In a recent letter to investors, Petri Deryng, head of the Finnish Pyn Elite Fund, offered a positive assessment of the Vietnamese stock market. With a price-to-sales ratio (P/S) of 1.3, Vietnam offers an attractive valuation. The country’s economic growth continues to drive revenue for listed companies, and the market’s growth potential is strong. The market’s price-to-earnings ratio (P/E) for 2025 is forecasted at a healthy 11.

However, trade tensions initiated by the US make the market’s trajectory in 2025 unpredictable. Mr. Deryng highlights that the current outlook is uncertain and dependent on various factors, including US economic growth, global trade tensions, Fed monetary policy, trade agreements between Vietnam and the US, USD strength, and investor fund reallocations.

The performance of the Vietnamese stock market could go either way, depending on the timing and impact of these events. Listed companies in Vietnam have the potential to expand their operations in the coming years, which could drive down the market’s P/S ratio to extremely low levels, close to 1.0.

“Vietnam’s stable macroeconomic environment, robust economic growth, rising profits for listed companies, favorable financial market conditions, and stock market modernization all support the argument that the country’s stock market P/S ratio could rise to nearly 2.0,” asserts Petri Deryng.

Pyn Elite Fund is known for its relatively optimistic outlook on the Vietnamese stock market. In his letter to investors last year, Mr. Deryng maintained his long-term view that the VN-Index could reach 2,500 points. Previously, in 2021, the fund had also expressed similar expectations for the index, but four years later, the market remains stagnant.

Despite their optimism, the fund managers caution that the upward trend may not be smooth, given the potential disruptions that could occur in the next six months. However, there is no need for concern about Vietnam’s investment portfolio or the Pyn Elite Fund, even in the face of challenges. Listed companies with low debt in a country with low national debt will quickly recover from any shocks.

Focus on Banking and Finance

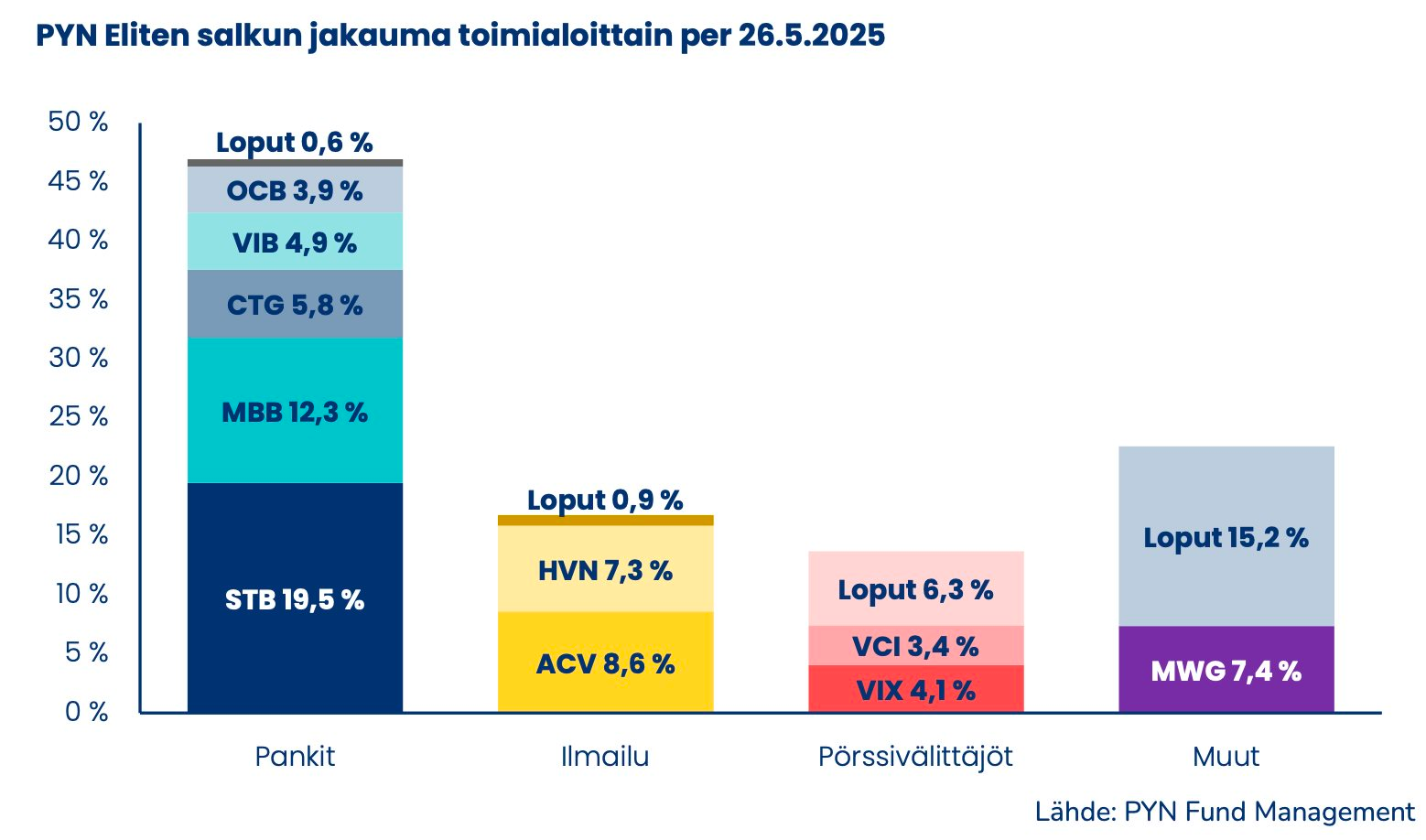

Petri Deryng reveals that the Pyn Elite investment portfolio is explicitly valued based on companies that grow with the demands of Vietnam’s domestic market. An exception to this is the aviation industry (ACV, HVN, SCS), which is also influenced by international air traffic to Vietnam and the global trade cycle. Additionally, the fund holds a small position in the seafood industry (VHC).

Pyn Elite Fund avoids investing in raw material producers or cyclical service companies whose fortunes fluctuate with the boom-and-bust cycles of global market demand. While Vietnamese real estate companies, including residential and industrial developers, are currently undervalued, the cyclical nature of the country’s housing market will indirectly affect the fund through its significant exposure to the banking sector.

Bank stocks continue to dominate the fund’s portfolio, accounting for nearly 50%. STB leads the way with a 19.5% allocation and an improved valuation as the market anticipates the conclusion of its restructuring and the resumption of dividend payouts. The fund also holds positions in banks that are expected to benefit from improved asset quality and the implementation of Resolution 42, which expedites the handling of secured assets when borrowers default.

Additionally, the fund has increased its exposure to securities companies like VIX and VCI to capitalize on the market upgrade. The launch of the KRX system in May and the potential market upgrade within the next ten months are expected to boost liquidity and improve the performance of these securities firms.

Overall, Pyn Elite views Vietnam as a market with a stable economic foundation, clear reform policies, and continued attractiveness to foreign capital. With a strategy focused on undervalued stocks with growth potential, the fund is optimistic about achieving positive results in the coming period.

The Stock That Brokerages Sold for Billions on May 28th

The proprietary trading arms of securities companies offloaded a net sell value of VND487 billion on the Ho Chi Minh Stock Exchange (HoSE).

“Defying the ‘Sell in May’ Adage, Bank Stocks Remain Attractive in May”

Contrary to the usual “Sell in May” sentiment that often makes investors hesitant, the Vietnamese stock market in May 2025 witnessed a positive performance from bank stocks. As the market leaders, bank tickers not only steered the VN-Index but also demonstrated enduring allure amid market fluctuations.