The VN-Index closed the 22nd trading week of 2025 at 1,332.60 points, a rise of +18.14 points or +1.38% from the previous week. While there was a negligible increase in liquidity (+3.1%), the trading value of matched orders on the HOSE reached VND 21,398 billion on average, 18.3% higher than the 5-week average.

When analyzing by market capitalization, there was a significant reduction in liquidity for large-cap stocks (VN30) and, conversely, a positive increase in liquidity for the two remaining groups, with the VNMID and VNSML indices outperforming the VN30.

In terms of sectors, Real Estate led the way in liquidity growth, but there was a noticeable differentiation. Specifically, there was a weakening in liquidity for the Vingroup stock group, while highly speculative stocks like NVL, CEO, DXG, and PDR saw substantial improvements in liquidity.

Additionally, some sectors witnessed a consensus between rising liquidity and price indices, including Securities, Oil Equipment, Textiles, Water Transport, Rubber & Plastics, Wood, and Personal Goods. On the other hand, the Banking and Electrical Equipment sectors experienced an increase in price indices but a decline in liquidity.

Across the three exchanges, the average trading value per session in week 22/2025 reached VND 25,514 billion, with the average matched order trading value at VND 23,680 billion, a 5.7% increase from the previous week and a 20.5% increase from the 5-week average.

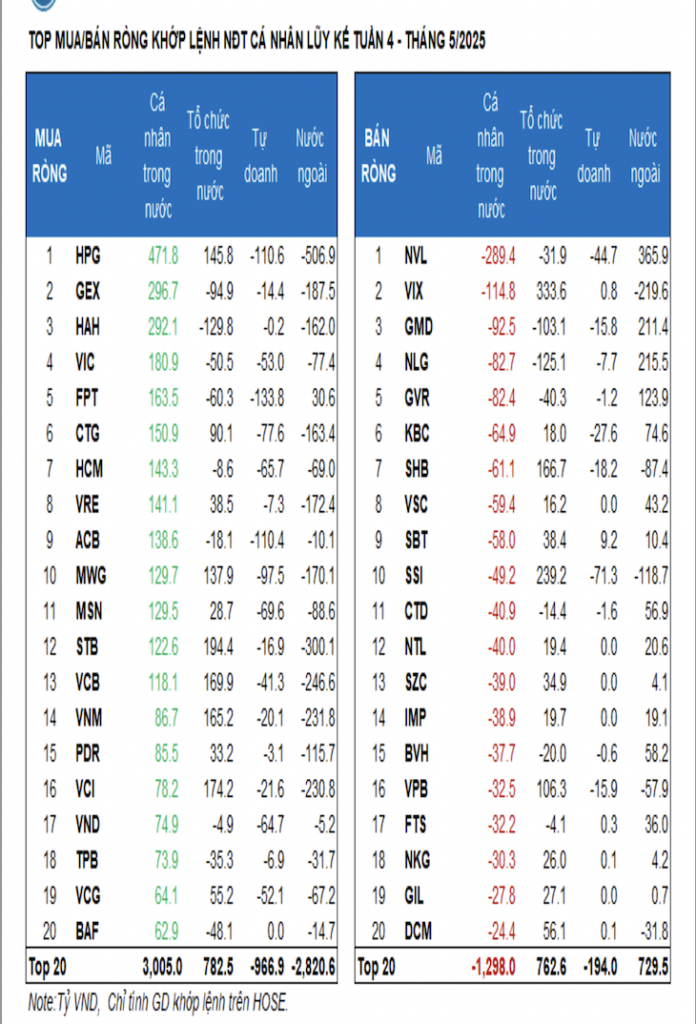

Looking at investor categories, foreign investors turned to net selling after three consecutive weeks of net buying. Their top net-sold sectors included Banking, Steel, Securities, Oil & Gas, and Retail, while they resumed net buying in Real Estate. Notably, domestic institutions net bought for the second consecutive week, focusing on Financials (Banking and Securities) and Chemicals.

Foreign investors net sold VND 2,706.1 billion, and when considering only matched orders, their net selling was VND 2,768.1 billion. Their main net buying sectors in matched orders were Real Estate, Power & Energy, and Water & Petroleum Gas. The top net bought stocks by foreign investors in matched orders included NVL, VHM, NLG, GMD, GVR, GAS, EIB, KBC, BVH, and CTD.

On the net selling side, the Banking sector dominated. The top stocks net sold by foreign investors in matched orders were HPG, STB, VCB, VNM, VCI, GEX, VRE, MWG, and CTG.

Individual investors net bought VND 3,223.9 billion, with a net buy of VND 2,478.6 billion in matched orders. In terms of matched orders, they net bought 12 out of 18 sectors, mainly in the Banking sector. The top stocks bought by individual investors included HPG, GEX, HAH, VIC, FPT, CTG, HCM, VRE, ACB, and MWG.

On the net selling side of matched orders, they net sold 6 out of 18 sectors, primarily in Chemicals, Personal & Household Goods. The top net sold stocks were NVL, VIX, GMD, NLG, GVR, KBC, VSC, SBT, and SSI.

Proprietary trading net sold VND 2,269.8 billion, with a net sell of VND 1,580.7 billion in matched orders. In terms of matched orders, proprietary trading net bought 3 out of 18 sectors, with Chemicals, Automobiles & Components being the top net bought sectors. The top net bought stocks by proprietary trading this week included FUEVFVND, E1VFVN30, DGC, DPM, SBT, DRC, CTI, PVT, TCH, and FUEVN100.

The top net sold sector was Banking. The top net sold stocks included FPT, TCB, HPG, ACB, MWG, DXG, CTG, MBB, SSI, and MSN.

Domestic institutional investors net bought VND 1,752.1 billion, and in terms of matched orders, they net bought VND 1,870.1 billion. Domestic institutions net sold 6 out of 18 sectors in matched orders, with the highest value in Industrial Goods & Services. The top net sold stocks were VHM, HAH, NLG, EIB, GMD, GEX, GAS, FPT, VIC, and RYG. The top net bought sector was Banking. The top net bought stocks included VIX, SSI, STB, VCI, VCB, SHB, VNM, HPG, DPM, and MWG.

The allocation of money flow increased in Real Estate, Securities, Steel, Retail, Oil Equipment, Water Transport, and Textiles, while it decreased in Banking, Food & Beverage, Electrical Equipment, Information Technology, and Power & Energy.

In week 22, Real Estate led in liquidity growth, but there was a noticeable differentiation. Specifically, there was a weakening in liquidity for the Vingroup stock group, while highly speculative stocks like NVL, CEO, DXG, and PDR saw substantial improvements in liquidity.

Additionally, some sectors witnessed a consensus between rising liquidity and price indices, including Securities, Oil Equipment, Textiles, Water Transport, Rubber & Plastics, Wood, and Personal Goods. On the other hand, the Banking and Electrical Equipment sectors experienced an increase in price indices but a decline in liquidity.

In terms of market capitalization, there was a significant reduction in liquidity for large-cap stocks (VN30) in week 22, while the mid and small-cap groups saw positive liquidity growth, with VNMID and VNSML outperforming VN30.

The allocation of money flow to large-cap stocks (VN30) decreased to 41.8% in week 22, the lowest level in 11 weeks since the end of February 2025, indicating a noticeable weakening in the appeal of blue-chip stocks. The average trading value decreased by VND 1,294 billion (-12.6%), leading to a price index increase of only 1.01% for this group, significantly lower than the overall market.

In contrast, mid and small-cap stocks experienced notable improvements in liquidity, with VNMID and VNSML increasing by VND 1,371 billion (+17.3%) and VND 478 billion (+30.4%), respectively. As a result, the allocation of money flow to VNMID and VNSML rose to 43.4% and 9.6% in week 22. The positive trading sentiment in these two groups became a driving force for price increases, with the VNMID and VNSML indices rising by +2.47% and +1.95%, outperforming the VN30.

[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates

The upcoming periodic information disclosures in June encompass several notable events in the stock market. These include the release of the PMI, the effective portfolio and market classification by MSCI, disclosure and effectiveness of the FTSE ETF and VNM ETF portfolios, the socio-economic situation report for May, the maturity of VN30F2506 futures contracts, and the Fed’s announcement of FOMC meeting results.

The Stock Market Slump: Shares Tumble Across the Board

The pressure to secure profits after a streak of consecutive gains, coupled with the fatigue of leading stocks, dragged the benchmark away from its previous peak. As the week’s final trading session concluded, the VN-Index witnessed a decline of over 9 points, with more than 230 stocks drowning in red.

Tomorrow’s Stock Market Outlook: Can VN-Index Surpass the 1,345-Point Mark?

“Amidst a cautious trading session on May 29th, the market still presented opportunities for those with a keen eye and patience. “

![[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates](https://xe.today/wp-content/uploads/2025/06/HinhT6_01-150x150.png)