The Vietnamese stock market experienced a volatile trading session, hovering around a three-year peak. The VN-Index briefly dipped below the reference mark before recovering towards the end of the day. At the close of the May 29 session, the VN-Index remained unchanged at 1,341.86 points, with a matching turnover of approximately 20,183 billion dong on the HoSE.

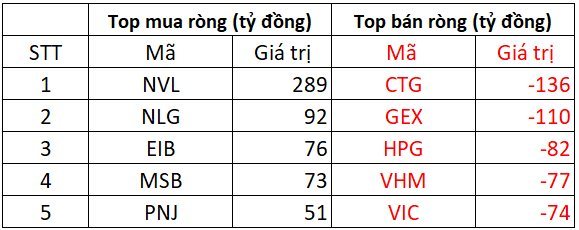

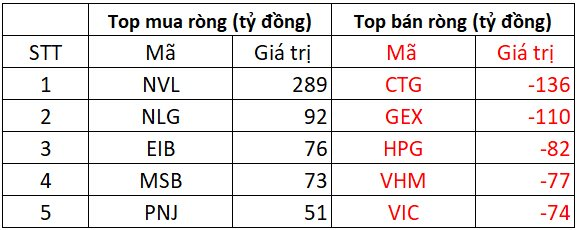

In terms of foreign investment, foreign investors continued their net selling streak, offloading nearly 301 billion dong worth of shares in this session. Here are the specifics:

HoSE: Net foreign selling of approximately 256 billion dong

On the selling side, foreign investors offloaded CTG shares the most, with a net sell value of 136 billion dong. This was followed by GEX, which saw net selling of 110 billion dong. Other stocks that witnessed net selling in the tens of billions of dong included HPG (-82 billion), VHM (-77 billion), and VIC (-74 billion).

Conversely, NVL attracted strong buying interest from foreign investors, recording a net buy value of 289 billion dong. NLG also saw net buying of around 92 billion dong. Additionally, EIB, MSN, and PNJ witnessed net buying, ranging from 51 billion to 76 billion dong per stock.

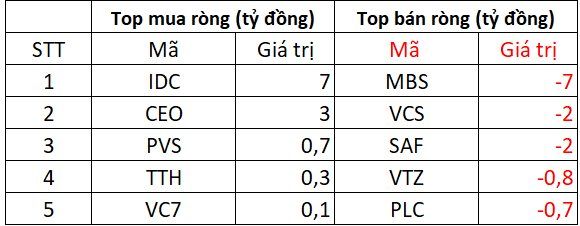

HNX: Net foreign selling of over 4 billion dong

On the buying side, IDC was the most purchased stock by foreign investors, with a net buy value of 7 billion dong, followed by CEO with 3 billion dong. PVS, TTH, and VC7 also made it to the top net bought list for this session.

Conversely, MBS witnessed the highest net selling value of 7 billion dong. VCS and SAF followed with net selling of around 2 billion dong each, while VTZ and PLC saw net selling of less than 1 billion dong.

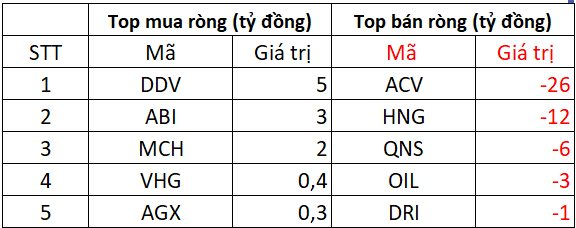

UPCOM: Net foreign selling of approximately 40 billion dong

In terms of net buying, DDV, ABI, and MCH saw net buying in the range of 2 to 5 billion dong. VHG and AGX also witnessed net buying of a few hundred million dong each.

On the other hand, ACV, HNG, and QNS faced net selling of 26 billion, 12 billion, and 6 billion dong, respectively. OIL experienced net selling of 3 billion dong, while DRI saw negligible net selling.

The Hottest Stock on the Block Unveiled

The regional stock markets surged following the news of a US court blocking Trump’s tariff plans. However, the VN-Index struggled to maintain its peak performance this year due to profit-taking pressures, resulting in a return of bearish sentiment. Novaland’s NVL stock surprised, while SHB consistently topped the stock exchange in liquidity, trading over VND 1,000 billion on May 29th.

Technical Analysis for May 29: Short-Term Risks Begin to Emerge

The VN-Index and HNX-Index displayed a contrasting performance, with the Stochastic Oscillator indicating a potential bearish divergence in the overbought territory. This divergence suggests a heightened risk of a short-term correction if sell signals emerge and the indicator drops out of this zone.