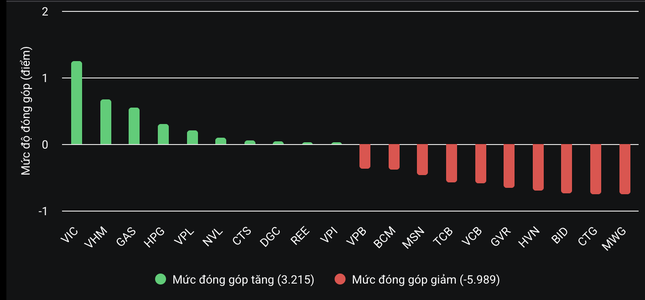

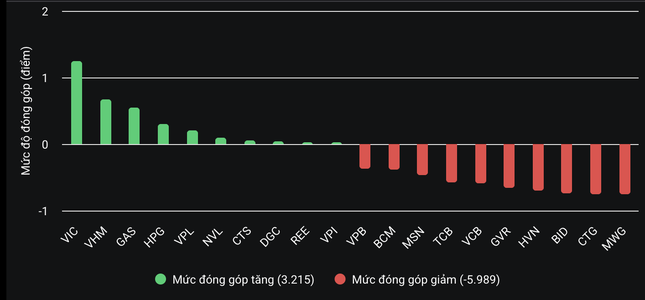

The stock market today (May 30) faced significant pressure from the VN30 group, with half of the stocks in this basket recording sharp declines. Specifically, PLX, CTG, BVH, MSN, GVR, BCM, and MWG were all in the red.

MWG had the most negative impact on the index.

Outside of the VN30 basket, many mid-cap stocks also witnessed strong selling pressure, notably DIG and VIX, which fell by 1.8%, VCG dropped by 2%, POW and TCH declined by 1.5% each, while PDR fell by 2.6%, PVD by 2.4%, and HDG by 2.7%.

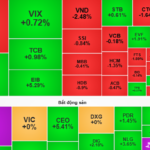

Notably, the banking group was the main drag on the VN-Index in today’s trading session. Almost all codes in the industry fell sharply, including STB down 1.45%, HDB down 1.59%, VPB down 1.1%, TPB down 1.12%, BID down 1.23%, OCB down 1.85%, and VIB down 2.19%.

Meanwhile, some real estate stocks outperformed the broader market. CEO surged by 5.8%. Last week, this stock rose nearly 30% with high liquidity.

On the HNX, PCG shares of Urban Gas Investment and Development Joint Stock Company (PVGas City) continuously fell to the floor price, trading weakly around VND 2,200 per share – the lowest since listing. The enterprise is mired in crisis with its financial statements being rejected by the auditor, losses extending to three years, and many unclear transactions.

Recently, HNX announced the mandatory delisting of all 18.87 million PCG shares due to the auditor’s refusal to express an opinion on the 2024 financial statements. The delisting date is June 27, with the last trading session on June 26.

Previously, the auditor refused to express an opinion on the company’s financial statements due to their inability to perform necessary procedures, including inventory and fixed asset counts.

At the close, the VN-Index fell 9.26 points (0.69%) to 1,332.6 points. The HNX-Index fell 1.08 points (0.48%) to 223.33 points. The UPCoM-Index fell 0.13 points (0.13%) to 98.49 points. Liquidity matched the previous session, with the trading value on HoSE exceeding VND 22,000 billion.

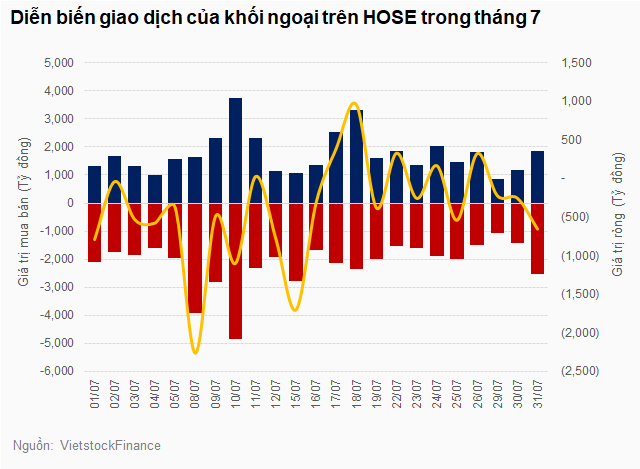

Foreign investors net sold over VND 1,127 billion, focusing on HPG, MWG, STB, and DIG…

The Real Estate Stock Surge: Novaland Skyrockets with “Buyout Frenzy”, What’s the Buzz?

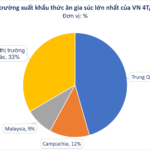

The real estate market has been witnessing a surge in stock prices recently, owing to the revival of the property sector based on three fundamental factors: Legal, Interest Rates, and Infrastructure.

“Market Watch: Uncertainty Creeps In?”

The VN-Index narrowed its losses after a prolonged tug-of-war session, featuring a Doji candlestick pattern. This indicates investor indecision in the market. Currently, the index remains resilient above the old peak of March 2025 (around 1,320-1,340 points), offering a glimmer of optimism. However, the Stochastic Oscillator is venturing deep into overbought territory. Investors are advised to exercise caution in the coming days if the indicator retreats from these elevated levels.