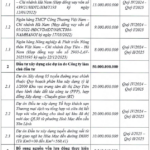

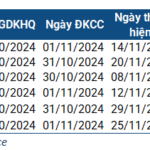

Dong Hai Ben Tre Joint Stock Company (DHC) has successfully issued over 16.1 million shares as dividends to its shareholders for the fiscal year 2024. The distribution ratio was set at 5:1, meaning that for every 5 shares owned, shareholders received 1 additional share.

The capital source for this issuance was derived from the company’s undistributed post-tax profits as of December 31, 2024, as per the audited consolidated financial statements for 2024.

Any fractional shares resulting from this issuance will be rounded down to the nearest whole number, with the fractional amount being canceled.

The issuance concluded on May 19, 2025, and the distribution of the new shares is expected to take place in June 2025.

A total of 5,078 shareholders received these additional shares, except for 200 shareholders who were excluded due to specific share handling and fractional share treatment methods.

Following this issuance, the total number of outstanding shares as of May 21, 2025, stands at approximately 96.6 million, and the charter capital has increased from nearly VND 805 billion to nearly VND 966 billion.

Image source: DHC

Dong Hai Ben Tre Joint Stock Company, established in 1994, specializes in the production and trading of industrial paper and carton packaging.

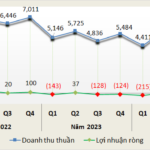

According to the company’s consolidated financial statements for the first quarter of 2025, revenue reached over VND 826 billion, a 1.88% increase compared to the same period last year. Cost of goods sold also witnessed a slight increase of VND 4 billion, amounting to VND 711 billion.

Financial income surged by 263.75%, reaching nearly VND 16 billion, while financial expenses decreased marginally by 2.21% to nearly VND 8.7 billion.

After accounting for taxes and other expenses, the company reported a net profit of nearly VND 76 billion for the first quarter of 2025, representing a 36.18% increase compared to the same period in 2024.

This improvement in net profit can be attributed to stable production and sales volumes, increased paper selling prices, a 1.88% rise in revenue, and a 0.55% increase in cost of goods sold.

The surge in financial income by 263.75% was primarily driven by increased interest income from savings accounts and bond investments, as well as favorable exchange rate differences when making payments for imported raw materials.

Other income witnessed a significant jump of 388.05%, mainly due to increased compensation receipts from paper suppliers.

Additionally, Dong Hai Ben Tre’s wholly-owned subsidiary, Ben Tre Packaging Joint Stock Company, reported a 6.76% increase in production volume and a 7.06% rise in sales volume, contributing a profit of VND 4.6 billion.

The Businesses Smashing Profit Records in 2024

Vietnam Airlines, FPT, PNJ, Gelex, and Idico are among the top Vietnamese companies that have announced record-breaking profits for 2024. With impressive financial results, these businesses have showcased their resilience and growth amidst economic challenges. As they soar to new heights, they set a benchmark for success in the dynamic Vietnamese market.

The Cement Business: Stuck in a Rut of Losses

Amidst challenging circumstances, sluggish consumption, and rising costs, several cement businesses had to resort to reducing their product prices to offset operational expenses.