Petrolimex Joint Stock Commercial Bank (PGBank, code: PGB) recently announced the resignation of Mr. Nguyen Trong Chien from the position of Deputy General Director, effective June 15, due to personal reasons.

Mr. Nguyen Trong Chien, born in 1987, holds a Bachelor’s degree in Finance and Banking from the Academy of Finance. With over 14 years of experience, he has worked at MB, Mcredit, and AMC of the Military Bank. He was appointed to the Executive Board of PGBank on March 12, 2025.

With Mr. Chien’s resignation, the PGBank Executive Board now comprises three members, including Mr. Nguyen Van Huong as General Director, and two remaining Deputy General Directors, Mr. Tran Van Luan, and Mr. Le Van Phu.

A PGBank Deputy General Director resigns effective June 15

PGBank plans to hold an extraordinary general meeting of shareholders on July 22 in Hanoi to elect an additional independent member to the Board of Directors and a member to the Supervisory Board for the term 2025 – 2030. The record date for shareholders is June 6, 2025.

Previously, at the 2025 Annual General Meeting, the bank expected to have a Board of Directors consisting of six members (including two independent directors) and five members of the Supervisory Board. However, due to the last-minute withdrawal of two candidates, only five members of the Board of Directors and four members of the Supervisory Board were elected.

PGBank shareholders elected five members to the Board of Management for the term 2025 – 2030: Ms. Cao Thi Thuy Nga, Mr. Nguyen Van Huong, Mr. Vuong Phuc Chinh, Mr. Dinh Thanh Nghiep, and Mr. Nguyen Van Ty – Independent Member of the Board of Directors.

According to the election results, Ms. Cao Thi Thuy Nga, an independent member of the previous term’s Board of Directors, was trusted to hold the position of Chairman of the Board of Directors of PGBank for the new term. Meanwhile, Mr. Tran Ngoc Dung continues as the head of the Supervisory Board.

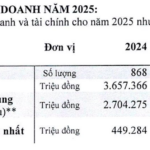

In terms of business plans for 2025, PGBank aims to achieve a pre-tax profit of VND 1,001 billion, up 135.3% compared to 2024; total assets of VND 91,226 billion, an increase of 24.9%, equivalent to an increase of VND 18,211 billion compared to the end of 2024.

Total credit outstanding is targeted at VND 48,653 billion, up 17.1% compared to 2024, while total mobilised capital is expected to reach VND 78,449 billion, up 17.6% from the previous year.

In the first quarter of 2025, PGBank recorded a 21% year-on-year increase in net interest income to VND 458 billion. Several other business segments also saw growth.

PGBank significantly increased its credit risk provision by 248.8% to VND 147 billion. This was the main reason for the 17% year-on-year decrease in pre-tax profit, which stood at VND 96 billion.

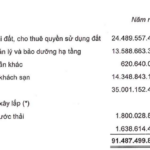

As of March 31, 2025, PGBank’s total assets were VND 73,551.5 billion, slightly higher than at the beginning of the year. Customer lending stood at VND 45,348.5 billion, up 10% year-to-date, while customer deposits reached VND 46,717.5 billion, a 7.8% increase from the start of the year.

As of the end of the first quarter of 2025, PGBank’s total bad debt was VND 1,229.1 billion, a nearly 16% increase from the beginning of the year. Substandard debt increased by 48%, doubtful debt by 4.1%, and debt with potential losses by 11.3%, accounting for 56% of total bad debt. Consequently, the non-performing loan ratio increased from 2.57% to 2.71%.

Credit Relationships: Are Borrowers Always at the ‘Mercy’ of Lenders?

“The current contract signing process involves lengthy and complex bank templates, often dozens of pages long, filled with intricate clauses. These contracts are challenging for borrowers to fully comprehend, leaving them vulnerable to unseen risks when putting pen to paper.”

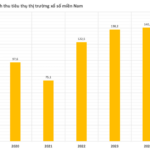

The Industry of “Turning Regular People into Billionaires” in 21 Southern Provinces: Millions Participate, Investing Over VND 1.4 Quadrillion and Receiving VND 680 Trillion in Returns, Changing Countless Lives

For every $1 lottery ticket, almost $0.50 goes towards prizes, with the state claiming around a third of the remaining funds, and the rest covering operational costs.