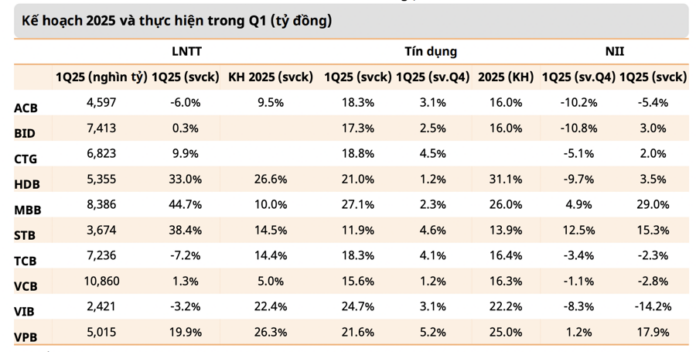

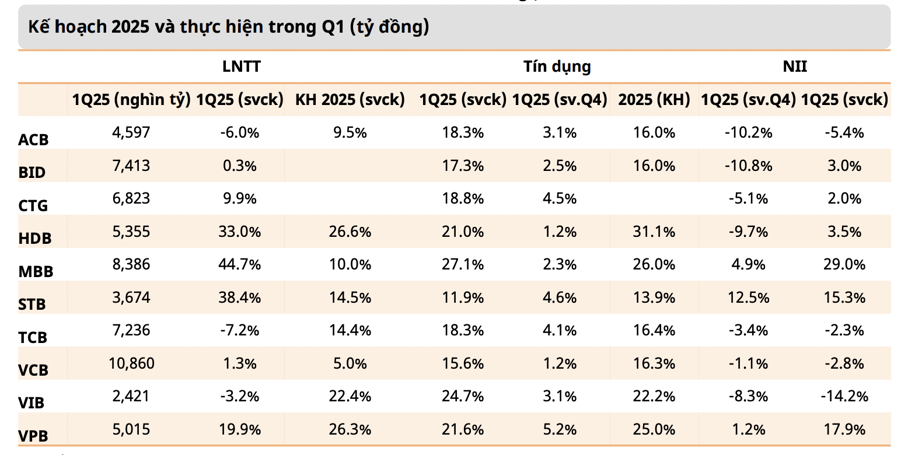

In Q1 of 2025, the pre-tax profits of 27 listed banks decreased by 5% compared to Q4 of 2024, amounting to over 82 trillion. This figure is more optimistic when compared to the same period last year, showing a 14.2% increase. However, in correlation with the credit growth of 19.6%, this growth rate is relatively modest.

The group leading the profit growth was the medium and small-sized banks, with an impressive growth rate of 48.8% compared to Q4 of 2024 and 28.3% compared to the same period last year. These positive results stem from extraordinary income increases of 44.3% compared to Q4 of 2024, such as divestment in subsidiaries and increased income from bad debt processing.

In the context of a lack of positive momentum in main income sources like NII and NSI, profit growth may continue to decelerate in 2025, according to Mirae Asset.

The banks’ business plans for 2025 are relatively more cautious, and it is likely that these large extraordinary incomes will also be used to strengthen asset quality.

It is noteworthy that these growth targets are mostly established based on less favorable business conditions and before the new US administration announced the maximum tariffs that could be imposed, at the beginning of April. Accordingly, Mirae Asset has adjusted its profit growth projection for the banks under its coverage, from the previous range of 15-17% to below 14%, as adverse factors are increasing.

In terms of stock prospects, the banking sector is assessed to be more cautious in both fundamental and valuation aspects compared to the previous period. Meeting higher safety standards, along with a volatile macro environment both domestically and internationally, leads to a decline in growth rate and stability.

Market sentiment is somewhat optimistic after the news of a 46% tariff postponement. However, there is a reality that the additional 10% tax has already been applied, negatively affecting export prospects, at least in the short term. Moreover, these changes may bring back the risk of a protectionist trade trend.

Tariff pressures may not be temporary, especially in the unfavorable scenario where Vietnam faces high taxes, as Trump’s policies from his first term are maintained under the Biden administration.

From a valuation perspective, complying with higher standards will contribute to the stability of commercial bank operations and reduce systemic risks, which may lead to a downward adjustment in the valuation of these banks.

On a positive note, as risk minimization leads to a lower required yield spread for capital mobilization, it will support the discount rate to some extent. However, reducing the cost of capital also comes with reduced profit expectations, likely resulting in a decrease in the average valuation of banks compared to historical or peer levels.

And despite the high credit growth of around 20% or more in 2023-2024, a significant portion of the banks’ credit balances has been renewed at new interest rate margins, limiting the potential for strong NIM recovery and future valuation increases.

Investment-focused banks are attracting cash flow. While national banks are still considered safe choices, they face challenges in supporting the economy and urgent capital-raising needs.

In contrast, large private banks with good growth potential and investment stories related to extraordinary income or post-restructuring, such as STB, MBB, TCB, and VPB, are and can continue to attract the attention of cash flow.

“High credit growth is only a necessary condition. The system-wide credit balance is estimated at 15.5 million trillion (~$607 billion) at the end of 2024, equivalent to nearly 130% of GDP – a level that is not too risky but also not conservative. Meanwhile, the demand for fiscal spending is increasing, especially through public investment and possible tax incentives, which could weaken national financial safety indicators or increase foreign borrowing costs (typically, the lowest borrowing cost for enterprises is equivalent to the country’s borrowing cost)

Therefore, fiscal policy needs to be cautious and focus capital on sectors with high growth multipliers,” emphasized Mirae Asset.

“Retail Stock Valuations at Historic Highs: The Risk of a Sharp Correction Looms as Consumer Demand May Not Evenly Recover.”

The Retail stock group faces the risk of premium valuation compared to the broader market. This exposure could trigger a significant correction if the industry’s outlook is adversely affected, especially with the backdrop of uneven recovery in purchasing power.

Is the Mid and Small-Cap Stock Group Undervalued?

The notable observation here is that the P/E ratio of the Non-Financial sector, excluding Real Estate, has plummeted by a staggering -35% from its peak a year ago, which also marked a historical high for this group. This represents a significantly deeper discount compared to the broader market, with the overall market’s P/E declining by -14%, Banks by -10%, and Real Estate by -28%.

“NIM Bank Under Pressure: Can It Weather the Storm?”

The net interest margin (NIM) story for Q1 2025 is a concerning tale, with over half of the banking system witnessing a decline. This is more than just a trend; it reflects a worrying shift in the industry’s profit landscape, monetary policy movements, asset-liability structure, and credit consumption behavior.