Each month, a significant amount of money is spent on accommodation – a basic need that doesn’t create long-term ownership value. This raises an important question: Are there any financial solutions that can help with both housing and building valuable assets for the future?

With VIB’s home and apartment loan package, the answer lies in a strategic choice: smart home loans that transform monthly expenses into sustainable investments.

From Rent to Ownership Aspirations

It’s no secret that rental costs in Hanoi and Ho Chi Minh City are high and continue to rise. In Hanoi, renting a basic two-bedroom apartment in populous districts such as Cau Giay, Thanh Xuan, or Dong Da can cost between 80 million VND to over 150 million VND per month. Similarly, in Ho Chi Minh City, renting an equivalent apartment in areas like Binh Thanh, Phu Nhuan, or District 7 can cost young families anywhere from 90 million VND to over 200 million VND per year. This means that a significant amount of money is spent on rent without creating any ownership value.

Today’s young people are making a significant shift in their thinking: instead of spending money on rent, they are looking for ways to invest in real estate – a tangible asset with potential to appreciate over time. This shift stems from the growing realization that a home is not just a place to live, but also a valuable asset and a strategic investment for the future.

This legitimate aspiration, especially among young people building their independent lives, requires a solid financial boost. Deeply understanding this need, VIB, since the end of Q1, has pioneered the research and introduction of a breakthrough financial solution with a scale of up to 45,000 billion VND, aiming to fulfill the homeownership dreams of young people.

Instead of focusing on short-term incentives, VIB’s home and apartment loan package helps customers build a long-term, transparent, simple, and consistent capital borrowing roadmap from the outset. Customers can clearly visualize their monthly cash flow, proactively plan to make additional payments when possible, and predict various financial scenarios.

VIB’s Home and Apartment Loan Package: A Superior Financial Solution for Your First Home

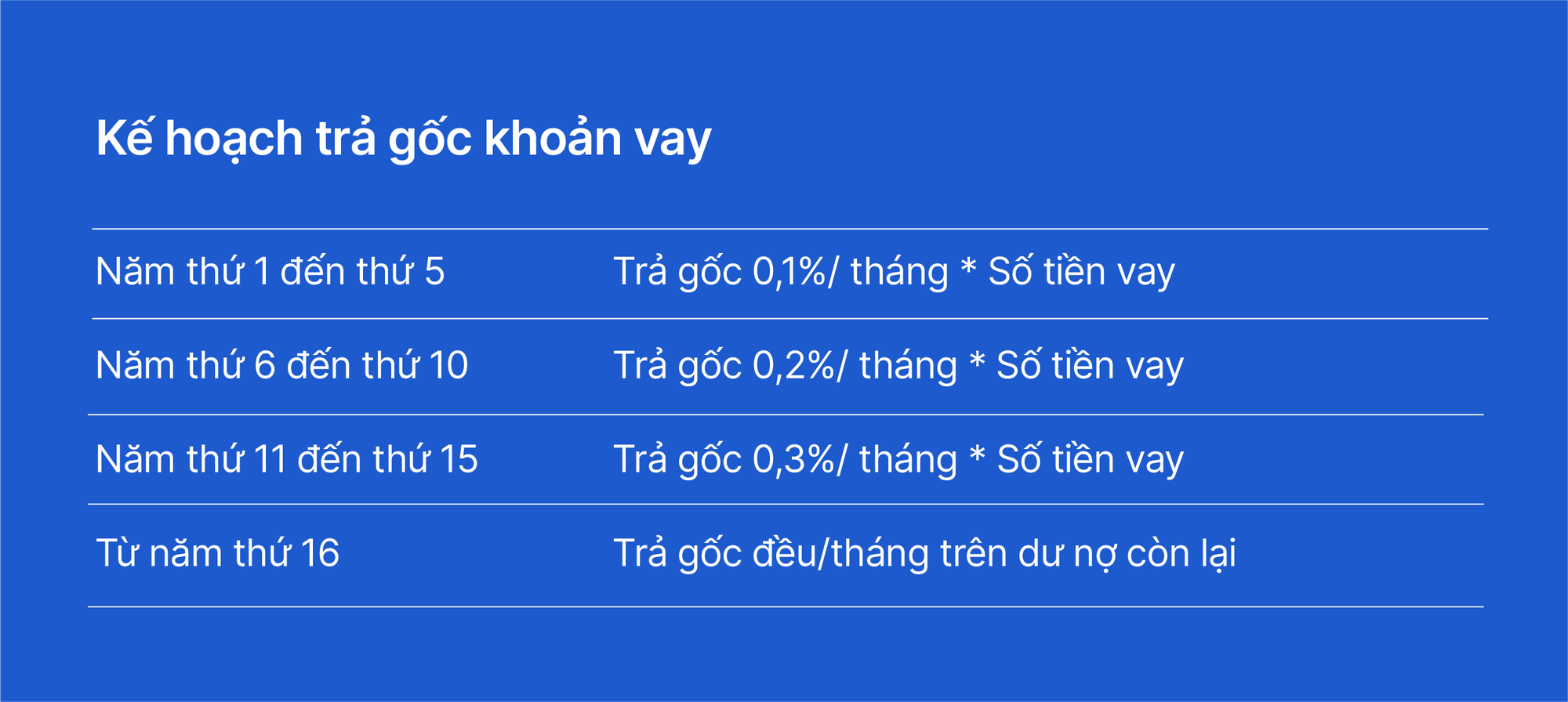

Gone are the rigid loan packages with stringent conditions. Today’s home loan products focus on flexibility, transparency, and understanding customers’ real needs. VIB’s home and apartment loan package has made a strong impression in the market with its flexible principal repayment policy. Especially for first-time homebuyers, VIB offers a breakthrough policy: borrow 1 billion VND and pay only 1 million VND/month (equivalent to 0.1% of the outstanding balance) for the first 5 years, 0.2% – 0.3% of the outstanding balance for the next 10 years, or opt for no principal payment for the first 5 years.

This solution significantly reduces initial financial pressure, enabling young people to confidently own their first home while allocating resources to other personal plans, aligning with their expected income growth trajectory.

VIB’s loan package also offers attractive incentives with competitive interest rates of 5.9%/year (fixed for 6 months), 6.9%/year (fixed for 12 months), and 7.9%/year (fixed for 24 months), applied transparently without cross-selling conditions. The maximum loan-to-value ratio is up to 85% for a term of up to 30 years. Notably, customers can prepay up to 25 million VND/month (equivalent to 300 million VND/year) without penalty, and prepayment is free from the 5th year onwards.

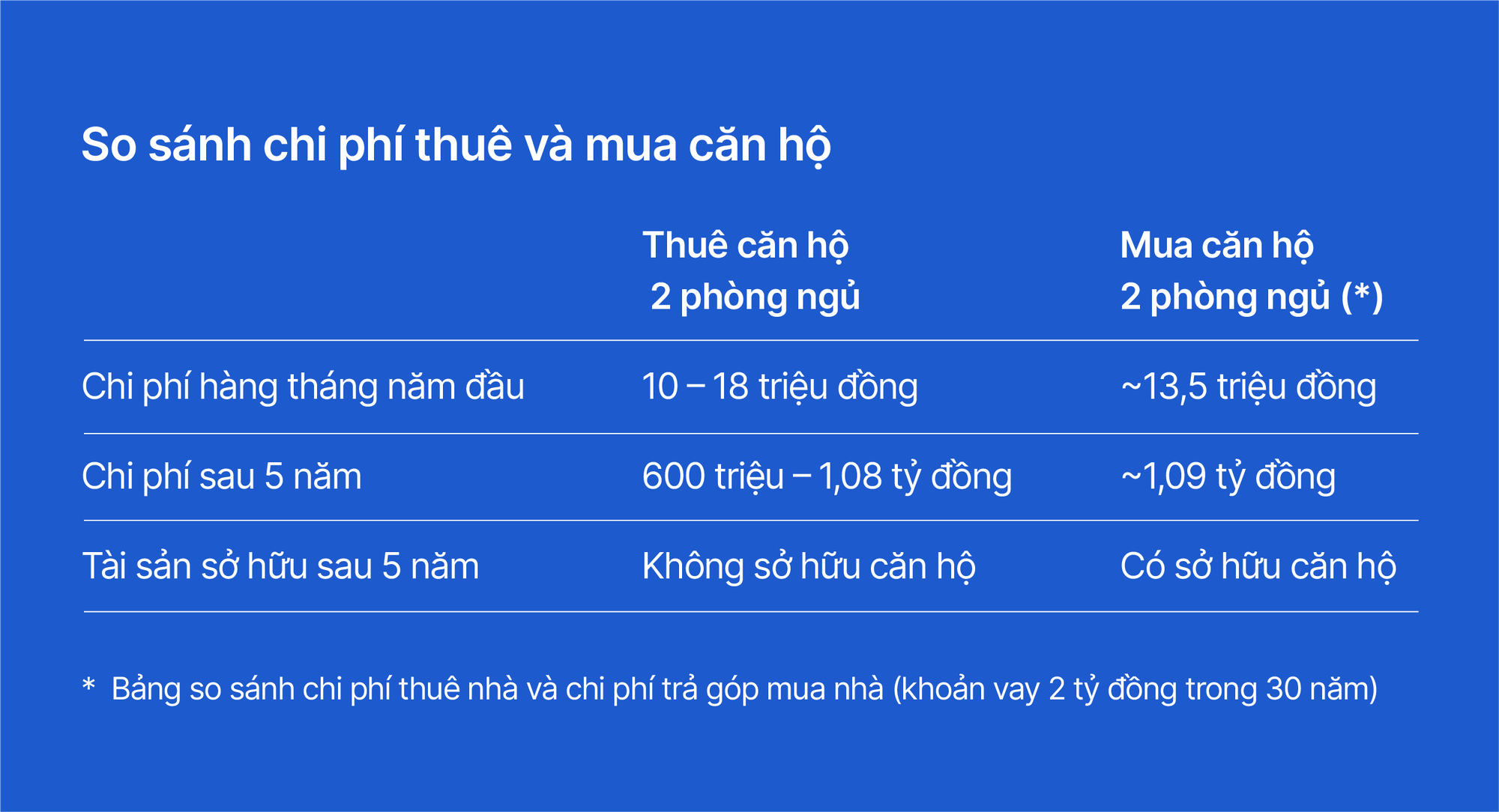

From Rent to Installments: A Smart Calculation

Let’s do a simple calculation. If you’re renting an apartment for 10 million VND per month, after 5 years, you would have spent 600 million VND without owning anything. With VIB’s loan package, with a similar or slightly higher monthly amount, you can pay installments on your own home. This money is not lost but is gradually turning into tangible assets with potential for appreciation.

Ms. Hoang Mai Phuong (29 years old, a technology expert in Hanoi) shared: “At first, I thought I needed to save for a few more years. But when I sat down to calculate, VIB’s flexible package allowed me to own my dream apartment immediately. The monthly installment is only slightly higher than my previous rent, but in return, it’s my own property with potential for future price appreciation. This decision has really helped me optimize my cash flow and save a significant amount in opportunity cost.”

Similarly, Mr. Le Thanh Dat (26 years old, a business employee in Ho Chi Minh City) said: “Instead of paying 8 million VND in rent each month, with VIB’s support, I only need to pay 1 million VND in principal plus interest to own my apartment. The peace of mind and sense of ownership are wonderful.”

In a market full of uncertainties, owning real estate with a timely financial strategy will enable young people to not only have a place to live but also take advantage of opportunities to accumulate long-term assets. VIB’s home and apartment loan package is not just a loan; it’s a commitment to accompany customers on their journey to stabilize their lives, invest in their future, and elevate their standard of living.

For more information and to apply for a loan, please visit here.

“FinanceAsia: SHB is Vietnam’s ‘Best Bank for Public Sector Clients’ in 2025”

Within the prestigious FinanceAsia Awards 2025, the Saigon-Hanoi Commercial Joint Stock Bank (SHB) has been recognized as the “Best Bank for Public Sector Clients” in Vietnam. This esteemed accolade celebrates SHB’s unwavering dedication to offering comprehensive and efficient financial solutions to public sector entities, standing as a testament to their commitment to fostering the country’s sustainable development.

“Eximbank Empowers FDI Enterprises with Comprehensive Financial Solutions”

In a volatile global economic landscape, Vietnam remains a shining beacon for FDI attraction. Eximbank stands as a trusted financial partner for FDI enterprises, offering tailored financial solutions that optimize costs and enhance competitive advantage. With our support, businesses can unlock sustainable growth opportunities, bolstered by our agile approach to financing.

“Capital Solutions for Small and Medium-Sized Enterprises”

“At the “Elevating Vietnamese Enterprises” event held on the morning of May 8, experts from banking and payment solution companies offered insights into supporting Vietnam’s small and medium-sized enterprises (SMEs) to enhance their governance, optimize operations, and foster sustainable growth in the current economic landscape.”