The financial results and profits of the Saigon Jewelry Company (SJC) have been on a rollercoaster ride from 2012 to 2024, with many periods of significant decline.

2012 marked the issuance of Decree 24, which placed SJC gold under the management of the State Bank of Vietnam (SBV). Since then, the company has solely acted as a gold buyer, seller, and refiner (restamping misshapen gold to meet circulation standards), no longer producing gold bars as before.

First hundred-billion-dollar profit in 2024

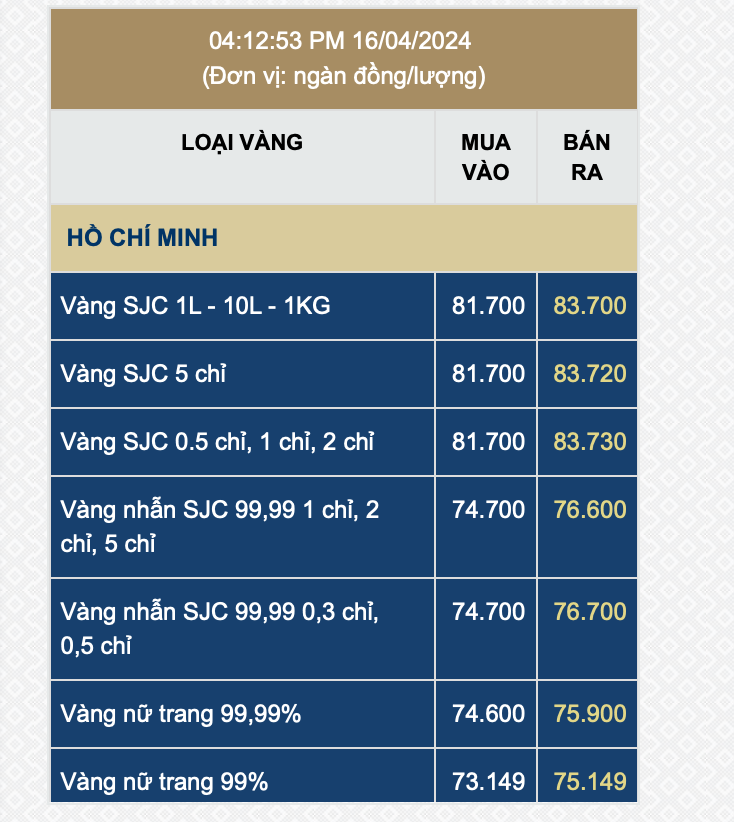

According to SJC’s audited financial report, in 2024, the company’s revenue increased by nearly VND 4,000 billion compared to the previous year, reaching VND 32,193 billion.

Accompanying the high revenue, profits also surged in 2024. The company reported a four-fold increase in after-tax profit compared to 2023, reaching VND 283 billion. This was the highest profit for SJC in the past decade. Notably, this figure was VND 213 billion higher than the plan presented by SJC to the Ho Chi Minh City People’s Committee.

SJC is the only company authorized to restamp national brand gold bars in Vietnam from 2012 to the present under Decree 24.

By the end of 2024, SJC had total assets of over VND 2,000 billion, an increase of nearly VND 200 billion compared to 2023. The company has 27 directly affiliated units and subsidiary and associated companies.

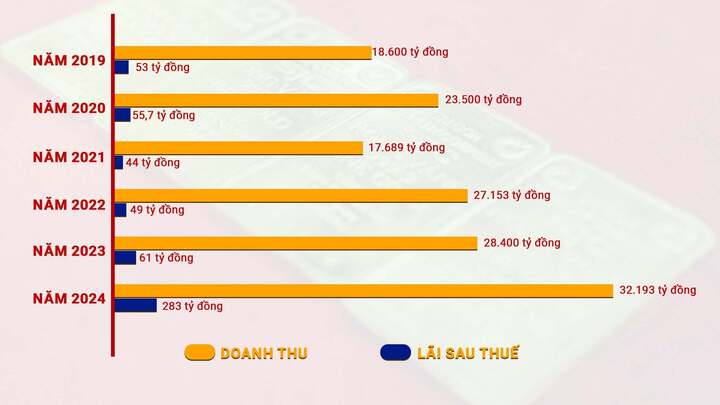

2024 was a record-breaking year for the gold market, with domestic gold prices experiencing their most significant fluctuations. At the beginning of the year, each SJC gold bar was sold at around VND 74 million, reaching VND 84 million per tael by the end of the year, but the highest price was VND 92.4 million per tael on May 10, 2024, an increase of nearly 20%.

In total, domestic gold prices peaked 21 times in 2024.

Also, in 2024, the SBV employed various measures to stabilize the gold market and narrow the gap between domestic and international gold prices. For the first time, the central bank sold gold bars directly to the people through four state-owned commercial banks and SJC. This intervention was unprecedented in the SBV’s management and administration of the gold market.

Nearly 13.3 tons of gold were sold to the market in 2024. Previously, for ten years, from 2014 to 2023, the SBV did not increase the supply of SJC gold bars to the market. In 2013, nearly 70 tons of gold were sold by the SBV.

Since the beginning of 2025, SJC gold bars have touched VND 124 million per tael, with transactions on May 29 ending the day at VND 118 million per tael.

Revenue in the tens of thousands of billions, profit in the tens of billions

SJC is the only state-owned gold trading enterprise, under the Ho Chi Minh City People’s Committee, established in 1988. In 1989, SJC introduced its first gold bar product, the 9999 Dragon Gold SJC, including 1, 2, 5, and 10-tael bars.

In the Vietnamese gold market, SJC gold bars have the most significant influence. When buying gold, especially from 2012 to the present, people think of SJC, but this is not a type of gold but a gold bar brand. The dominant position of SJC gold bars stems from the Government’s Decree 24, issued in 2012, aiming to stabilize the gold market, counter “goldization” of the economy, and tightly manage gold bar production and trading activities.

2024 was the first year in over a decade that SJC achieved an after-tax profit of VND 283 billion. (Illustrative image: Ha Linh)

According to this regulation, the state has a monopoly on gold bar production, and the SBV is the organizing and managing agency. They chose SJC as the national gold bar brand to produce according to approved quotas and plans. Other enterprises are not permitted to produce gold bars.

Therefore, SJC is the only company authorized to restamp national brand gold bars in Vietnam from 2012 to the present.

This year, SJC submitted a business plan with revenue of over VND 34,897 billion, higher than the 2024 performance by about VND 2,700 billion. After-tax profit is expected to reach VND 88.9 billion, while last year’s profit was VND 283 billion.

The company also announced it would restamp 20,074 deformed gold bars and focus on jewelry production and trading. The projected jewelry sales include 503,858 items, a significant increase from 2024’s figure of 444,912.

The company also outlined its investment orientation in jewelry production and trading, aiming to become one of the leading enterprises in the industry, expand its market presence, and introduce the SJC brand to Southeast Asia.

SJC’s revenue over the last six years.

Notably, while SJC’s revenue has consistently been in the tens of thousands of billions of VND, its profits have been meager. Except for 2024, in the past decade, from 2013 to the present, the company’s after-tax profit has never exceeded VND 100 billion.

For example, in 2023, this leading gold trading enterprise recorded revenue of over VND 28,400 billion but had an after-tax profit of only VND 61 billion. The reason for the low profit is that the cost of gold trading accounted for 99% of the revenue.

In 2022, the company also recorded revenue of over VND 27,153 billion, a significant increase from 2021’s figure of over VND 17,689 billion due to the severe impact of COVID-19. However, the profit was quite modest, at just under VND 49 billion. In 2021, revenue was over VND 17,689 billion, and after-tax profit reached nearly VND 44 billion.

One reason SJC cited for high revenue but lower profit than peers is the low-profit margin in the gold bar business. (Illustrative image: Ha Linh)

In 2020, the company had revenue of nearly VND 23,500 billion and an after-tax profit of over VND 55.7 billion. The previous year, in 2019, SJC’s revenue from sales and services – mainly gold trading – reached over VND 18,600 billion, with an after-tax profit of nearly VND 53 billion.

2017 was also a year of high revenue for SJC, with nearly VND 23,000 billion and an after-tax profit of over VND 81.3 billion. However, in 2018, revenue dropped by more than VND 2,000 billion, and after-tax profit was surprisingly low, at just under VND 28 billion.

In 2016, SJC’s revenue was over VND 21,593 billion, with an after-tax profit of over VND 63.3 billion…

In reality, before the gold bar monopoly in 2012, the company’s revenue reached over VND 72,087 billion, and after-tax profit was over VND 294.5 billion. But in the following year, revenue plummeted to just over VND 27,667 billion, and after-tax profit dropped to just over VND 190 billion. Total assets also decreased significantly from over VND 3,092 billion in 2012 to VND 1,804 billion in 2013.

Compared to PNJ, a company in the same industry, in 2012, SJC’s revenue was more than ten times higher than PNJ’s (approximately VND 6,428 billion), and PNJ’s after-tax profit was just over VND 225 billion.

However, in 2024, PNJ’s after-tax profit reached over VND 2,110 billion, nearly ten times that of SJC, while PNJ’s revenue also surpassed SJC, reaching over VND 38,232 billion.

At a press conference on Ho Chi Minh City’s socio-economic situation in 2024, an SJC representative shared that the company did not benefit from being chosen as the exclusive producer of the national brand gold bars. The company’s profits declined sharply after 2012 due to the cessation of gold production and imports.

At a working session with the Central Committee on Policies and Strategies on May 28, 2025, General Secretary To Lam acknowledged that the mechanisms and policies for managing and regulating the gold market had not kept pace with market developments. He urged the swift amendment of Decree 24 toward marketization with a roadmap and strict control, enhancing the connection between the domestic and international markets.

The General Secretary called for eliminating the state monopoly on the national brand gold bars in a controlled manner, with the state continuing to manage production activities but potentially licensing multiple qualified enterprises to foster a competitive environment, diversify supply sources, and stabilize prices.

He also emphasized expanding controlled import rights to increase supply, reduce the gap between domestic and global prices, and curb smuggling.

Oil, Gold, and Coffee: A Triple Dip on May 31st

The commodities market witnessed a broad-based decline on Friday, with oil, gold, copper, coffee, and rubber all trading lower. Conversely, raw sugar and cocoa were the only commodities that bucked the trend and ended the session in positive territory.