The Billion-Dollar Business Empire in Vietnam

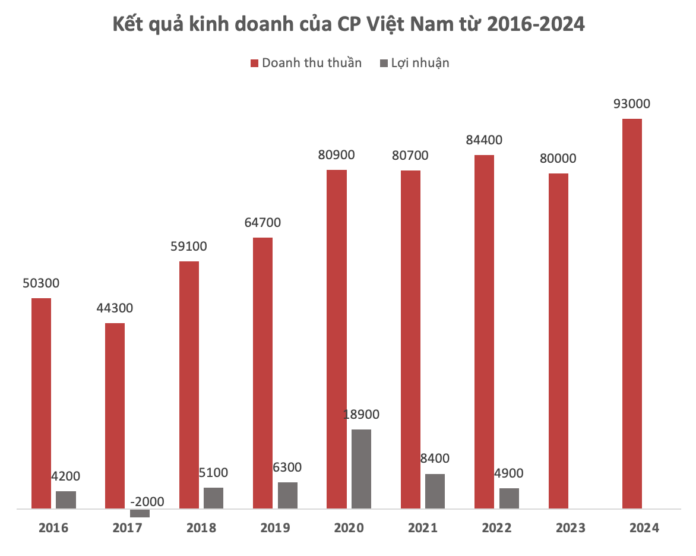

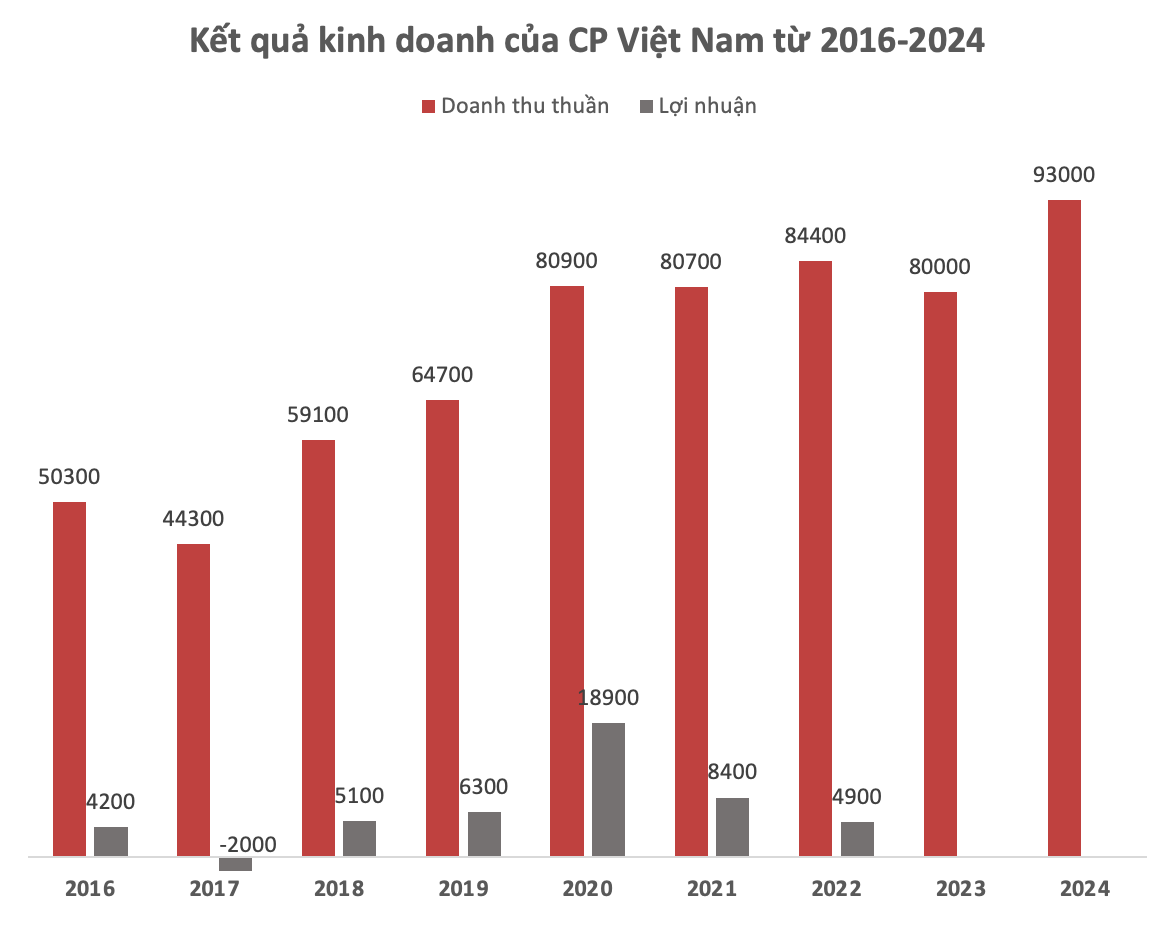

According to disclosures from its parent company in Thailand, C.P Vietnam’s revenue in 2024 reached approximately VND 93,000 billion, a 5% increase from the previous year, marking the highest figure to date.

Over the past decade, from 2016 to 2024, C.P Vietnam’s revenue has consistently increased year-over-year, rising from VND 50,300 billion to VND 93,000 billion. The year 2020 marked a turning point, with revenue surpassing VND 80,000 billion, and it has maintained this level since.

Net profit has fluctuated more significantly. In 2017, the company recorded a loss of VND 2,000 billion but returned to profitability in 2018. Notably, 2020 was a breakthrough year, with net profit reaching VND 18,900 billion, coinciding with a sharp increase in pork prices due to the African swine fever outbreak.

From 2021 onwards, profits gradually decreased to VND 8,400 billion and then to VND 4,900 billion in 2022. Financial figures for the past two years have not been disclosed. Nonetheless, the company has maintained its large-scale operations in the animal husbandry and food processing industry.

In 2025, the company expects to achieve a total revenue increase of 5-8% with improved profit margins, thanks to the positive momentum in its international business operations, especially in Vietnam and China.

Vietnam is currently C.P Foods’ largest international market, accounting for approximately 21% of its global revenue from overseas operations (as of 2024). The combined weight of the three main markets – Thailand, China, and Vietnam – contributes more than 64% of the group’s total revenue.

The Buzz About an IPO

Currently, C.P Vietnam is a subsidiary of C.P Group, a diversified conglomerate headquartered in Bangkok, Thailand, established in 1921, specializing in agriculture and food. Following Vietnam’s open-door policy, the group opened a representative office in Ho Chi Minh City in 1988.

In 1993, C.P Vietnam Livestock Co., Ltd. was established, marking its official presence in the market. The first factory was built in Bien Hoa 2 Industrial Park (Dong Nai province), which is now the company’s headquarters. In 2009, the company consolidated its legal entities and changed its name to C.P Vietnam Livestock Joint Stock Company, with its current English name being C.P. Vietnam Corporation.

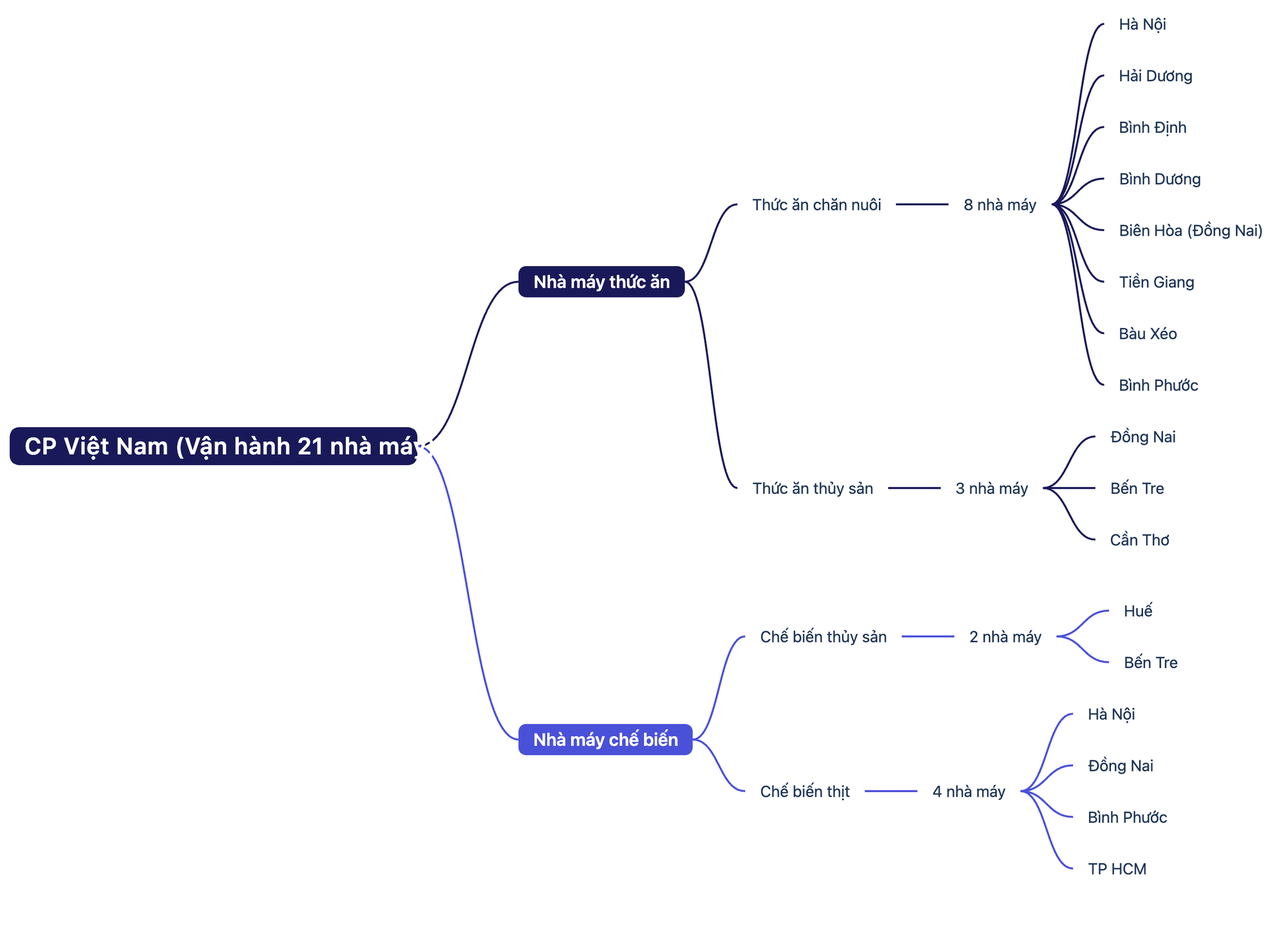

As of 2024, C.P Vietnam operates 21 factories across the country.

These include 8 animal feed mills for livestock and poultry in Hanoi, Hai Duong, Binh Dinh, Binh Duong, Bien Hoa (Dong Nai), Tien Giang, Bau Xe, and Binh Phuoc; 3 aquafeed mills in Dong Nai, Ben Tre, and Can Tho; 2 seafood processing plants in Hue and Ben Tre; and 4 meat processing plants in Hanoi, Dong Nai, Binh Phuoc, and Ho Chi Minh City.

Scale of C.P Vietnam

Additionally, the company is linked to over 2,500 livestock farms nationwide. According to its website, C.P Vietnam has a total of approximately 200,000 contracted sows, with a productivity of 23.5 piglets per sow per year, equivalent to 4.7 million weaned pigs. Annually, the company supplies more than 6.8 million pigs to the market, far surpassing its domestic competitors.

The CPV Food Binh Phuoc project, with an investment of USD 250 million, has been operational since 2020, enabling Vietnam to become a processed chicken exporter to Japan and Europe. The project includes a feed mill (300,000 tons/year), 5 breeder farms, a hatchery (producing 1.1 million chicks/week), 24 broiler farms, and a large-scale slaughterhouse on a 25-hectare site.

According to Bloomberg, C.P Foods is expediting the IPO process for C.P Vietnam after receiving positive signals from the authorities. Previously, the IPO plan was mentioned in 2022 but did not make significant progress. The goal of this IPO is to raise capital for expansion plans and to strengthen the company’s presence in Vietnam.

C.P Foods CEO, Mr. Prasit Boondoungprasert, stated that the listing would not only enhance financial resources but also contribute to raising the group’s brand awareness in one of its most critical markets.

The Power of Persuasion: Unveiling the Secrets of Effective Selling to a Massive 700,000 Strong Crowd

The multi-level marketing industry in 2024 witnessed a remarkable performance, boasting a staggering turnover of 16,206 billion VND. The industry engaged nearly 700,000 participants, reflecting its significant reach and impact in the market.

How Did the Fund Management Industry Perform in the First Quarter?

The statistics from 43 active fund management companies in the Vietnamese stock market paint an interesting picture. With a focus on revenue and net profit growth, the numbers reveal a thriving industry. However, a deeper dive into the figures uncovers a notable decline in net profit margins, leaving room for further analysis and exploration.