|

Textile enterprises are taking advantage of the 90-day tax deferral to boost production and secure orders – Illustrative image |

Vinatex will hold its 2025 Annual General Meeting of Shareholders (AGM) on the morning of June 16 in Hanoi. The meeting materials presented to shareholders include the business plan for this year with consolidated revenue and profit targets of VND 18,315 billion and VND 910 billion, respectively, representing a slight increase in revenue and a 9% profit growth compared to 2024.

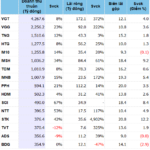

| Vinatex’s Financial Performance over the Past Decade |

In the first quarter of 2025, Vinatex achieved VND 4,268 billion in revenue and VND 271 billion in pre-tax profit, accounting for 23% and 30% of the annual plan, respectively. Compared to the same period in 2024, revenue and profit increased by 7% and 146%, respectively, thanks to the recovery of the fiber sector, which turned from loss to profit, and the garment sector, which maintained a full order book until the second quarter of 2025.

A notable point in the meeting materials is Vinatex’s decision to not pay dividends for 2024, marking the first time since 2015 that the company has not distributed profits to shareholders. During the period of 2015-2023, Vinatex maintained a cash dividend payout ratio ranging from 2-6%, with the latest dividend for 2023 being 3%.

Instead, Vinatex proposed to allocate approximately VND 47 billion (equivalent to 30% of 2024 net profit) to the development investment fund. Additionally, VND 10 billion (6.4%) will be allocated to the reward and welfare fund, and VND 1.1 billion (0.7%) to the management bonus fund.

This AGM will also elect the Board of Directors and Supervisory Board for the term 2025-2030, comprising 7 members on the Board of Directors and 5 members on the Supervisory Board. Currently, the Board of Directors consists of 6 members, including Chairman Le Tien Truong, Vice Chairman Tran Quang Nghi, and CEO Cao Huu Hieu.

Navigating the Challenges of US Tariffs

As a leading enterprise in the industry, Vinatex is noticeably impacted by the new US tariff policy on textiles and apparel. However, this regulation has been temporarily postponed for 90 days, ending on July 10. According to Chairman Le Tien Truong, enterprises need to maximize order opportunities in the first half of the year, as “at least two-thirds of the profit plan needs to be completed during this period to buffer against potential fluctuations in the latter half”. He emphasized the need for the textile industry to quickly adapt, just as it overcame previous tariff barriers before Vietnam’s accession to the WTO.

The Vinatex system of enterprises has proactively responded by accelerating production, renegotiating delivery schedules, and seeking new markets to diversify risks. A positive signal emerged recently when, on May 25, President Donald Trump stated that the tariff policies primarily target the high-tech and military equipment sectors, rather than textiles and apparel.

This positive development was reflected in the stock market, with many textile stocks reaching the ceiling price on May 26, including VGT, which rose to VND 11,700 per share and further increased to VND 11,800 per share on May 29. Compared to the low of below VND 10,000 per share in early April, VGT has risen by 21%, although it is still 25% lower than a year ago. The average trading volume for the year reached 1.7 million shares per session.

| VGT Share Price Movement over the Past Year |

– 15:28 29/05/2025

The Textile Industry Navigates Turbulent Waters: Riding the Wave or Drowning in Tariff Troubles?

The textile industry witnessed a remarkable rebound in the first quarter of 2025, attributed to improved profit margins and steady orders. Despite this positive trajectory, the industry faces a significant headwind in the form of looming 46% tariffs from the United States, which, although postponed for 90 days, necessitates a swift strategic shift to sustain this growth momentum.

The Big Players in Textile Industry Navigate a 90-Day Tariff Reprieve from the US

Amidst the pressures of price-sharing, order competition, and tariff risks, prominent textile and garment enterprises such as Vinatex, Hoa Tho, Huegatex, and M10 are in a 90-day sprint before the tariff exemption ends. With the volatile American market, the garment industry is compelled to pivot, diversify risks, and pinpoint strategies for the third quarter of 2025.

The Trade Tensions Weave Uncertainty for Vietnam’s Textile Industry

In light of the US-China trade truce, while Vietnam is still in negotiations, Vinatex forecasts a stable order volume for Q3 due to low US inventory levels. However, the company predicts a potential 10% decline in orders for Q4 as purchasing power may weaken. Chairman Le Tien Truong emphasizes the industry’s need to seize the negotiation “lull” to proactively adapt and stay resilient.

The Vietnamese Textile and Apparel Industry: Leading the Pack with Impressive Growth Rates

The textile industry is a powerhouse in Vietnam, with 2024 exports reaching an impressive $44 billion. This significant milestone has propelled the country to second place globally, just behind China, in terms of total textile and apparel exports, surpassing Bangladesh. Vietnam’s dominance in this sector is projected to continue, with forecasts estimating a further increase to $46 billion in 2025.