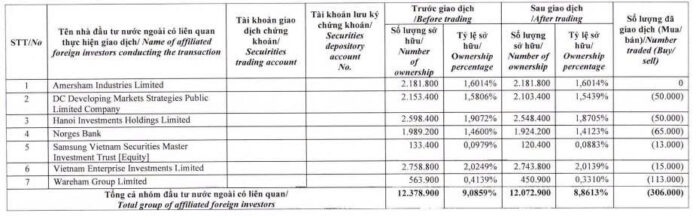

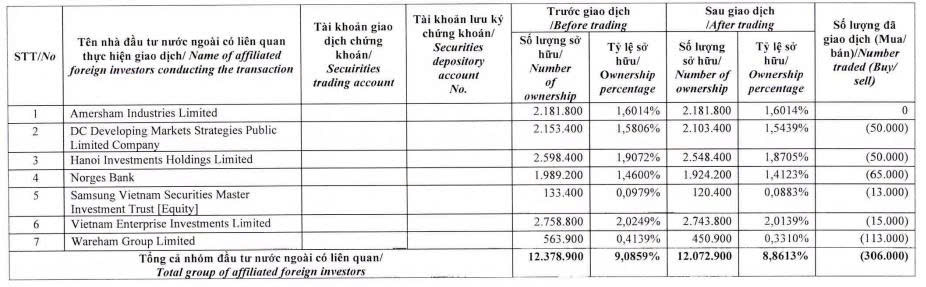

FPT Digital Retail Joint Stock Company (FPT Retail, Stock Code: FRT, HoSE: FRT) has just announced a report on changes in the ownership of foreign investors holding 5% or more of the company’s shares.

Accordingly, during the trading session on May 22, 2025, the Dragon Capital group, represented by Ms. Truong Ngoc Phuong, sold a total of 306,000 FRT shares through its six member funds.

Specifically, DC Developing Markets Strategies Public Limited Company sold 50,000 shares; Hanoi Investment Holdings Limited sold 50,000 shares; Norges Bank sold 65,000 shares; Vietnam Enterprise Investments Limited sold 15,000 shares; Wareham Group Limited sold 113,000 shares, and Samsung Vietnam Securities Master Investments Trust [Equity] sold 13,000 FRT shares.

Source: FRT

Following this transaction, Dragon Capital’s ownership of FRT shares decreased from nearly 12.38 million shares to 12.07 million shares, equivalent to a decrease in holding ratio from 9.0859% to 8.8613%.

Based on the closing price of FRT shares on May 22, 2025, at VND 164,600 per share, Dragon Capital is estimated to have earned approximately VND 50.4 billion from this sale.

In terms of business results, according to the consolidated financial statements for the first quarter of 2025, FPT Retail recorded net revenue of over VND 11,669.8 billion, up 29.1% compared to the same period last year. After deducting the cost of goods sold, gross profit reached over VND 2,324.5 billion, an increase of 28.6% year-on-year.

During this period, the company also recorded nearly VND 37.9 billion in financial income, up 49.8% year-on-year. In line with this, financial expenses increased by 46.4% to nearly VND 88.7 billion; selling expenses increased by 15.1% to nearly VND 1,588.2 billion; and general and administrative expenses increased from nearly VND 302.5 billion to nearly VND 418.5 billion.

After deducting taxes and other expenses, FPT Retail reported a net profit of nearly VND 212.8 billion, 3.5 times higher than the same period last year.

As of March 31, 2025, FPT Retail’s total assets increased by 5.1% from the beginning of the year to over VND 16,636.1 billion. Inventories accounted for 58.7% of total assets, amounting to nearly VND 9,765.9 billion, while cash and cash equivalents stood at over VND 3,391.1 billion, representing 20.4% of total assets.

On the liabilities side of the balance sheet, total liabilities were over VND 14,303.5 billion, an increase of 4.3% from the beginning of the year. Short-term borrowings and finance lease liabilities accounted for VND 8,899.1 billion, or 62.2% of total liabilities.

How Did the Fund Management Industry Perform in the First Quarter?

The statistics from 43 active fund management companies in the Vietnamese stock market paint an interesting picture. With a focus on revenue and net profit growth, the numbers reveal a thriving industry. However, a deeper dive into the figures uncovers a notable decline in net profit margins, leaving room for further analysis and exploration.

“Thaigroup and LPBS Nominate Members for HAGL’s Board of Directors”

The Hoang Anh Gia Lai Joint Stock Company (HOSE: HAG) has unveiled its slate of nominees for the Board of Directors and Supervisory Board for the upcoming term (2025-2030), to be elected at the forthcoming 2025 Annual General Meeting of Shareholders. Notably, alongside current members, the nomination list features several candidates from the large shareholder group holding 121 million HAG shares.

The Long Chau Chain Accelerates with a “Breath-Taking” Pace: Averaging One New Store Opening Per Day Since the Start of the Year

As of the end of 2024, Long Chau’s network of pharmacies and vaccination centers boasted an impressive 2,069 stores. Fast forward to the present, and that number has skyrocketed to an astonishing 2,251, reflecting a substantial expansion of 182 additional stores.