The annual General Meeting of Asean Securities Joint Stock Company is expected to take place on the morning of June 25, 2025, in Hanoi. Previously, the Company announced a postponement of the meeting until no later than June 30, 2025, to ensure the best preparation.

According to Aseansc, in the context of a volatile global economy with risks and uncertainties (especially tariff shocks), inflation and interest rates may fall slower than expected, and global economic growth in 2025-2026 is projected to be low at 1.8-2%. Vietnam’s economy is forecast to be quite negatively affected in 2025 and the next 1-2 years. However, Aseansc is optimistic about the positive outcome of tariff negotiations and trade balance solutions with the US, and Vietnam is expected to maintain its advantages and target GDP growth for the full year 2025.

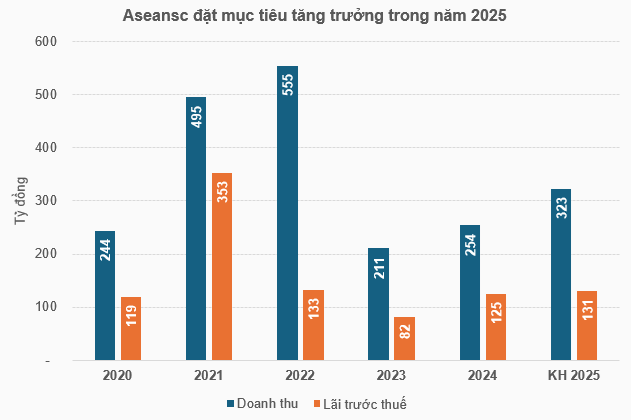

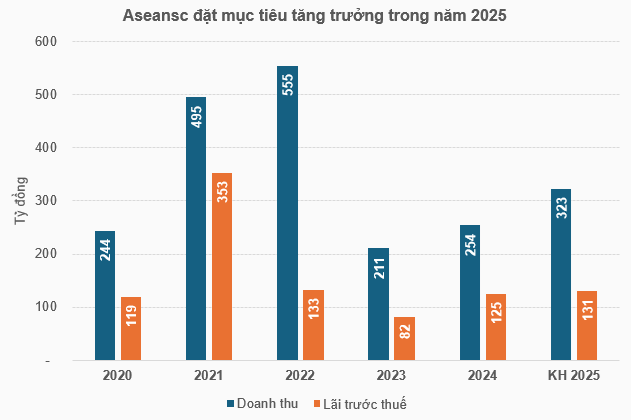

At the meeting, the Board of Directors will present to the shareholders the business plan for 2025, with a revenue target of VND 323 billion and a pre-tax profit of VND 131 billion, up 27% and 5%, respectively, compared to the previous year’s performance.

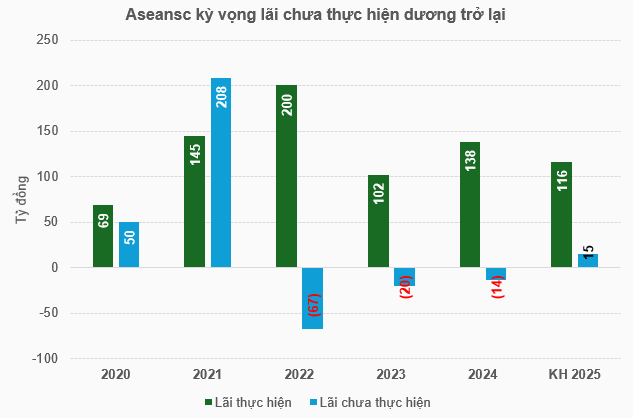

Notably, the Company sets a profit target of VND 116 billion, lower than the figure of VND 138 billion in the same period last year, implying an expected unrealized profit of VND 15 billion. This marks the first time in three years that the Company has returned to a positive unrealized profit status.

In the first quarter of 2025, Aseansc recorded VND 52 billion in revenue and VND 28 billion in pre-tax profit, equivalent to 16% and 22% of the full-year plan, respectively.

Source: VietstockFinance

|

Source: VietstockFinance

|

In 2025, the Company aims to boost the development of digital products, enhance marketing and sales through digital channels, strengthen the Company’s brand position, and digitize operating procedures.

Aseansc’s development orientation is based on the Wealth-Tech model, with a strategy to focus on building a digital ecosystem on the One-Stop-Shop platform. The Company’s business development strategy revolves around key pillars: technology, product and service innovation, sales channel expansion, and digital communication and branding.

Regarding long-term goals, the Company aims to develop its technology platform, digital products, and asset management capabilities, targeting two main customer segments: Mass and Private. Aseansc aims to be among the top 10 securities companies in terms of market capitalization, successfully complete an IPO and list on a stock exchange in Vietnam, and attain 1 million digital customers by 2028.

Additionally, as the terms of two members of Aseansc’s Board of Directors, Ms. Nguyen Hong Hai and Ms. Le Thi Thanh Binh, will end in 2025, the upcoming meeting will elect two new members to the Board to ensure its quorum.

– 6:22 PM, May 29, 2025

A PGBank Vice President Steps Down Effective June 15th

Mr. Nguyen Trong Chien has stepped down from his role as Deputy General Director, effective June 15th, due to personal reasons.

“Thaigroup and LPBS Nominate Members for HAGL’s Board of Directors”

The Hoang Anh Gia Lai Joint Stock Company (HOSE: HAG) has unveiled its slate of nominees for the Board of Directors and Supervisory Board for the upcoming term (2025-2030), to be elected at the forthcoming 2025 Annual General Meeting of Shareholders. Notably, alongside current members, the nomination list features several candidates from the large shareholder group holding 121 million HAG shares.

The Great Talent Shuffle at VIX Securities

The VIX Securities has recently undergone a transition with the resignation of two board members, which was approved by the shareholders. Subsequently, the company has appointed two new individuals to fill these vacant positions. This strategic move is expected to bring fresh perspectives and expertise to the board, potentially driving new initiatives and fostering innovation within the company.