Nam Long Investment Joint Stock Company (code: NLG, HoSE) has recently approved a plan to issue private placement bonds worth VND 660 billion, non-convertible, without warrants, and asset-backed.

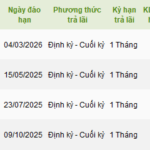

The expected bond term is 3 years, with an interest rate of 11% p.a. for the first two interest periods and 9.8% p.a. for the remaining periods. Each interest period is calculated as six continuous months from the issuance date until the maturity date or early redemption date.

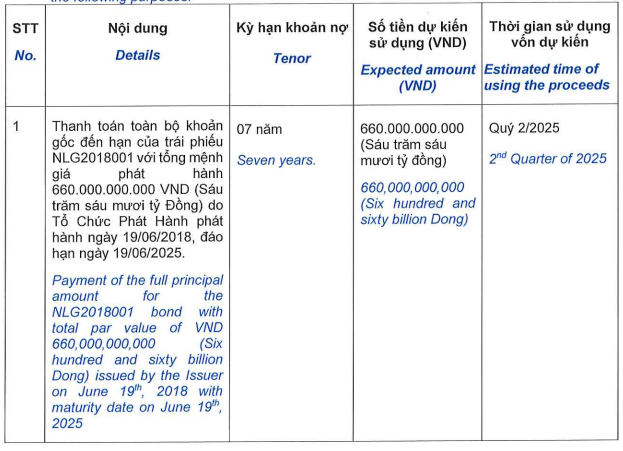

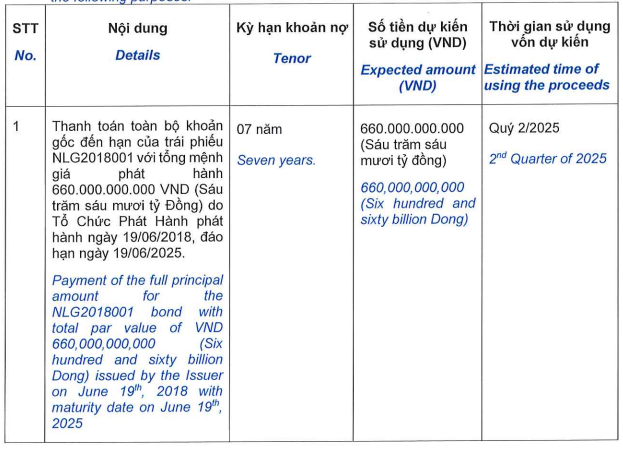

The proceeds from this issuance will be used to fully repay the principal amount of NLG2018001 bonds worth VND 660 billion, maturing on June 19, 2025. Accordingly, the expected timing for the issuance and utilization of proceeds is the second quarter of 2025.

The initial bond security comprises nearly 38.6 million shares of Nam Long VCD, valued at VND 990 billion, equivalent to VND 25,680 per share, as per the Appraisal Certificate dated April 17, 2025.

Source: NLG

On June 6, Nam Long will finalize the list of shareholders to pay 2024 dividends at a rate of 4.99%, meaning that for every share owned, shareholders will receive VND 499.

Nam Long is expected to spend VND 192 billion on this dividend payment. The payment date is set for June 30, 2025.

In another development, Nam Long recently received Decision No. 1938/QD-CCTKV02 from Area II Tax Department, imposing administrative sanctions for tax violations.

Nam Long was found to have made errors in their VAT and CIT declarations, resulting in an underpayment of taxes due. Additionally, there were errors in VAT and CIT declarations that did not lead to an underpayment.

For these violations, Nam Long was fined over VND 371.2 million. The company is also required to rectify the situation by paying the outstanding tax amount of nearly VND 1.8 billion and late payment interest of over VND 33 million.

The late payment interest was calculated up to May 23, 2025. Nam Long is responsible for calculating and paying any additional late payment interest accrued from that date until the actual payment of the outstanding tax and penalty amounts into the state budget, as per regulations.

In total, Nam Long needs to pay nearly VND 2.2 billion in tax penalties, tax arrears, and late payment interest.

Furthermore, the company has to reduce its VAT credit amount by nearly VND 4.4 million. The tax authority requested Nam Long to adjust this amount in their VAT declaration for the tax period in which they received this decision.

Additionally, they need to adjust the loss carried forward from 2023 to 2024 (for production and business activities) by over VND 1 billion.

The Great Treasury Bond Buyback: Over 10.3 Trillion VND of Bonds Redeemed Ahead of Schedule in April

According to data compiled by the Vietnam Bond Market Association (VBMA) from HNX and SSC, as of April 30, 2025, there were a total of 21 corporate bond issuances valued at over 34 trillion VND in April 2025.

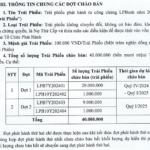

The VDS Issuance of Corporate Bonds: An Exclusive Offering of 800 Billion VND

The Board of Directors of Rong Viet Securities Corporation (VDSC, HOSE: VDS) approved a plan to issue the second tranche of bonds worth VND 800 billion to professional investors on May 7th, 2025. This move aims to restructure the company’s debt and strengthen its financial position. With this new issuance, VDSC demonstrates its commitment to optimizing its capital structure and ensuring long-term financial stability.

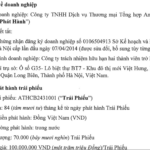

“LPBS Plans to Invest Up to VND 1,400 Billion in LPBank Bonds”

The Board of Directors of LPBank Securities JSC (LPBS) approved an investment plan to purchase and trade up to VND 1,400 billion in face value of bonds issued by LPB Vietnam Commercial Joint Stock Bank (HOSE: LPB), with the code LPB7Y202401.