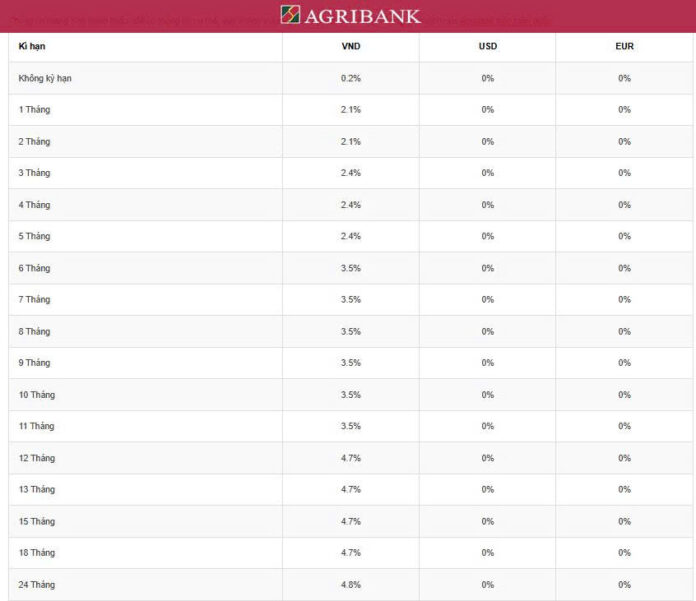

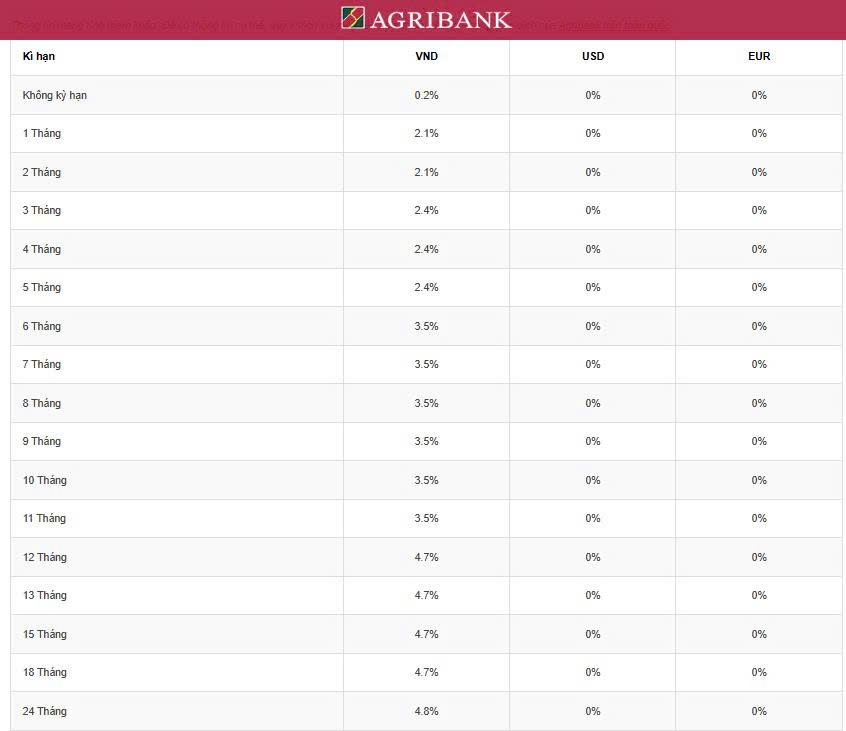

As of late May 2025, the Vietnam Bank for Agriculture and Rural Development (Agribank) offers interest rates ranging from 2.1% to 4.8% per annum for individual customers.

Specifically, short-term deposits with a duration of 1-2 months earn an interest rate of 2.1% per annum, while those with a term of 3-5 months enjoy a rate of 2.4%. The interest rate increases to 3.5% per annum for terms of 6-11 months. For longer-term deposits of 12-18 months, the rate is 4.7%, and the highest rate of 4.8% is offered for a 24-month term. Non-term deposits or transactional accounts earn an interest rate of 0.2% per annum.

With a deposit of VND 100 million at a 24-month term with a 4.8% interest rate, an individual can expect to receive approximately VND 4.8 million in interest after the first year and a total of VND 9.6 million in interest after the full two-year term, resulting in a final balance of VND 109.6 million.

Opting for a 12-18 month term at 4.7% per annum would yield VND 4.7 million in interest after one year, resulting in a total of VND 104.7 million, which may be a more suitable option for those who anticipate an earlier withdrawal.

For those seeking flexibility, a 6-11 month term at 3.5% per annum would provide VND 1.75 million in interest after six months, resulting in a total of VND 101.75 million. Shorter-term deposits of 1-5 months, with interest rates of 2.1-2.4% per annum, offer lower returns, ranging from VND 175,000 to VND 600,000 per term.

The choice of term depends on individual needs. For those who do not require access to their funds for an extended period, the 24-month term at 4.8% is optimal, allowing depositors to take advantage of the highest interest rate. On the other hand, the 12-18 month term at 4.7% offers a balance between a decent interest rate and flexibility. However, it is important to note that early withdrawals will result in a reduced interest rate of 0.2% per annum.