Mr. Pham Hong Hai – CEO of OCB introduces digital products to the Prime Minister, Governor of the State Bank, and other leaders

|

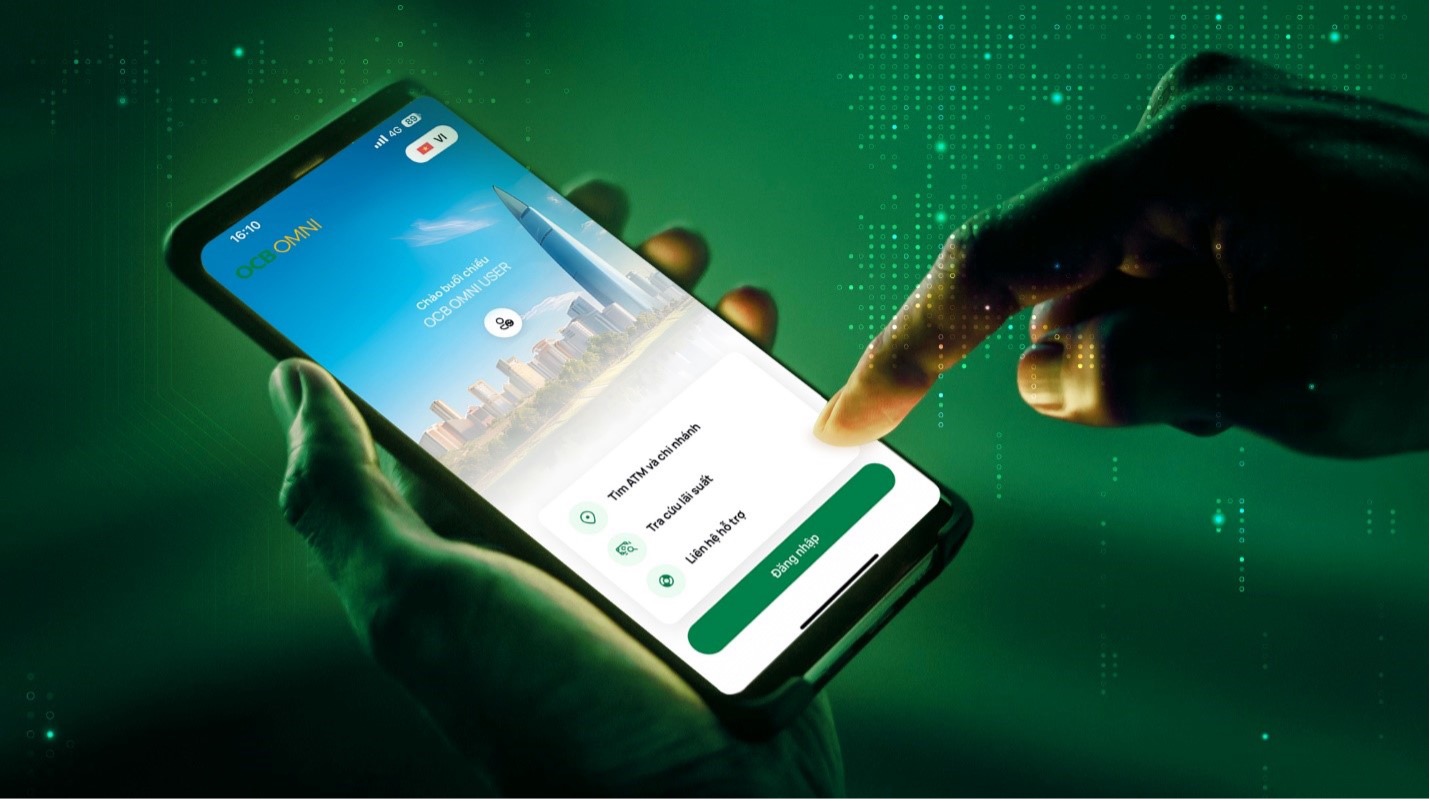

As one of the leading banks in digital transformation with a well-invested, professional system and a solid foundation built over the years, at the 2025 Banking Digital Transformation event, OCB continued to introduce superior financial products tailored to the needs of each customer segment, such as OCB OMNI, the digital bank for young people Liobank, and especially the OCB Smart Merchant platform – a comprehensive smart payment and sales management solution designed exclusively for merchants, especially small and medium-sized enterprises (SMEs).

With OCB OMNI, launched in May 2024, the platform has set a new standard in Vietnam’s digital banking industry in terms of speed and convenience. In addition to using FIDO security technology with a strong encryption algorithm and multi-layer security for transaction signing, considered the safest today, OCB OMNI integrates over 200 features in one application, comprehensively meeting customers’ daily financial and consumption needs. Moreover, OCB OMNI also leverages data technology and artificial intelligence (AI) to enhance customer care and personalize their experience. By analyzing behavior and needs in real-time, the application proactively customizes products and services for each customer at the right time, quickly, conveniently, and effectively. Popular e-wallets are allowed to be linked and controlled within the application, enabling users to easily monitor status, check transaction history, and manage multiple wallets simultaneously without leaving the platform – a significant step forward in consolidating the digital financial experience.

OCB OMNI leverages data technology and artificial intelligence (AI) to enhance customer care and improve their experience

|

For young, modern customers, the digital bank Liobank has proven its pioneering role in effectively implementing digital solutions and shaping new habits for customers in this segment. Since its launch, Liobank has impressed users with a series of unique transaction features such as Shake to pay – shake the phone to transfer money, reply transfer to the sender without needing their account number, and transfer money to Liobank contacts in the phone book. The credit limit for customers is not dependent on traditional data. Instead, an experience limit (EduLimit) is offered, providing access to credit for customers without a transaction history, helping them familiarize themselves with financial products and building a behavioral scoring system. This is an effective financial education model for those who have just entered university or started their careers.

In addition to designing “tailor-made” products for individual customer segments, which are highly appreciated in the market, OCB is also known as a leading bank for corporate products through Open API (open application programming interface), delivering a comprehensive financial ecosystem.

At the event, OCB introduced the digital solution OCB Smart Merchant, a platform that integrates all financial tools for business activities into a single interface, enabling businesses to manage centrally and thus saving significant time and costs in managing cash flow, orders, and revenue, with diverse payment methods such as QR Code and Pay By Link. In addition, the bank provides a diverse and modern range of payment devices, such as POSM QRcode, QR POS, Smart POS, and POS, especially the QR Soundbox payment device, which immediately notifies of successful transactions, including the amount and payment method, suitable for both small shops and large-scale retail chains.

OCB Smart Merchant – A smart and modern sales and payment management solution

|

Beyond payment activities, OCB Smart Merchant also integrates specialized financial management tools such as real-time cash flow monitoring, business performance analysis, order and revenue management, and expense tracking. These tools support merchants in making faster and more accurate decisions. Notably, the platform also supports multi-branch cash flow management, allowing business owners to share balance information with branch employees/managers and customize access rights to ensure revenue confidentiality for each business area. Integrating payment solutions on a single platform automates the reconciliation, refund, payment confirmation, and debt cancellation processes, reducing up to 97% of manual processing time.

In the next phase, OCB Smart Merchant will implement the integration of electronic invoices initiated from cash registers connected to tax data, ensuring complete reporting, accurate tax calculation, and more convenient tax payment. To date, OCB is one of the pioneering units in providing electronic invoice solutions directly on the sales management platform. This is extremely important, helping businesses with an annual revenue of VND 1 billion or more easily comply with the new regulations in Decree 70/2025/ND-CP without any complex additional steps.

“At OCB, we leverage big data not only in unsecured lending but also in many other operations. A typical example is the OCB Smart Merchant platform. The core of this digital solution is the ‘All-in-one’ feature – all merchant data is scientifically centralized. Especially, the application of big data and AI technology helps us better understand their financial picture, cash flow, and actual capital needs. From there, OCB can offer ‘tailor-made’ financial solutions, including unsecured loans, quickly, accurately, to the right people at the right time, and most importantly, reducing risks,” said Mr. Pham Hong Hai, CEO of OCB, at the event.

It is known that in the near future, with the OCB Smart Merchant product, the bank will continue to develop more specialized and personalized financial solutions. For example, providing flexible capital for merchants based on actual cash flow or implementing the buy-now-pay-later (BNPL) model directly on the merchant’s sales platform, targeting the buyer. These solutions not only help merchants optimize their cash flow and accelerate their business but also contribute to building a closed financial ecosystem between sellers and buyers. Notably, this digital solution can also integrate a knowledge library where users can access and update their knowledge about operations, marketing, and finance. This feature is designed for interaction through AI Chatbots, enabling businesses to quickly find information and receive customized consultations.

OCB’s digital products received great attention from customers at the event

|

Through this event, the above digital products have brought special technological experiences to each participant and demonstrated OCB‘s strong commitment to its digital transformation journey, bringing optimal benefits to customers.

“We not only provide separate products, but OCB has been offering a complete and comprehensive digital financial ecosystem for individual and corporate customers. We expect that with the strong transformation of the Vietnamese banking industry, ushering in a new era where digital transformation is the key to success, comprehensive financial platforms like this will be OCB‘s strong differentiator in the market,” added Mr. Pham Hong Hai.

– 21:16 29/05/2025

Unlocking the Potential: Empowering State-Owned Enterprises for Efficient and Effective Operations.

“Vice Prime Minister Ho Duc Phoc signs Government Directive No. 77/CD-TTg. This directive, dated May 29, 2025, outlines strategic initiatives to boost state-owned enterprises’ (SOEs) productive business operations. The measures aim to enhance efficiency and foster growth within these businesses.”

Merging Three Provinces: A Golden Opportunity for Vietnam’s Economic Growth

“The merger of Lam Dong, Binh Thuan, and Dak Nong provinces presents a golden opportunity to create a new, large-scale growth pole with strong momentum. This new entity has the potential to spearhead a green development trend for the entire Central – Highlands region,” emphasized Mr. Dinh Van Tuan, Vice Chairman of Lam Dong Provincial People’s Committee.