On May 29th, Prime Minister Pham Minh Chinh attended the “Banking Sector Digital Transformation Day 2025” event at the Government Headquarters and announced a VND 500,000 billion credit package for science, technology, innovation, digital transformation, and strategic infrastructure.

Governor of the State Bank of Vietnam Nguyen Thi Hong speaking at the event

In her opening remarks, Governor Nguyen Thi Hong emphasized the importance of data in the digital transformation journey, stating that “data is the heart and the driving force behind the entire process.” She highlighted that for the banking sector, data is the key to connecting open ecosystems and transforming banks into digital platforms that integrate value across industries, including healthcare, education, and commerce, ultimately providing seamless experiences for customers.

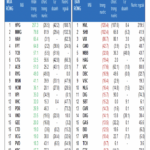

The banking sector has made significant progress in digital transformation over the years. Industry databases have been deployed synchronously and efficiently, connecting and sharing data with various national and specialized databases. These include the credit database, which stores information on 54 million borrowers; the anti-money laundering database with information on 36 million customers, 154 million accounts, and 1.3 billion transactions; and connections with the National Public Service Portal and other national databases, especially the National Population Database.

To date, 57 million customer loan files have been cross-referenced, and 113 million individual customer and 711,000 organizational customer profiles have been matched with biometric information. By integrating, connecting, and sharing data, the sector has facilitated online payments for fees, taxes, hospital fees, school fees, transportation, fuel, and the purchase of goods and services, linked to the issuance of electronic invoices, contributing to a 20% annual growth in e-commerce.

Cashless payment activities have been extensively promoted and have witnessed remarkable development. The proportion of adults with payment accounts has reached 87%, surpassing the 2025 target of 80%. The value of cashless payments in 2024 amounted to over VND 295 million billion, 25 times the GDP. Approximately 80% of pensioners and social insurance and unemployment benefit recipients in urban areas receive their payments through accounts. The payment infrastructure has been maintained continuously, smoothly, and safely, without any incidents or disruptions, and cross-border retail payment connections have been established with Thailand, Cambodia, and Laos, with similar initiatives underway with China and South Korea.

At the event, the State Bank announced a VND 500,000 billion credit program (with the participation of 21 commercial banks) for infrastructure projects in areas such as transportation, power, and digital infrastructure, offering preferential interest rates (a reduction of 1% or more compared to medium and long-term lending rates).

Prime Minister Pham Minh Chinh speaking at the event

The Prime Minister, in his speech, commended the digital transformation efforts demonstrated at the event and acknowledged the high level of commitment and active participation of banks, especially commercial banks, in placing people and businesses at the center of their digital transformation journey. He noted the significant progress, growth, and development exhibited by the banks through their exhibition booths.

Emphasizing that “everyone needs money,” the Prime Minister highlighted that the goal of digital transformation is to facilitate smoother connections and transactions between commercial banks, people, businesses, and the state, contributing to the country’s rapid and sustainable development. He underscored the role of digital transformation in advancing the digital economy, digital government, digital society, and digital citizens, as well as in maintaining macroeconomic stability and controlling inflation. This can be achieved by reducing costs in the banking sector, lowering costs for people and businesses, saving time, reducing hassles, and combating corruption and negativity by minimizing direct human interaction.

Representative of SHB presenting their technology product at this year’s event to Prime Minister Pham Minh Chinh and Governor Nguyen Thi Hong

The Prime Minister also expressed his appreciation for the preparation and announcement of the VND 500,000 billion credit program to support businesses and individuals in implementing projects in science, technology, innovation, digital transformation, and strategic infrastructure. He acknowledged that the program contributes to the implementation of Resolution 57 of the Politburo and reflects the “kindness” of the banking sector, demonstrating the significant efforts of the State Bank and the contribution of commercial banks.

While emphasizing that the program should reduce costs and offer more favorable terms, the Prime Minister suggested that banks further reduce their costs and offer interest rates at least 1.5% lower than medium and long-term lending rates for this program.

The Prime Minister requested the State Bank and commercial banks to promptly organize the implementation of the VND 500,000 billion credit program with a sense of urgency and commitment to delivering tangible results. He emphasized the importance of effective management, designing feasible regulations, and, most importantly, encouraging people and businesses to borrow from this program, bringing it to life and channeling capital into the economy. He encouraged banks, people, and businesses to work together in a spirit of patriotism and solidarity, sharing in the successes, joys, and pride that will come from their collective efforts.

The Prime Minister also shared his concerns about small, medium, and micro-enterprises, as well as the existing 5 million business households. He suggested that relevant agencies explore ways to provide suitable support, such as through public-private partnerships, to help them adopt electronic invoices generated from cash registers. This would not only promote digital transformation but also enable these businesses and households to contribute fairly to the state budget and prevent tax losses, especially in the fields of catering and services.

Reiterating that the digital transformation of the banking sector is on the right track and gaining momentum, the Prime Minister wished the sector continued acceleration and breakthroughs in its digital transformation journey, setting an exemplary standard for other industries to follow.

“Digital Transformation: Empowering Banks to Better Serve Customers and Stay Market-Relevant”

Prime Minister Pham Minh Chinh has outlined key areas where banks need to accelerate their efforts and embrace digitalization to better serve the people and understand the market.

“A Glimpse into the Future: PM’s Tour of the Tech Space at the 2025 Digital Transformation Event”

“Hanoi, May 29 – Military Commercial Joint Stock Bank (MB) proudly participated in the Vietnam State Bank’s flagship event, ‘Digital Transformation in Banking 2025: Smart Digital Ecosystem in the New Era.’ The event was graced by the presence of Prime Minister Pham Minh Chinh, Governor of the State Bank of Vietnam Nguyen Thi Hong, Hungarian President Sulyok Tamas, and other esteemed leaders from various industries, commercial banks, and international organizations. MB showcased its latest digital innovations, with a spotlight on Biz MBBank, a dedicated digital banking platform for businesses, aiming to accelerate comprehensive digital transformation and enhance the competitiveness of Vietnam’s private sector.”

“Online Accessibility: Seamless Digital Journey for Businesses in the Construction Sector.”

The Ministry of Construction’s Administrative Reform Plan for 2025 aims to revolutionize the way the government operates. With a sharp focus on institutional reform, we are streamlining administrative procedures, reorganizing the government’s structure, and overhauling public financial systems. But we’re not stopping there; we’re also driving the development of a digital government, harnessing the power of technology to create a more efficient, effective, and transparent administration.