TMT Motors (HoSE: TMT), a leading automotive company, has announced its investment in a new venture: TMT Electric Vehicle Charging Station Investment and Business Joint Stock Company.

With an initial chartered capital of VND 100 billion, of which TMT Motors contributes VND 98 billion, holding a 98% stake, the new company will primarily focus on the business of electric vehicle charging stations.

The investment is expected to be finalized by August 2025, after which TMT Motors will become the parent company and gain control of this newly established entity.

Illustrative image

At the annual general meeting of TMT Motors shareholders held on April 26, 2025, the shareholders approved the proposal for the establishment of this new company.

As per the plans outlined for the period leading up to 2030, TMT Motors will invest and form joint ventures with domestic and foreign partners possessing advanced charging station production technology. The goal is to install a minimum of 30,000 charging stations (equivalent to 60,000 charging points) adhering to European (CCS2) and other market-demanded standards. These stations will have a capacity of 7KW and above, catering to the diverse needs of the population and the requirements of taxi companies, ensuring that electric vehicles are as convenient as their fossil fuel counterparts.

Additionally, the company will engage in the assembly and trading of two and three-wheeled electric vehicles for passengers and cargo, along with trading spare parts and accessories for three-wheeled electric cars and two-wheeled electric motorcycles.

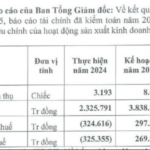

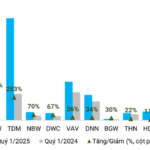

In terms of financial performance, TMT Motors reported impressive results for the first quarter of 2025. With a net revenue of nearly VND 675.7 billion, the company witnessed a 30.9% increase compared to the same period last year. After deducting taxes and expenses, TMT Motors posted a net profit of VND 33.8 billion, an astounding 125.6 times higher than the previous year’s figure.

For the full year 2025, TMT Motors has set ambitious targets, aiming for a net revenue of over VND 3,838.7 billion and a net profit of nearly VND 270 billion.

As of the first quarter of 2025, the company has achieved 17.6% of its net revenue target and 12.5% of its net profit goal for the year.

As of March 31, 2025, TMT Motors’ total assets stood at nearly VND 1,731.3 billion, an increase of 18.1% from the beginning of the year. Cash and cash equivalents amounted to VND 398.4 billion, a 40.3% jump, and accounted for 23% of total assets, while inventory reached nearly VND 567.8 billion, a 17% increase, making up 32.8% of total assets.

As of the same date, the company’s total liabilities were nearly VND 1,585.1 billion, a 17.1% rise from the start of the year. Short-term accounts payable stood at nearly VND 670 billion, surging by 116.7% and accounting for 42.3% of total assets, while loans and finance lease liabilities amounted to VND 541.3 billion, constituting 34.1% of total assets.

The Profit Divide: A First Quarter Review of Water Industry Performance in Ho Chi Minh City

The first quarter profit landscape in the water industry presented a stark contrast. While some businesses thrived by increasing their selling prices, others struggled with declining consumption and soaring operating costs.