FPT Announces Plans to Issue New Shares and Pay Dividends

FPT Corporation has announced its plans to issue new shares to increase capital from the company’s equity source. According to the resolution passed by the Board of Directors, FPT aims to issue 222.2 million new shares, equivalent to a 15% ratio (for every 20 shares held, shareholders will receive 3 new shares). The expected timeline for this share issuance is by Q3 2025.

In addition, FPT will also distribute the remaining 2024 dividends in cash, with a ratio of 10% (VND 1,000 per share). The record date for shareholders is set for June 13th, and the expected payment date is June 20th. With approximately 1.47 billion shares in circulation, FPT is expected to spend nearly VND 1,500 billion on this dividend payout.

On the stock exchange, FPT’s share price currently stands at VND 117,100 per share, reflecting a 23% decrease compared to the beginning of the year. The market capitalization has correspondingly decreased to approximately VND 174,000 billion.

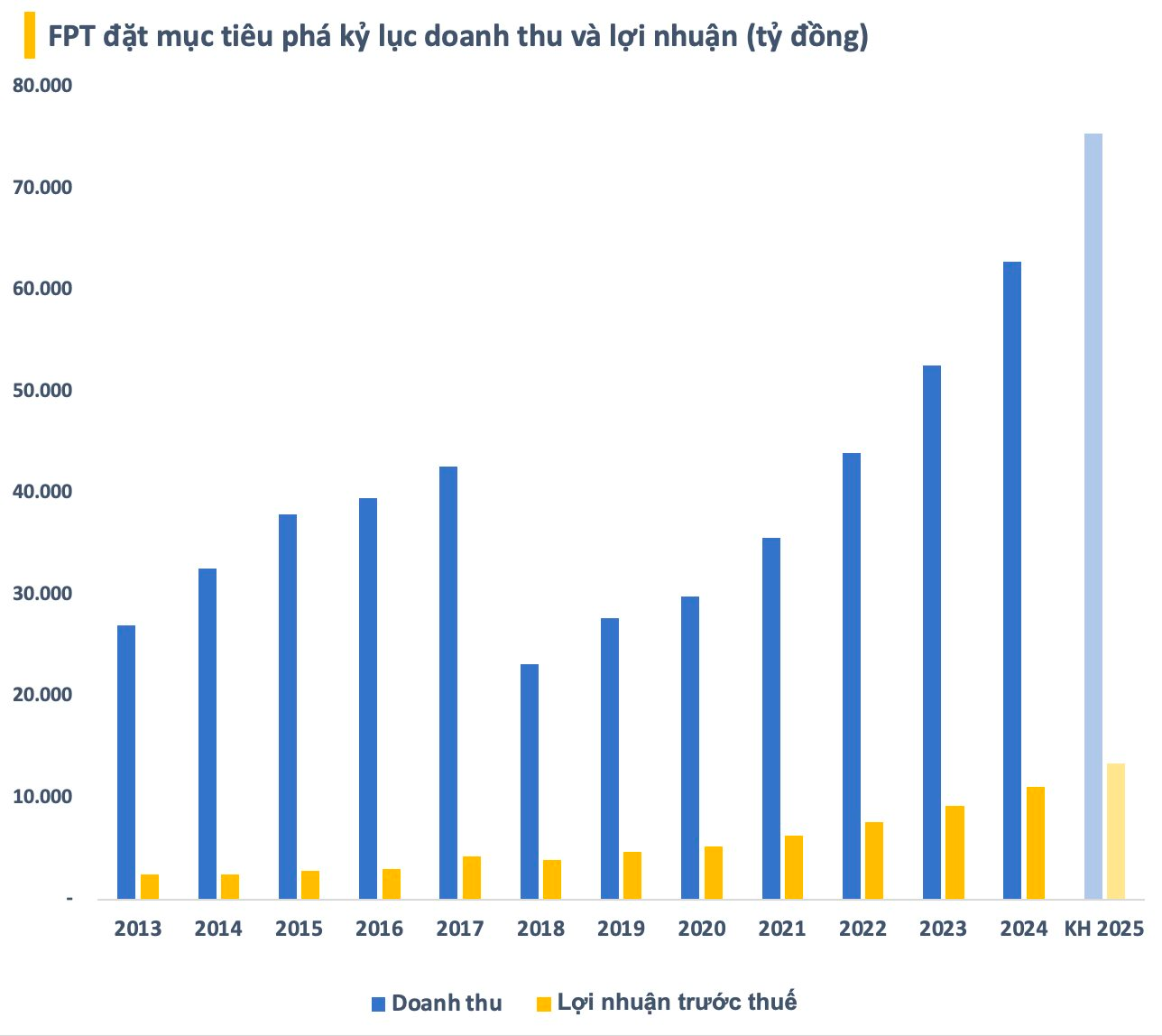

For the first four months of 2025, FPT reported a revenue of VND 21,557 billion and a pre-tax profit of VND 4,065 billion, representing a 13.5% and 17.9% increase, respectively, compared to the same period last year. The after-tax profit attributable to the company’s shareholders (net profit) increased by 18% to VND 2,897 billion, resulting in an EPS of VND 1,970 per share.

Specifically, in April 2025, FPT’s revenue reached VND 5,499 billion, a 12.3% increase year-over-year. The net profit for April also increased by 10% compared to the previous year, amounting to VND 723 billion. This marks a rare occasion in recent years where the technology conglomerate has not been able to maintain a 20% growth rate.

FPT attributes this situation to the current economic and geopolitical uncertainties, which have made global businesses more cautious in their IT spending decisions. Despite these challenges, FPT remains committed to its ambitious business plan for 2025, targeting a 20% increase in revenue and a 21% rise in pre-tax profits compared to 2024.

At the annual general meeting of shareholders held in mid-April, Mr. Truong Gia Binh, Chairman of the Board of Directors of FPT, acknowledged the “extremely difficult” context. He pointed out the challenges in planning for multiple years when policies can change overnight. However, he also emphasized that within these challenges lie opportunities, and FPT remains focused on maintaining a disciplined approach with a target growth rate of around 20%.

Mr. Nguyen Van Khoa, CEO of FPT, added that the company’s business plan for this year was formulated in January, before the announcement of the new US tax policy. He stated, “We think we were really brave to set such a plan, but we won’t be subjective. FPT will closely monitor the actual situation and be ready to adjust our plans if needed.”

How Did the Fund Management Industry Perform in the First Quarter?

The statistics from 43 active fund management companies in the Vietnamese stock market paint an interesting picture. With a focus on revenue and net profit growth, the numbers reveal a thriving industry. However, a deeper dive into the figures uncovers a notable decline in net profit margins, leaving room for further analysis and exploration.

The Great Talent Shuffle at VIX Securities

The VIX Securities has recently undergone a transition with the resignation of two board members, which was approved by the shareholders. Subsequently, the company has appointed two new individuals to fill these vacant positions. This strategic move is expected to bring fresh perspectives and expertise to the board, potentially driving new initiatives and fostering innovation within the company.