Following the transaction, the EVS Chairman increased his ownership in the Company from over 6.5 million shares (a shareholding ratio of 3.95%) to nearly 8.7 million shares (5.25%), thus becoming a major shareholder.

Explaining the reason for not being able to purchase the full 2.2 million shares as initially planned, the EVS Chairman attributed it to a change in investment strategy.

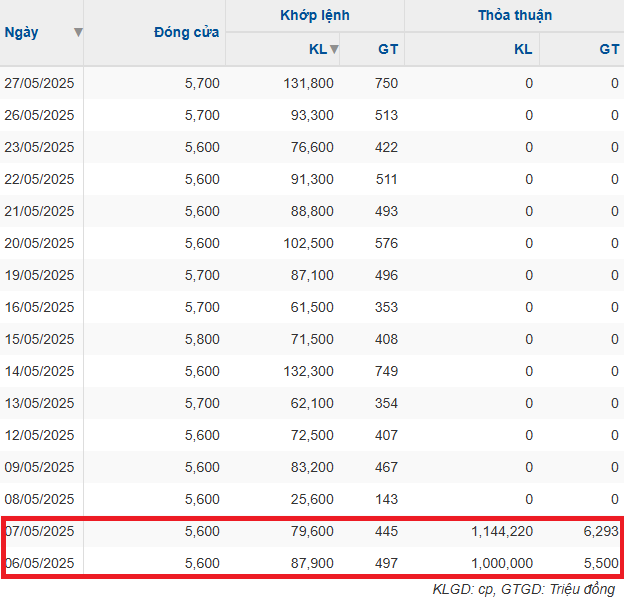

On the market, EVS‘s share price remained relatively stagnant during the Chairman’s trading period. On consecutive trading sessions on May 6 and 7, 2025, EVS witnessed two matched transactions with volumes of 1 million and over 1.14 million shares, respectively, totaling more than 2.14 million shares, which closely matches the volume reported by the EVS Chairman.

Hence, it is highly likely that the Chairman acquired the majority of these shares through matched transactions, valued at nearly VND 11.8 billion, equivalent to VND 5,500 per share.

Two matched transactions of EVS shares with large volumes on May 6-7, 2025 – Source: VietstockFinance

|

In Q1 2025, EVS recorded operating revenue of nearly VND 87 billion, a 70% increase compared to the same period last year, mainly due to higher revaluation gains on financial assets at FVTPL. However, the revaluation losses on financial assets at FVTPL also increased significantly, and the company had to make provision expenses instead of reversals as in the previous year. Consequently, EVS‘s net profit reached over VND 10 billion, a 31% decrease.

Nevertheless, compared to the annual general meeting-approved net profit plan of nearly VND 9.4 billion for 2025, EVS has officially exceeded its full-year plan in just the first quarter.

According to EVS‘s management, the conservative business plan for 2025, with a low-profit target, was designed to focus on the company’s restructuring, addressing financial receivables, and managing inefficient investments from the previous period that carried a high risk of losses. This strategy aimed to strengthen the company’s capital base for business expansion.

– 17:49 30/05/2025

“C.P. Vietnam’s Road to Success: Unveiling the Strategies Behind their Impressive Growth”

With a staggering revenue of nearly 93,000 billion VND and a supply of 6.8 million pigs per year, C.P. Vietnam is the undisputed leader in animal feed market share. The company plays a pivotal role in the global strategy of the renowned Charoen Pokphand (C.P.) Group.

Dragon Capital Slashes Stake in FPT Retail to Below 9%

Dragon Capital has recently offloaded 306,000 FRT shares, reducing its stake in FPT Retail to 8.8613%.

How Did the Fund Management Industry Perform in the First Quarter?

The statistics from 43 active fund management companies in the Vietnamese stock market paint an interesting picture. With a focus on revenue and net profit growth, the numbers reveal a thriving industry. However, a deeper dive into the figures uncovers a notable decline in net profit margins, leaving room for further analysis and exploration.