Monopoly on Gold: An Outdated Concept

– There has been much talk recently about amending Decree 24 on gold market management. Why is this considered the “right time” for amendments, sir?

This is not a new issue. The National Assembly has long made this request, and the Government has been working on it. The Prime Minister has been specifically involved, and the State Bank has reported on this matter several times.

Especially during the working session with the Central Policy and Strategy Committee, General Secretary To Lam made very clear directions regarding gold market management. These directions are not impulsive but are based on practical assessments and legal reviews.

National Assembly Deputy Trinh Xuan An. Photo: QH.

“We should use gold as a measure of wealth, not as a haven for money, not as an underground means of payment, and certainly not as an asset for hoarding,” said Deputy Trinh Xuan An.

Gold is not something insignificant compared to real estate or stocks, but it is closely related to finance, monetary factors, and social aspects. The gold price reflects the sentiment and health of the economy.

It is evident that the gold market has not been functioning as a true market for a long time. Decree 24 once played a crucial role, especially during turbulent times, but it is now outdated. Amendments are necessary to adapt to the new reality.

– One controversial issue is the monopoly on gold bars. What is your view on this matter?

The monopoly mechanism for gold bars, with SJC as the sole provider over a decade ago, was suitable for that time. However, it is no longer reasonable to maintain this monopoly. We should not allow a single enterprise or organization to have a monopoly on gold bars.

It is essential to emphasize that ending the monopoly does not mean abandoning control or returning to the chaotic period before Decree 24. We must have a roadmap and clear oversight. Only a limited number of qualified enterprises should be allowed to engage in gold import, mining, fabrication, and trading. This point was emphasized by the General Secretary during the recent working session.

– Will resuming gold imports affect the country’s foreign exchange reserves, as some worry?

Indeed, we previously avoided gold imports to prevent impacts on our foreign exchange balance. However, we need to reassess this carefully. If our annual gold imports remain below $4 billion, it won’t be a significant concern.

“We need to establish a genuine market with state management, macro-level adjustments, and taxation on gold production, trading, and sales,” said Trinh Xuan An.

Our gold imports and exports should be similar to those of other goods, with a crucial link between the domestic and international markets. Currently, we regulate through administrative orders, but economic management must follow market rules: supply, demand, and healthy competition.

Gold is Not a Speculative or Hoarding Tool

– Besides gold bars, the gold jewelry market seems to be “neglected,” isn’t it, sir?

Yes. When gold bar prices rise, people turn to buying gold rings and jewelry as a way to own gold. However, we treat gold jewelry almost the same as gold bars: we don’t allow imports, causing a shortage of raw materials and creating many negative consequences.

We should focus on developing the gold jewelry market alongside gold bars. (Illustrative image)

Meanwhile, Thailand’s gold jewelry market reaches $20 billion per year. This presents a significant opportunity to develop the gold jewelry industry, creating real economic value instead of focusing solely on hoarding.

– Some experts propose establishing an official gold exchange. What is your opinion on this matter?

I agree. However, the gold exchange must be legitimate and transparent, with traceable product origins. We cannot allow a recurrence of the previous situation with virtual gold, speculation, and money laundering. As a market, it must operate by market rules. Gold offered for trading must have a clear origin, and the state should regulate it through tools like taxation and macroeconomic policies.

Ultimately, amending Decree 24 is not just a practical necessity but also an urgent political and legal requirement, as directed by the General Secretary. We need to change our perspective: manage it as a market with strict control, reduce monopolies, and create a transparent competitive environment.

The goal is to restore gold to its proper role as a commodity asset, not a speculative or hoarding tool. Doing this well will stabilize the market, increase revenue, and boost economic growth.

– Thank you, sir!

What’s the Deal with SJC’s Monopoly on Gold Bars Over the Past Decade?

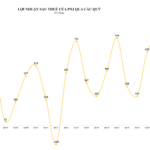

In 2024, the volatile gold prices resulted in a significant revenue shift for SJC. The company raked in 32,193 billion VND, marking a notable surge of nearly 4,000 billion VND compared to 2023. This performance is especially noteworthy considering SJC’s previous monopoly on gold bullion, during which it boasted revenues surpassing 72,000 billion VND.

Unlocking Gold’s Monopoly: From Hoarding to Transparent Investment

The gold market, when well-regulated, can be more than just a venue for buying and selling assets. It has the potential to become an integral component of a modern, integrated, and stable national financial development strategy.

Restoring Order to the Gold Market

The State Bank has been issuing directives to regulate gold trading activities amidst persistently high prices of SJC gold bars and rings.