Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (CII) has announced its offering of bonds to the public.

Accordingly, CII plans to offer 20 million bonds with the code CII425001, a par value of VND 100,000/bond, corresponding to a total bond value of VND 2,000 billion at par.

Proceeds from the bond issuance will be used for debt restructuring of the issuing organization.

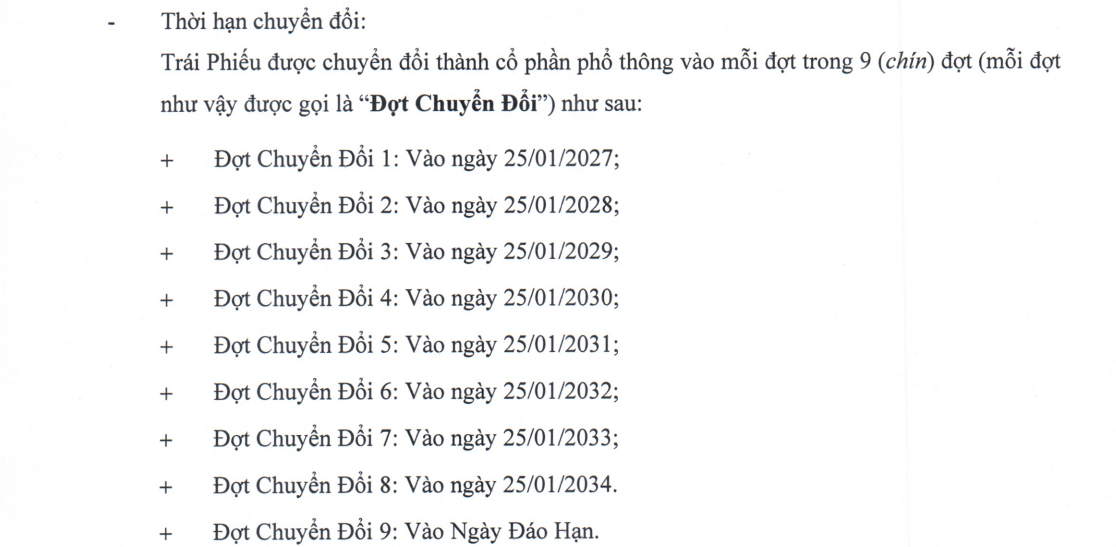

These are convertible bonds into common shares, unsecured, and without warrants. The bond term is 10 years, and the interest rate is a combination of fixed and floating rates.

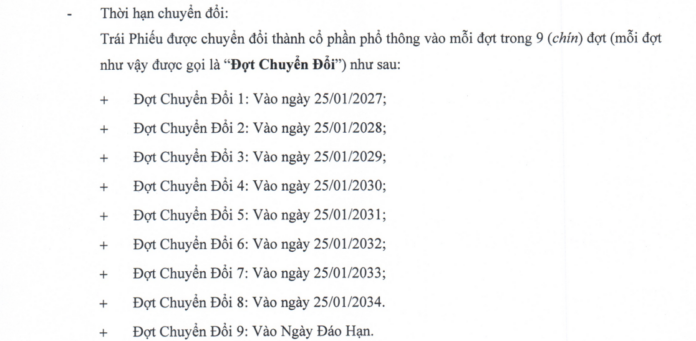

Expected conversion period for CII425001. Source: CII

The distribution method is through the issuing agent, Vietnam Industrial and Commercial Bank Securities Joint Stock Company (“VietinBank Securities”). The deadline for receiving bond subscription applications is from June 2, 2025, to 5:00 PM on July 9, 2025, and the expected issuance date is July 16, 2025.

In another development, on May 16, 2025, the State Securities Commission (SSC) issued Document No. 1711/UBCK-QLCB, announcing that it had received the report on the results of the issuance of shares to convert CII42013 bonds – Batch 9 (issued according to Certificate of Registration of Public Offering of Bonds No. 187/GCN-UBCK dated September 15, 2020) according to Report No. 376/2025/CV-CII dated May 13, 2025, of CII.

Accordingly, CII has issued 217,700 shares to convert 2,177 CII42013 bonds in Batch 9, thereby increasing the number of issued shares from 547,976,583 shares to 548,194,283 shares.

The SSC also requested the enterprise to carry out procedures for registering, depositing, and listing additional shares according to the provisions of law.

Therefore, the Board of Directors issued Resolution No. 127/NQ-HĐQT (NK 2022-2027) dated May 19, 2025, approving the increase of CII’s charter capital from nearly VND 5,480 billion to nearly VND 5,482 billion.

The number of CII42013 bonds still in circulation is 12.87 bonds.

Securities HD Borrows VND 500 Billion Limit to Invest in Government Bonds

The HDS Board of Directors has approved a resolution to borrow up to VND 500 billion from banks over the next 12 months to invest in government bonds.

The Ultimate Guide to Refinancing: Strategies for Lowering Your Interest Payments and Boosting Your Business’s Bottom Line.

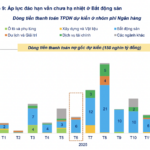

In the remaining eight months of 2025, the non-banking group is expected to face approximately VND 45.6 trillion in maturing bond interest payments. Notably, the real estate sector accounts for over half (53%) of the group’s maturing value.

The Stock Market Conundrum: Experts Advise Caution as VN-Index Surges in Banking and Real Estate Sectors.

The Vietnamese market has demonstrated remarkable resilience, bouncing back from the challenges posed by the US government’s tariff policies. This recovery can be largely attributed to the strong performance of the VN30, particularly the real estate and banking sectors, which have played a pivotal role in driving the market’s resurgence.