Vietnam’s stock market experienced significant volatility near three-year highs, with real estate stocks becoming a focal point of attention. A rush of cash propelled a slew of stocks higher, including NVL, HDC, NLG, and CEO, among others, with NVL, Novaland’s stock, even hitting the ceiling with “all buy, no sell” orders.

In reality, several leading real estate stocks had been making waves beforehand, with NVL being one of the most notable names. In less than two months, the stock has climbed over 70% since its long-term low on April 9th. Currently, NVL’s market price has rebounded to its highest level in nearly a year.

Real estate stocks surged amid signs of recovery in the real estate market as legal hurdles in many areas were gradually removed. Most recently, on May 29, 2025, the People’s Committee of Dong Nai province issued a decision approving the adjustment of the detailed planning of subdivision C4, according to the master plan of Bien Hoa city in Long Hung commune and a part of Tam Phuoc ward.

The adjustment focuses on projects: Long Hung Residential Area (227 ha) and Phuoc Hung Islet Urban, Service and Trade Area (286 ha) invested by DonaCoop; Dong Nai Waterfront Urban Area (170 ha, commercial name Izumi City) of Nam Long (NLG); and Aqua City Urban Area (305 ha) of Novaland (NVL). This move helps remove legal obstacles and facilitate the early implementation of these projects.

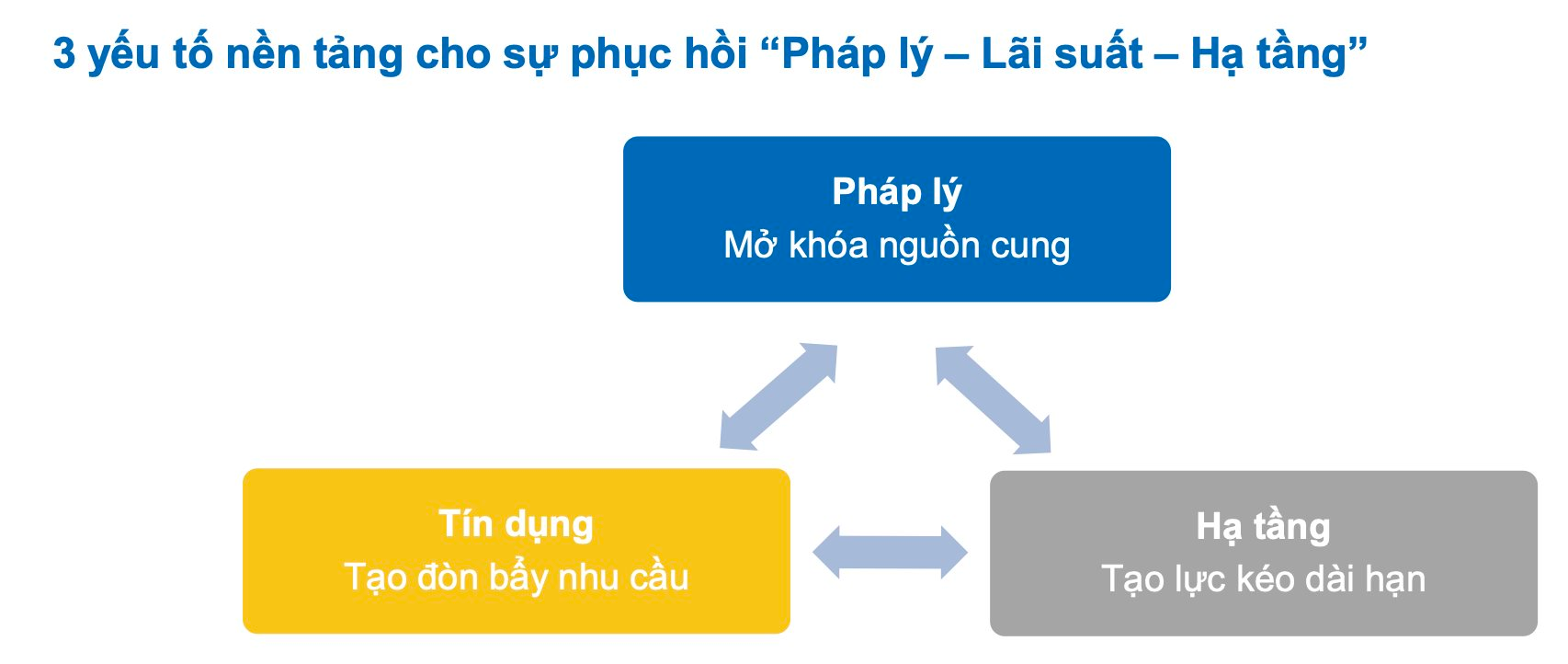

According to a recent analysis by NHSV, the fundamental factors will continue to drive the recovery cycle of the real estate market in 2025, including the completion of the legal framework, with three essential laws (Land Law, Housing Law, and Business Law) taking effect from August 2024, helping to resolve bottlenecks and unlock supply.

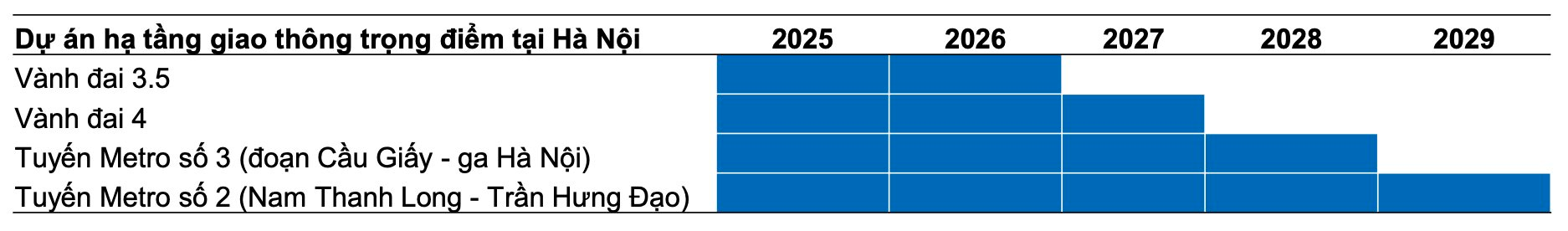

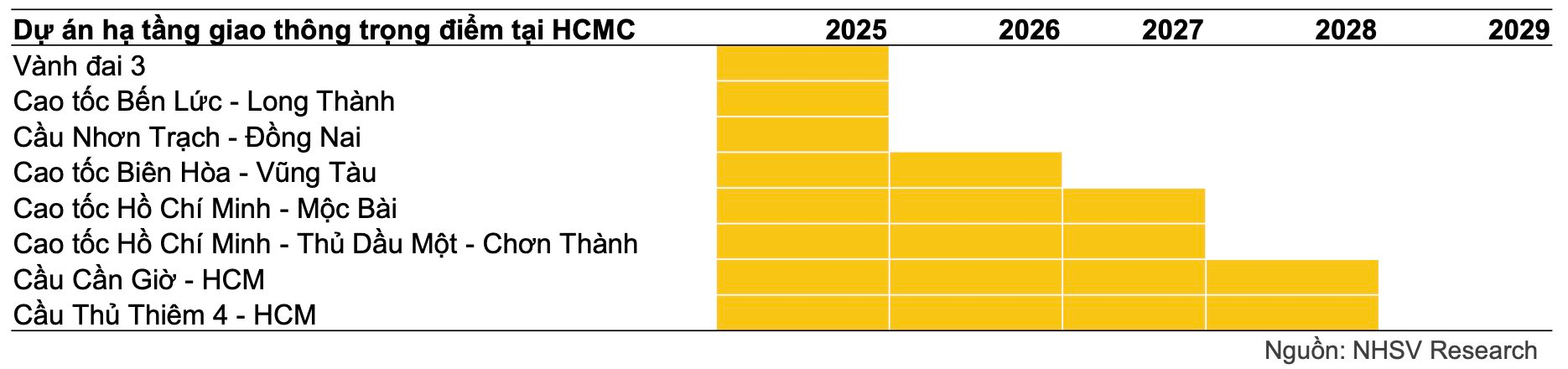

Additionally, low-interest rates have supported buyers’ purchasing power and reduced financial pressure on businesses. Furthermore, improved transportation infrastructure and increased public investment have boosted housing demand in suburban areas while enhancing the potential for price appreciation in well-connected projects.

In 2025, the real estate market is expected to continue its recovery, but in a more selective and substantial manner. While apartments remain the mainstay, low-rise buildings in satellite cities will become a highlight, benefiting directly from infrastructure projects such as beltways 3 and 4, expressways, and new industrial zones. The investment psychology is maintained, but the trend leans towards long-term investment and asset accumulation rather than short-term speculation.

In reality, the revenue and profits of listed real estate companies in 2024 showed signs of improvement, but there was a clear differentiation between those with ready-to-transfer projects and those still in the restructuring process. NHSV anticipates a continued market recovery in 2025-2026, but with a strong differentiation based on project legal status, implementation capabilities, and geographical location.

According to this securities company, the industry’s revenue is expected to recover in 2025 due to the transfer of inventory and ready-to-exploit projects. However, as the number of buyers paying in advance has not significantly recovered, growth in the first half of 2025 will remain limited. Revenue and profits are expected to improve noticeably in late 2025 and 2026 when new projects licensed in 2024 enter the revenue recognition phase.

The trend of differentiation will likely intensify, reflecting variations in land fund quality, legal readiness, and actual project implementation capabilities among investors. Some enterprises, such as VHM, NLG, and KDH, are in a more favorable position due to their large land banks with completed legal procedures and swift project implementation capabilities.

“Novaland Guarantees $73 Million Loan for its Subsidiary”

Novaland leverages an array of real estate assets to secure a substantial loan of 1.75 trillion VND for its subsidiary, Nova Riverside. This strategic move showcases the group’s financial prowess and highlights the value of their diverse property portfolio.

“A Major Win for Novaland and Nam Long: Dong Nai Approves Adjustment to Local Planning in Bien Hoa’s Subdivision C4”

“Introducing the vibrant and bustling C4 Zone in Bien Hoa City, spanning across 1,500 hectares of prime land. This thriving area is a hotspot for major real estate developments, featuring renowned projects such as Aqua City, Waterfront, and the captivating Cu Lao Phuoc Hung. With a diverse range of attractions and amenities, the C4 Zone is a dynamic hub, offering a unique blend of modern conveniences and a vibrant lifestyle.”