The stock market witnessed a tug-of-war during the May 28 session, with the VN-Index climbing 2.06 points to reach 1,341.87. Foreign exchange transactions continued to be a downside, with net selling of nearly VND 209 billion across the market.

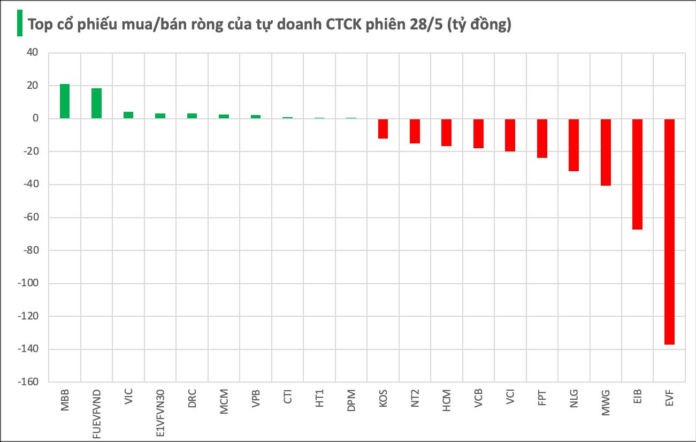

Securities companies recorded a net sell-off of VND 487 billion on the HoSE.

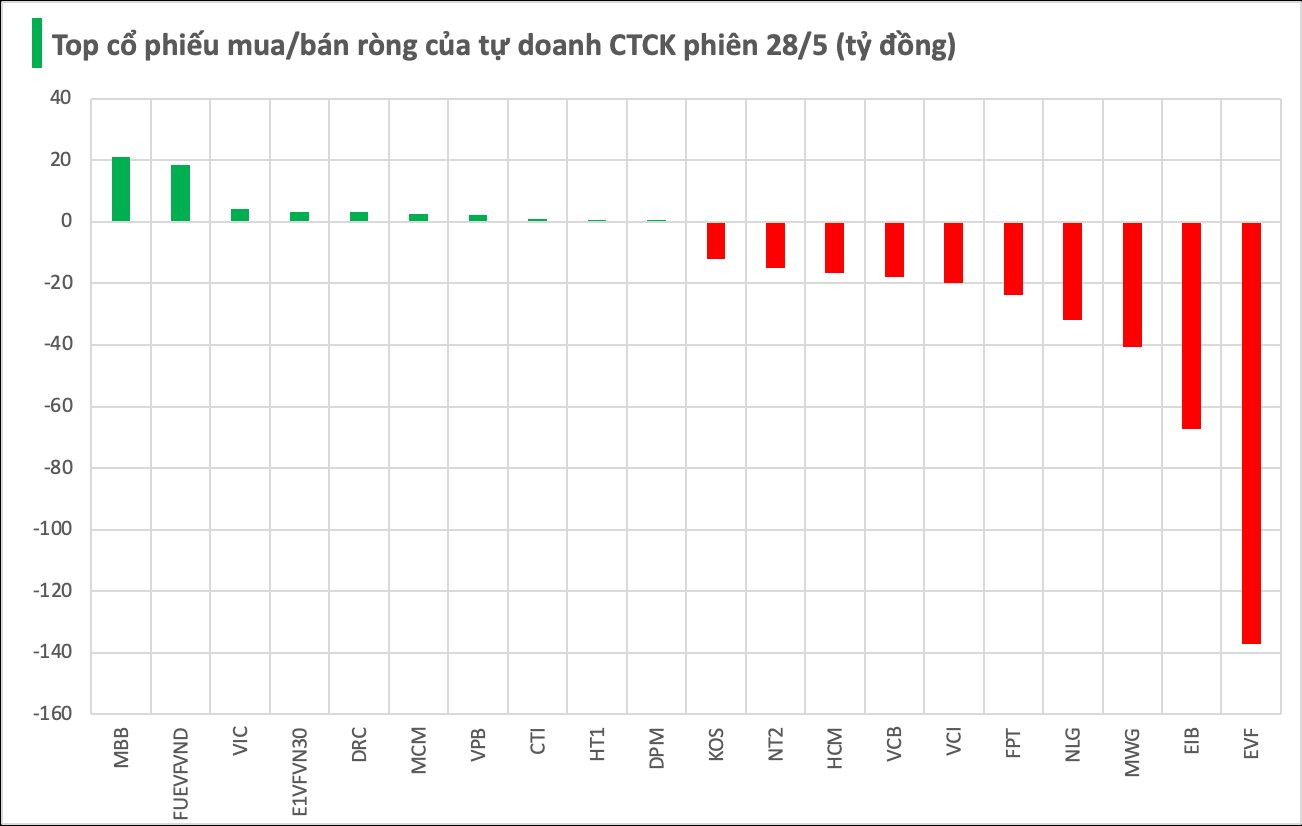

Specifically, securities companies offloaded the largest amount of EVF shares, totaling VND 137 billion. EIB and MWG shares were also net sold at VND 67 billion and VND 41 billion, respectively. Other stocks that experienced net selling during this session included NLG, FPT, VCI, and VCB…

On the flip side, securities companies net purchased MBB and FUEVFVND shares worth VND 21 billion and VND 18 billion, respectively. VIC, E1VFVN30, DRC, and MCM stocks were also among those that were net bought…

Tomorrow’s Stock Market Outlook: Can VN-Index Surpass the 1,345-Point Mark?

“Amidst a cautious trading session on May 29th, the market still presented opportunities for those with a keen eye and patience. “

“Market Watch: Uncertainty Creeps In?”

The VN-Index narrowed its losses after a prolonged tug-of-war session, featuring a Doji candlestick pattern. This indicates investor indecision in the market. Currently, the index remains resilient above the old peak of March 2025 (around 1,320-1,340 points), offering a glimmer of optimism. However, the Stochastic Oscillator is venturing deep into overbought territory. Investors are advised to exercise caution in the coming days if the indicator retreats from these elevated levels.