Novaland’s ESOP Issuance in 2025

In recent developments, Novaland (code: NVL) has announced two resolutions by its Board of Directors, approving the 2025 ESOP issuance with two options for employee stock ownership plans, totaling a 5% ratio. This was passed at the 2025 Annual General Meeting of Shareholders.

Specifically, with the ESOP issuance, Novaland plans to offer over 48.75 million shares, representing a 2.5% ratio, at a price of VND 10,000 per share. The expected proceeds from this offering amount to VND 487.5 billion.

Additionally, regarding the bonus ESOP option, the company intends to issue an equivalent number of shares, totaling 48.75 million, or a 2.5% ratio. The capital source for this issuance will be derived from the surplus capital account based on the audited separate financial statements for 2024.

Upon completion, Novaland’s chartered capital is expected to increase to VND 20,476 billion. The timeline for executing both options is set for the second and third quarters of 2025, following written notification from the State Securities Commission regarding the receipt of the company’s full reporting package for the issuance.

As per Novaland, amidst ongoing challenges and obstacles, achieving strategic goals demands unity, effort, and a strong commitment from the entire team. The 2025 ESOP policy is proposed to fulfill three primary objectives: fostering unity, recognizing contributions, and enhancing competitive advantages, while also ensuring optimized operating costs to focus on restructuring, recovery, and resuming growth.

Specifically, the 2025 ESOP issuance options aim to increase cohesion and provide long-term incentives for key and potential human resources. Simultaneously, they serve to acknowledge the dedication and contributions of the Group’s employees during the company’s business operations, particularly during the challenging phase over the past two years.

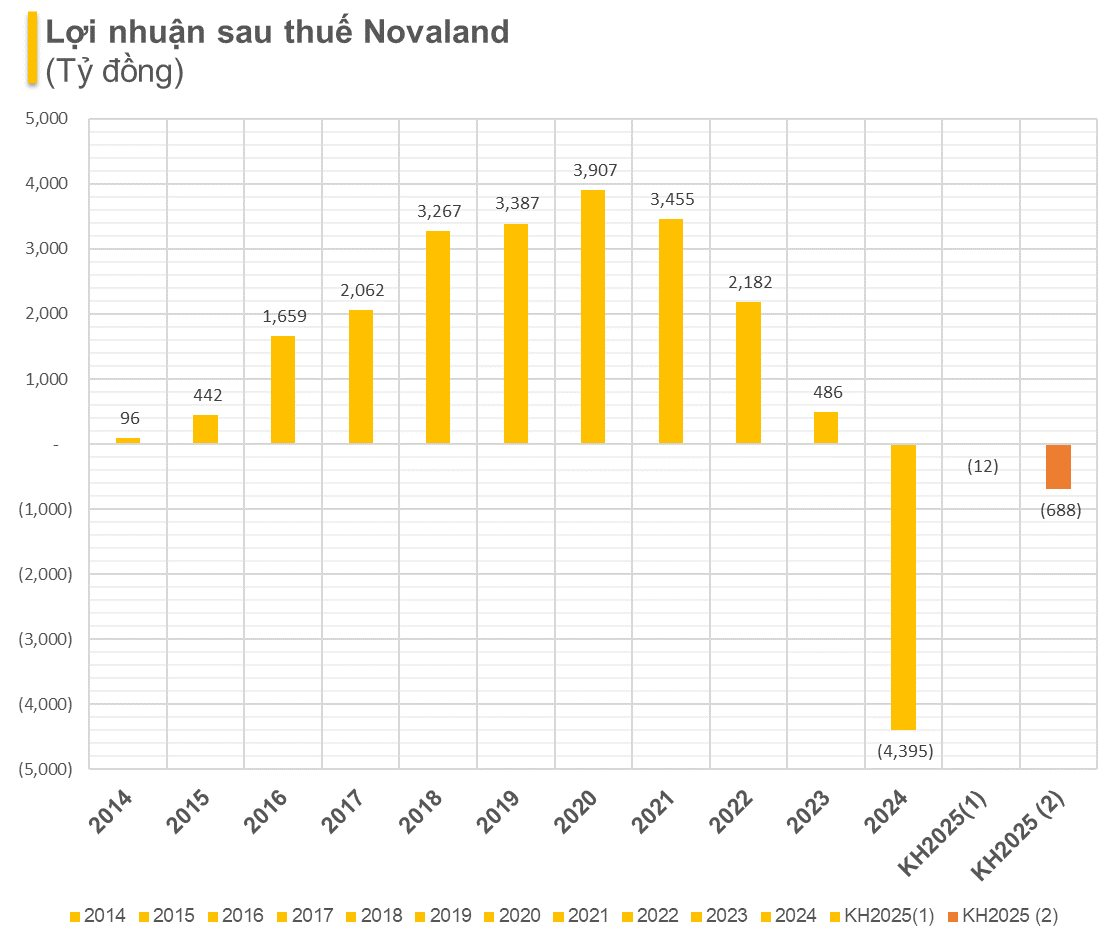

Regarding its 2025 business plan, Novaland has outlined two cautious scenarios for its financial performance. In the first scenario, the company projects net revenue of VND 13,411 billion and a net loss of VND 12 billion. The second scenario estimates net revenue of VND 10,453 billion and a net loss of VND 688 billion.

The company attributes the variance in these scenarios to the resolution of legal obstacles surrounding its projects. As such, Novaland has proposed two cautious plans for 2025, considering two potential scenarios: one with more favorable conditions and the other with less favorable circumstances.

In the market, NVL shares have been on a positive recovery trajectory, reaching a 1-year high, currently trading at VND 14,200 per share.

The Newest Update: Novaland’s Ventures in Dong Nai, a Step Forward.

The initial master plan and sub-zone C4 planning approval lacked comprehensive detail, with project-specific 1/500 scale plans missing. This resulted in an unfortunate disconnect, causing a halt in the development and operations of numerous projects.

“A Major Win for Novaland and Nam Long: Dong Nai Approves Adjustment to Local Planning in Bien Hoa’s Subdivision C4”

“Introducing the vibrant and bustling C4 Zone in Bien Hoa City, spanning across 1,500 hectares of prime land. This thriving area is a hotspot for major real estate developments, featuring renowned projects such as Aqua City, Waterfront, and the captivating Cu Lao Phuoc Hung. With a diverse range of attractions and amenities, the C4 Zone is a dynamic hub, offering a unique blend of modern conveniences and a vibrant lifestyle.”