VN-Index closes 29-May with a slight dip of 0.01 points (0%), ending at 1,341.86

Vietnam’s stock market opened on May 29 with a subtle green hue, continuing the positive trend from the previous session. However, the upward momentum was quickly curbed as the VN-Index hit the resistance level of 1,348 points, causing the market to cool down and trade cautiously.

At one point, the market turned red due to profit-taking pressure, but the selling pressure wasn’t strong enough to cause a significant dip, allowing the VN-Index to maintain stability near the reference level.

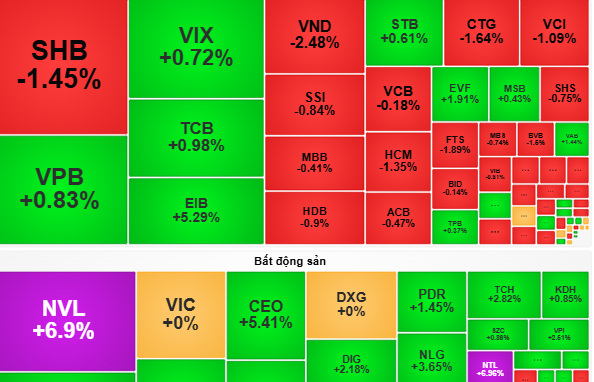

The VN-Index closed with a minor loss of 0.01 points (0%), ending the day at 1,341.86. The matched order volume on the HOSE reached 894.9 million shares, a decrease from the previous session, reflecting the hesitation from both buyers and sellers.

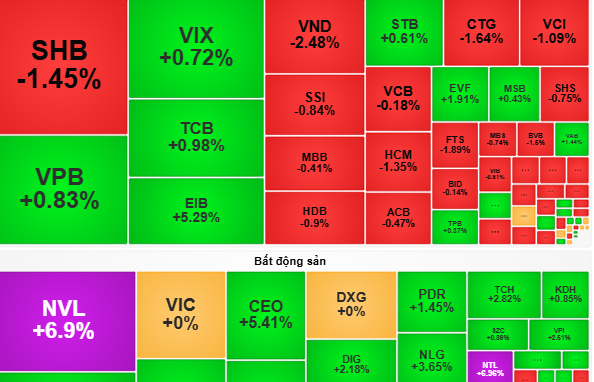

According to several securities companies, the fluctuation range of stock groups wasn’t significant. The real estate group became the focal point with vibrant trading and many codes turning green, led by VRE and VHM. In contrast, sectors such as transportation, technology, and oil and gas dipped into the red, with codes like PLX experiencing considerable selling pressure.

Rong Viet Securities Company (VDSC) stated that the VN-Index continued to fluctuate around the 1,340-point mark. The reduced volume indicates caution from both buyers and sellers. However, the market still has the opportunity to surpass the resistance zone of 1,340 – 1,345 points if it can absorb the profit-taking supply effectively.

On May 30, the back-and-forth trend is likely to persist, but if the VN-Index successfully breaches the 1,340 – 1,345 zone, the uptrend will be reinforced and expanded. “Investors can take advantage of the price hikes to realize profits, especially for stocks that have reached their expected returns,” VDSC forecasts and recommends.

Technical Analysis for May 29: Short-Term Risks Begin to Emerge

The VN-Index and HNX-Index displayed a contrasting performance, with the Stochastic Oscillator indicating a potential bearish divergence in the overbought territory. This divergence suggests a heightened risk of a short-term correction if sell signals emerge and the indicator drops out of this zone.

‘The Dark Side of Social Housing: How ‘Cò’ Profiteers are Distorting the Market’

“There is a persistent presence of brokers in the social housing sector, taking advantage of the high demand for such housing and creating a chaotic market with their resale practices. Mr. Nguyen Van Khoi, Chairman of the Vietnam Real Estate Association, highlights how these practices cause significant distress for legitimate buyers seeking social housing.”