Rồng Việt Securities JSC (VDSC) has announced that it will finalize the list of shareholders on June 11th, implementing the dividend payment in shares as approved at the recent Annual General Meeting of Shareholders.

VDSC will distribute dividends at a ratio of 10%, equivalent to the expected issuance of 24.3 million shares. The entitlement ratio is 10:1, meaning that for every 10 shares held, shareholders will receive 1 new share.

The issuance source is from undistributed post-tax profits on the audited consolidated financial statements for 2024. Upon completion of this dividend payment, Rồng Việt Securities will increase its circulating shares to 243.24 million.

Rồng Việt Securities to Pay Dividends in Shares

As of the end of the first quarter of 2025, Rồng Việt Securities had four major shareholders. They are Chairman Nguyễn Miên Tuấn, holding 41.27 million units, accounting for 16.99% of charter capital. It is estimated that Mr. Tuấn will receive 4.1 million shares in dividends.

Shareholder Nguyễn Xuân Đô owns 38.8 million shares, representing 15.97% of the charter capital. This shareholder is expected to receive 3.8 million new shares.

Shareholder Nguyễn Hoàng Hiệp also holds 38.8 million shares and is estimated to receive 3.8 million new shares.

Phạm Mỹ Linh (mother of Phạm Hữu Luân – Member of the Board of Directors of VDS) holds 27.27 million shares, accounting for 11.22% of the charter capital. It is estimated that Ms. Mỹ Linh will receive 2.7 million new shares.

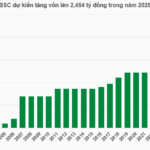

Following the approved plan for capital increase in 2025, after the aforementioned dividend payment, Rồng Việt Securities will proceed with the issuance of shares under the Employee Stock Ownership Plan (ESOP).

Finally, VDS will offer a private placement of up to 48 million shares to its shareholders.

In terms of business results, according to the consolidated financial statements for the first quarter of 2025, Rồng Việt Securities recorded operating revenue of nearly VND 170 billion, a decrease of 41% compared to the same period last year.

Among the revenue structure, proprietary trading decreased the most by 76% to just under VND 34 billion. Brokerage service revenue also decreased by 36% to VND 34 billion. Other business segments showed some growth but were not significant.

While operating revenue decreased significantly, operating expenses increased by 4.2%, reaching nearly VND 123 billion.

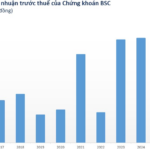

Consequently, Rồng Việt Securities’ pre-tax profit was VND 22.6 billion, and after-tax profit was VND 19 billion, both down 85% over the same period.

The Annual General Meeting of Shareholders for the 2024 fiscal year, held on April 3, approved the business plan for 2025 with a total revenue of VND 1,106 billion, up 6% compared to 2024; pre-tax profit of VND 368 billion, up 3.5%; and after-tax profit of VND 294 billion, up 1%. Thus, VDSC has only achieved 15% of revenue and 6% of profit in the first three months.

As of the end of the first quarter of 2025, Rồng Việt Securities’ total assets were VND 6,348 billion, a decrease of approximately VND 47 billion from the beginning of the year, mostly comprising short-term assets.

Cash and cash equivalents decreased from VND 1,207 billion at the beginning of the year to nearly VND 664 billion. The HTM investments remained unchanged at VND 400 billion. Loans increased by over VND 448 billion to VND 3,194 billion.

The FVTPL financial asset portfolio had a book value of VND 1,437 billion, entirely invested in stocks. Notably, during this period, the company increased its investment in KBC stocks by VND 280 billion and is currently making a temporary profit of 8.2%.

The AFS portfolio had a book value of nearly VND 278 billion, a decrease of VND 214 billion from the beginning of the year, all in stocks. This portfolio is currently slightly underwater with CMG and MWG stocks.

In terms of capital sources, short-term bank loans amounted to VND 433 billion, and bond debt stood at VND 2,980 billion.

“Binh Dien Fertilizer to Dish Out Nearly VND 143 Billion in Dividends to Shareholders”

“Binh Dien Fertilizer plans to spend over VND 142.9 billion on dividends for its shareholders for the fiscal year 2024, with a generous payout ratio of 25%. The record date for shareholders to be eligible for this dividend is set for June 12, 2025.”

“Unanimous Shareholder Approval: ACV’s 96% Dividend Payout in Stock”

“As per the plans, ACV will allocate VND 7.13 trillion to the development investment fund, leaving approximately VND 14 trillion for dividend payout in shares. ACV expects to issue around 1.4 billion new shares, representing a ratio of 64.58% (for every 100 shares held, shareholders will receive 64.58 new shares).”