Oil Slump

Oil prices slumped over 1% on Thursday, reversing earlier gains, as investors weighed the potential impact of a US court ruling blocking Donald Trump’s sweeping tariffs.

The market also eyed potential new US sanctions that could curb Russian crude flows and OPEC+’s decision to boost output in July.

Brent crude fell 75 cents, or 1.2%, to $64.15 a barrel. US West Texas Intermediate (WTI) crude dropped 90 cents, or 1.5%, to $60.94.

Prices had earlier risen after a US court on Wednesday ruled that Donald Trump exceeded his authority when imposing tariffs on a wide range of products imported from US trading partners.

However, prices fell back later in the session as senior officials in the Donald Trump administration played down the ruling’s impact and asserted that there were other legal avenues to apply tariffs.

On the supply side, the Organization of the Petroleum Exporting Countries and allies, known as OPEC+, could agree on Saturday to bring forward their planned output increases for July.

Gold Edges Higher

Gold prices edged higher on Thursday, buoyed by weak US jobs data, while market participants also monitored the court ruling on Donald Trump’s tariffs.

Spot gold ended the session up 0.9% at $3,318.69 per ounce, after touching its lowest since May 20 earlier in the day. Gold futures for June 2025 delivery rose 0.6% to $3,343.90.

Data showed the number of Americans filing for unemployment benefits rose more than expected last week.

Iron Ore Rebounds

Iron ore futures rebounded on Thursday, ending a four-day losing streak, buoyed by market optimism after a US federal court blocked Donald Trump’s tariffs from taking effect.

The most-traded September iron ore contract on China’s Dalian Commodity Exchange (DCE) ended the session up 1.29% at 707 yuan ($98.31) a ton.

Singapore Exchange (SGX) iron ore futures for June rose 0.95% to $97 a ton.

Copper Steady

Copper prices steadied on Thursday, supported by market optimism after a federal court halted Donald Trump’s sweeping tariffs on imports from most US trading partners.

Three-month copper on the London Metal Exchange was almost unchanged at $9,567 a ton.

A weaker US dollar also underpinned the market, as a softer greenback makes dollar-denominated commodities cheaper for buyers using other currencies.

Corn Falls, Soybeans and Wheat Rise

Chicago corn futures fell on Thursday as favorable weather in the US Midwest weighed on prices. Cheaper supplies from South America also put pressure on US commodities.

The most-active corn contract on the Chicago Board of Trade (CBOT) fell 4 US cents to $4.47 a bushel.

The most-active soybean contract rose 3-1/4 US cents to $10.51-3/4 a bushel.

Wheat futures edged higher on Thursday, with forecasts for rain in the US Plains providing support.

Wheat ended the session up 3-3/4 US cents at $5.34 a bushel.

The US dollar weakened on Thursday, boosting wheat as investors monitored Donald Trump’s appeal against a US trade court ruling on Wednesday that blocked most of the tariffs he proposed. An appellate court reinstated the sweeping tariffs late on Thursday after the market close.

A softer dollar makes US agricultural exports more competitive for buyers using other currencies.

Place said, “There’s just too much uncertainty about trade for the market to really move in any direction too far.”

Robusta Coffee Hits 6-1/2 Month Low on Rising Supplies

ICE robusta coffee futures fell to a 6-1/2 month low on rising supplies from the new harvest in Brazil and Indonesia.

Robusta coffee ended down $36, or 0.8%, at $4,530 a ton, after touching its lowest since November at $4,494.

Brokers said the new robusta harvest was putting pressure on prices.

Arabica coffee fell 1% to $3,484 a lb. Reuters technical analyst Wang Tao forecast a further drop in arabica coffee to between $3,400.5 and $3,457.5.

Rubber Edges Lower

Rubber prices in Japan edged lower on Thursday as a price war in China’s auto market, the world’s top consumer, weighed on sentiment for the tire-making material, although wet weather in producing regions prevented steeper losses.

The most active rubber contract on the Osaka Exchange (OSE) for November delivery ended the session down 2.3 yen, or 0.73%, at 314.6 yen ($2.16)/kg.

The most-traded September rubber contract on the Shanghai Futures Exchange (SHFE) fell 190 yuan, or 1.35%, to 13,880 yuan ($1,929.98) a ton.

SHFE’s June butadiene rubber contract, which is used to produce synthetic rubber, rose 15 yuan, or 0.13%, to 11,345 yuan ($1,577.49) a ton.

Rice Remains Depressed

Abundant supplies and expectations of another bumper crop in India kept export prices near two-year lows this week, while trade was subdued in Vietnam and Thailand.

India’s 5% broken parboiled rice was quoted at $382-$389 per ton, unchanged from the previous week and near its lowest since June 2023.

Meanwhile, Thailand’s 5% broken rice was quoted at $405-$410 a ton, also unchanged from the previous week.

Vietnam’s 5% broken rice was offered at $396 per ton on Thursday, slightly down from $397 last week.

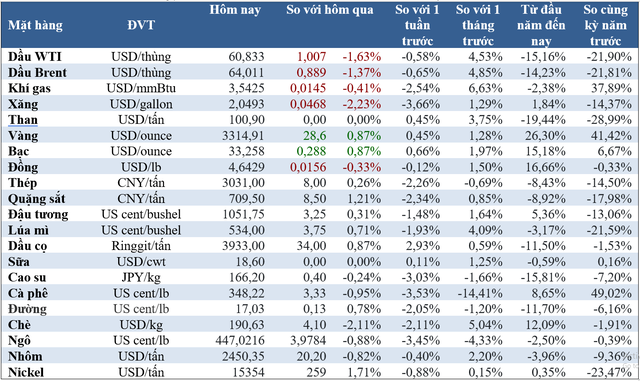

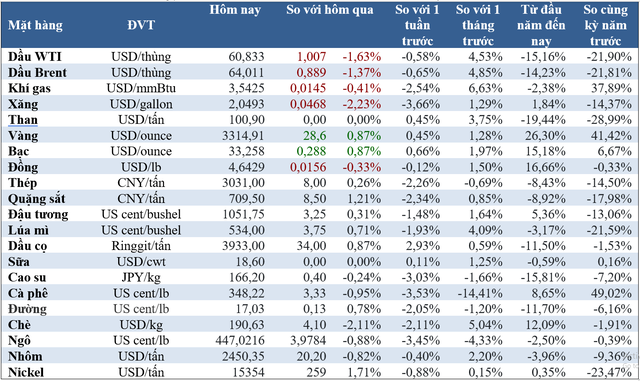

Key Commodity Prices on May 30

What’s the Deal with SJC’s Monopoly on Gold Bars Over the Past Decade?

In 2024, the volatile gold prices resulted in a significant revenue shift for SJC. The company raked in 32,193 billion VND, marking a notable surge of nearly 4,000 billion VND compared to 2023. This performance is especially noteworthy considering SJC’s previous monopoly on gold bullion, during which it boasted revenues surpassing 72,000 billion VND.

Oil, Gold, and Coffee: A Triple Dip on May 31st

The commodities market witnessed a broad-based decline on Friday, with oil, gold, copper, coffee, and rubber all trading lower. Conversely, raw sugar and cocoa were the only commodities that bucked the trend and ended the session in positive territory.

Gold, Oil, Rubber, and Iron Ore Markets: A Day of Declines

The commodities market witnessed a broad-based decline with gold prices dipping for the second straight session, iron ore and wheat slipping for the third consecutive session, and cacao falling for the fifth session in a row. This downward trend comes on the back of the US tariff reprieve for EU goods and a stronger US dollar.