|

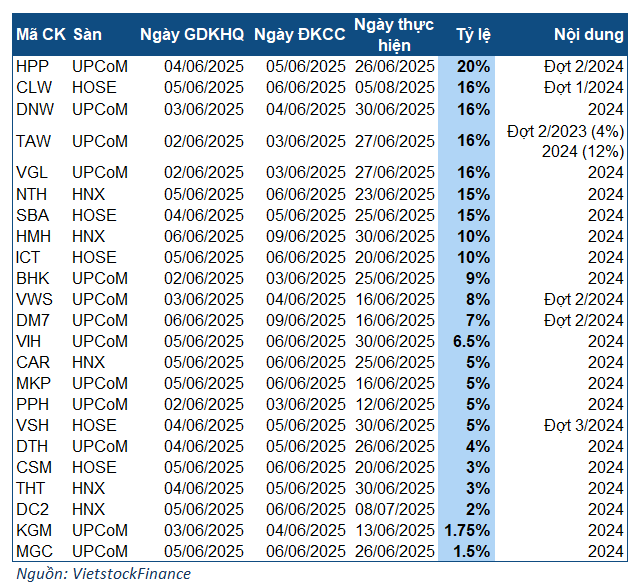

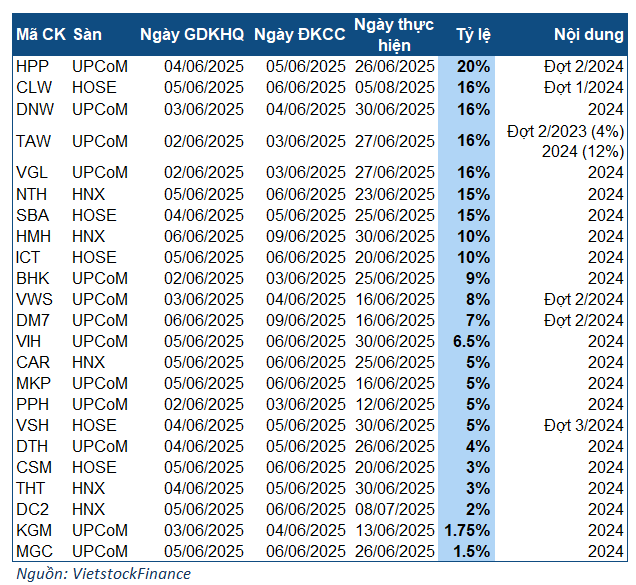

Companies finalising dividend payments for the week of 02-06/06/2025

|

The company with the highest dividend payout this week is HPP, at a rate of 20%, which is the second dividend payment for 2024. With nearly 7.96 million shares in circulation, the company is expected to spend nearly VND 16 billion on this dividend payment. The ex-dividend date is 04/06, and payment is expected on 26/06.

Previously, HPP paid an interim dividend of 10% (VND 1,000 per share) for the first dividend payment of 2024. Thus, the total dividend payout ratio of HPP is 30%, completing the dividend plan for the year. This is the tenth consecutive year that HPP has maintained this dividend rate since 2015.

The next three companies, all in the water industry, will finalise dividend payments at a rate of 16% (VND 1,600 per share), including CLW, DNW, and TAW.

For CLW, the ex-dividend date is 05/06, equivalent to a payout of VND 20.8 billion, expected to reach shareholders on 05/08/2025. The 2025 Annual General Meeting of CLW approved a dividend payout of up to 20%, the highest in the company’s operating history. Therefore, there will be one more dividend payment with a rate of 4%, and the expected ex-dividend date is 31/10.

DNW stands out the most. Although finalising dividend payments at a rate of 16%, the total payout amounts to VND 192 billion, with 120 million shares in circulation. The ex-dividend date is 03/06, and payment is expected on 30/06.

This is the third consecutive year that the company has maintained a 16% dividend rate. From 2015 to 2021, the dividend rate ranged from 4% to 12%, and for 2025, it is expected to be 14%. However, most of the nearly VND 123 billion will be allocated to its parent company, the Corporation for Industrial Zone Development (Sonadezi, UPCoM: SNZ), which holds nearly 64% of its charter capital.

Meanwhile, TAW‘s 16% dividend rate consists of two dividend payments: 4% for the second dividend payment of 2023 and 12% for 2024, totalling VND 8 billion in payouts. The ex-dividend date is 02/06, and payment is expected on 27/06.

Another company finalising dividend payments at a rate of 16% next week is VGL. The ex-dividend date is 02/06, and payment is expected on 27/06/2025. It is estimated that the company will spend approximately VND 15 billion on this dividend payment.

Next week, seven companies will finalise dividend payments in shares. The highest ratio is from CTS at 43%, meaning that for every 100 shares held, shareholders will receive 43 new shares. The ex-dividend date is 05/06, and nearly 64 million new shares are expected to be issued.

– 13:58 01/06/2025

The Mineral Company’s Ambitious Plans: Offering Shares to Acquire Large Reserves with a 581% Upsurge

“Following the distribution of dividends in 2024, Minco will offer a rights issue, providing existing shareholders with the opportunity to purchase additional shares. Specifically, for every 100 shares owned, shareholders will be entitled to buy 581 new shares, representing a substantial increase of up to 581%.”

“Exclusive Provider to VinFast Offers Lucrative Dividends and Stock Bonuses.”

Introducing a dynamic opportunity for investors and stakeholders alike – with a successful share offering, this company’s chartered capital is set to soar to an impressive 697 billion VND.

The Great Talent Shuffle at VIX Securities

The VIX Securities has recently undergone a transition with the resignation of two board members, which was approved by the shareholders. Subsequently, the company has appointed two new individuals to fill these vacant positions. This strategic move is expected to bring fresh perspectives and expertise to the board, potentially driving new initiatives and fostering innovation within the company.

“PV Gas Plans a ‘Reverse’ Business Strategy, Proposing an Additional 70 Million Bonus Shares”

In 2025, PV Gas targets a consolidated revenue of VND 74,000 billion and an expected after-tax profit of VND 5,300 billion, respectively a 29% and 50% decrease compared to 2024. This plan is formulated based on an oil price scenario of USD 70 per barrel.