Resale apartment transactions hit a new peak

Hanoi’s real estate market in April 2025 witnessed a remarkable surge in the resale segment, including resale apartments, houses, and low-rise project properties. According to data from the One Mount Group’s Market Research and Customer Insight Center, the total secondary market transactions reached approximately 7,600 units, a 67% increase from March and higher than the market average (6,150 units/month).

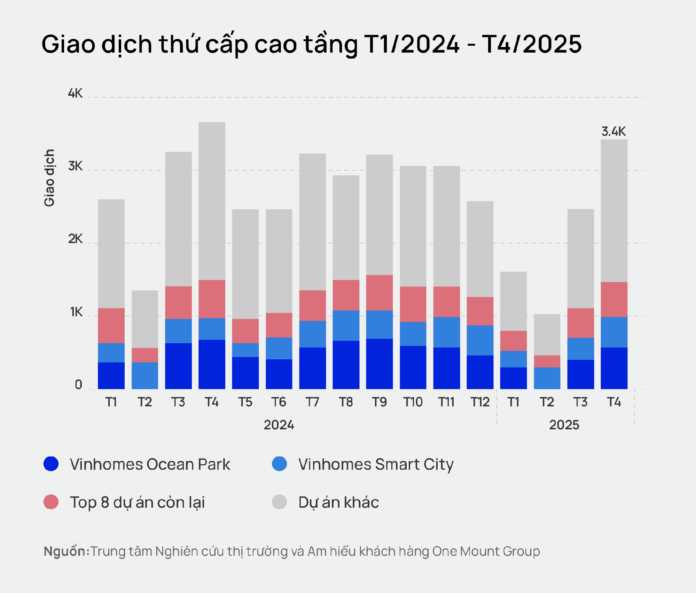

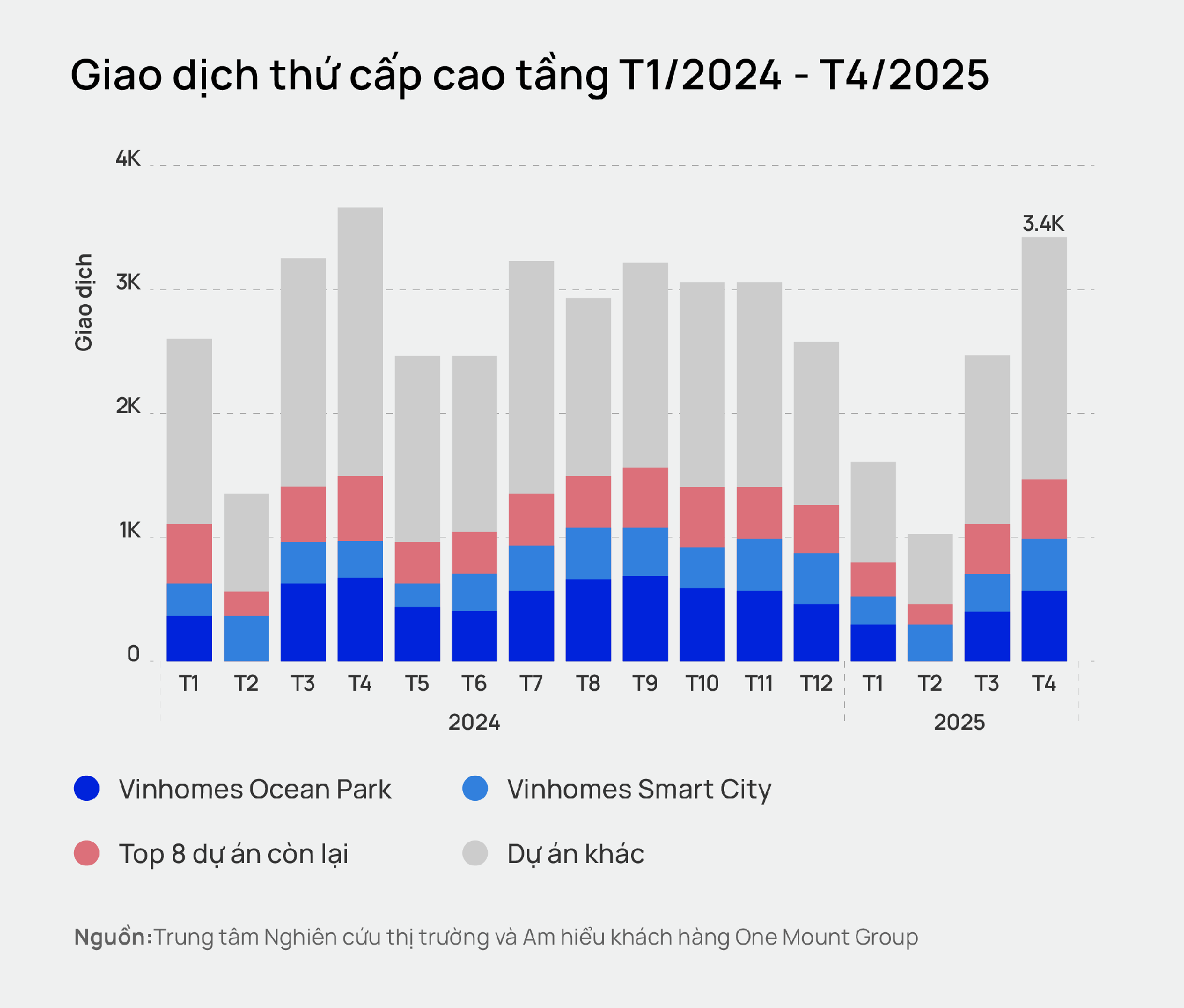

In the overall picture of the resale market, the apartment segment accounted for approximately 3,400 units, a 39% increase from the previous month and the highest level in the past 12 months (since May 2024). Compared to the “bottom” in February 2025 – with only 1,000 units traded, the market has seen two consecutive months of growth, surpassing the average of about 2,650 units/month.

According to Mr. Tran Minh Tien – Director of the One Mount Group’s Market Research and Customer Insight Center, the breakthrough in the resale apartment market in April 2025 was the result of the synergy of three main driving forces:

First, the demand for real housing remains high, especially from young families who tend to seek a place to settle in well-planned urban areas with complete infrastructure and ample amenities.

Second, the land fever in the surrounding provinces is cooling down, causing investment funds to tend to return to real estate products with high liquidity, clear legal status, and immediate exploitation potential, such as apartments that have been handed over.

Third, seasonal factors also played a significant role. Many customers had transaction needs before Tet, but only completed legal procedures and transfer dossiers after the holiday. This caused a tendency for transactions to be concentrated in March and especially April 2025 – creating a clear “point of fall” in liquidity in the early year cycle.

Capital flows back to leading urban areas

In Hanoi, the number of transactions was mainly concentrated in large urban areas such as Vinhomes Ocean Park (570 units), Vinhomes Smart City (430 units), and Vinhomes Times City (130 units), increasing by 48%, 36%, and 25%, respectively, compared to the previous month.

Secondary transactions in Vinhomes Ocean Park in April 2025 reached 590 transactions, up 48% from the previous month. Sapphire continues to be the subdivision with the highest number of transactions, reaching 350 transactions, up 41% month-on-month and accounting for 61% of the transactions in Vinhomes Ocean Park.

Notably, Masteri Waterfront had the second-highest number of secondary transactions in Vinhomes Ocean Park 1, with 70 units in April 2025.

The increase in transactions at Masteri Waterfront not only reflects the vibrancy of the secondary real estate market but also shows the emerging trend of buyers today. Customers tend to prioritize projects that have been handed over, possess convenient locations within large urban areas, easily connect to transportation infrastructure, and offer a full range of utilities to meet modern living needs.

Meanwhile, in the west, the entire Vinhomes Smart City recorded 430 transactions, up 36% from March and a significant 54% from the same period last year, setting a transaction record since 2024. Subdivisions such as The Miami, The Sakura, Masteri West Heights, and Imperia Smart City were noted as areas with many secondary transactions due to new supply handovers and immediate usability.

“Factors such as transportation connectivity, quality of handover, and the ecosystem of utilities are becoming crucial filters in consumers’ purchasing decisions,” said Mr. Tran Minh Tien. “Today’s buyers no longer focus solely on price or area but pay more attention to practical usage value and stable profit potential.”

The dynamics of the secondary market in the first four months of 2025 indicate a clear trend: capital is being strongly regulated from illiquid land to resale apartments that have been handed over. Stability, rental potential, quality of life, and legal clarity continue to be the factors that attract buyers to the secondary apartment market.

“If this recovery momentum is maintained in the coming quarters, the resale apartment segment will continue to play a crucial role in maintaining liquidity for the entire real estate market in 2025,” said Mr. Tran Minh Tien.

“Price Hike or Clever Marketing Ploy? – Shark’s Strategy Unveiled with a 20-30% Price Increase”

The prolonged unsold inventory of projects can be attributed to a multitude of factors: an inopportune launch window between 2020 and 2023, cautious buyer psychology, investor strategies, limitations of the remaining products, and competition from newer projects.

Winter Beach Bathing Privileges for the Elite 2.4%: An Exclusive Offering at Vinhomes Ocean Park 3

Embracing the VinWonders Wave Park, the exclusive community of just 192 quad-villas at Vinhomes Ocean Park 3 offers its residents a unique lifestyle with year-round access to a beachfront retreat. With the park’s proximity, the villas provide an unparalleled opportunity to indulge in a seaside escape, no matter the season.