MIC Approves Dividend Payout and Public Offering at Annual General Meeting

On May 23, Minco, a leading mineral company in Quang Nam (MIC), held its 2025 Annual General Meeting. The meeting approved a dividend payout and a public offering of shares.

MIC will issue a 55% stock dividend for 2024, meaning that for every 100 shares owned, shareholders will receive 55 new shares. With over 5.5 million shares currently outstanding, the company expects to issue approximately 3.05 million new shares, increasing its charter capital to around VND86 billion.

Following the dividend payout, MIC will offer up to 581% over-subscription rights to existing shareholders, allowing them to purchase additional shares at a rate of 581 new shares for every 100 shares owned. The maximum number of shares to be offered is 50 million, with a subscription price of VND 10,000 per share, 47.64% lower than the market price on May 28. The offering is expected to raise VND 500 billion.

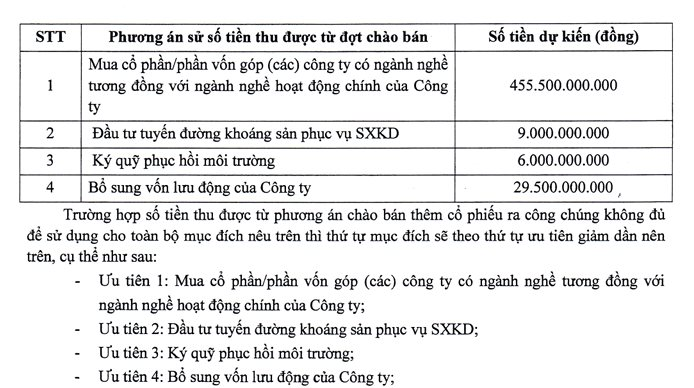

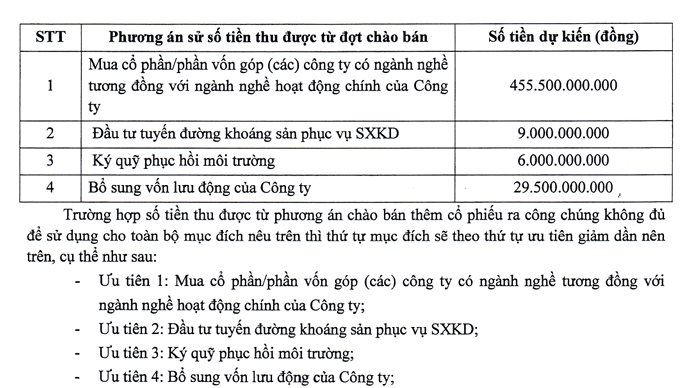

The proceeds from the offering will be used to invest in companies within the same industry, with a focus on acquiring sand mines with large reserves and high-quality raw materials. MIC aims to expand its market share in sand mining and processing by meeting specific criteria in its target companies, including a minimum reserve of 5 million tons of sand, an existing processing plant, a charter capital of over VND 100 billion, and a minimum ROE of 5% as per the latest audited financial statements.

MIC intends to hold a minimum of 51% of the real contributed capital in the target companies, with a maximum deal value of VND 480 billion. In terms of financial performance, MIC reported a 32% year-over-year decrease in revenue and a 13% drop in net income for the first quarter of 2025. For the full year, the company targets nearly VND 219 billion in revenue and almost VND 18 billion in pre-tax profits, representing a 5% decrease and a 3% increase, respectively, from 2024. As of the first quarter, MIC has achieved 17% of its revenue target and 9% of its profit target for the year.

MIC aims to expand its market share through strategic investments.

The Great Talent Shuffle at VIX Securities

The VIX Securities has recently undergone a transition with the resignation of two board members, which was approved by the shareholders. Subsequently, the company has appointed two new individuals to fill these vacant positions. This strategic move is expected to bring fresh perspectives and expertise to the board, potentially driving new initiatives and fostering innovation within the company.