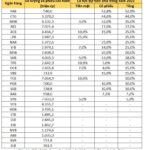

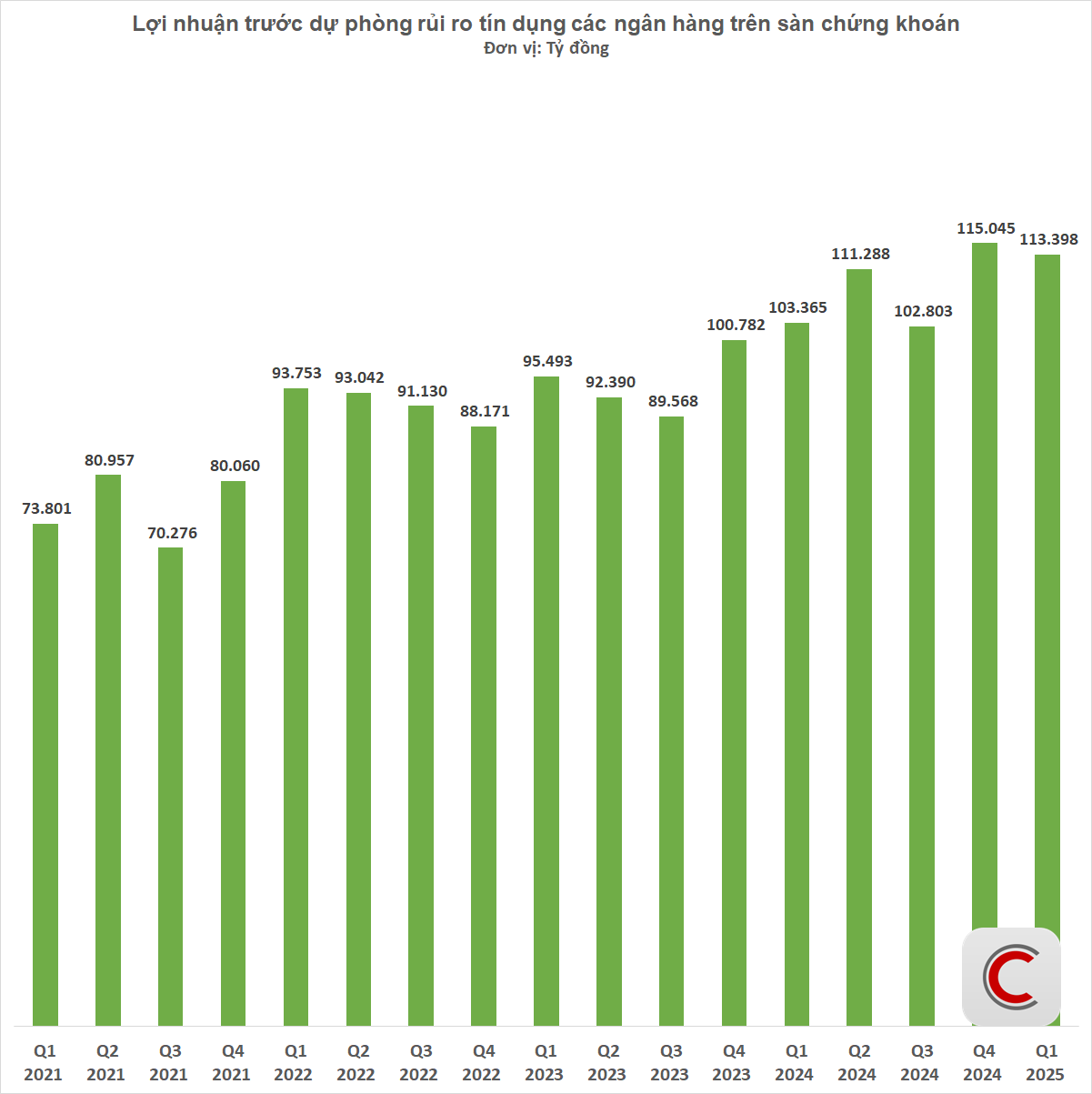

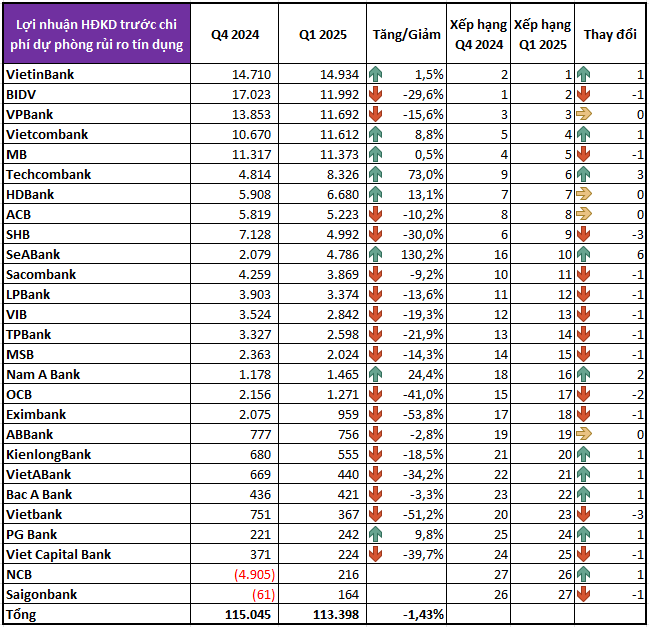

According to financial reports from 27 listed banks, their combined pre-provision profit for Q1 2025 reached VND 113,398 billion, a slight decrease of 1.43% from the previous quarter (VND 115,045 billion). However, this was still the second-highest quarterly profit ever recorded.

VietinBank surpasses BIDV to take the top spot

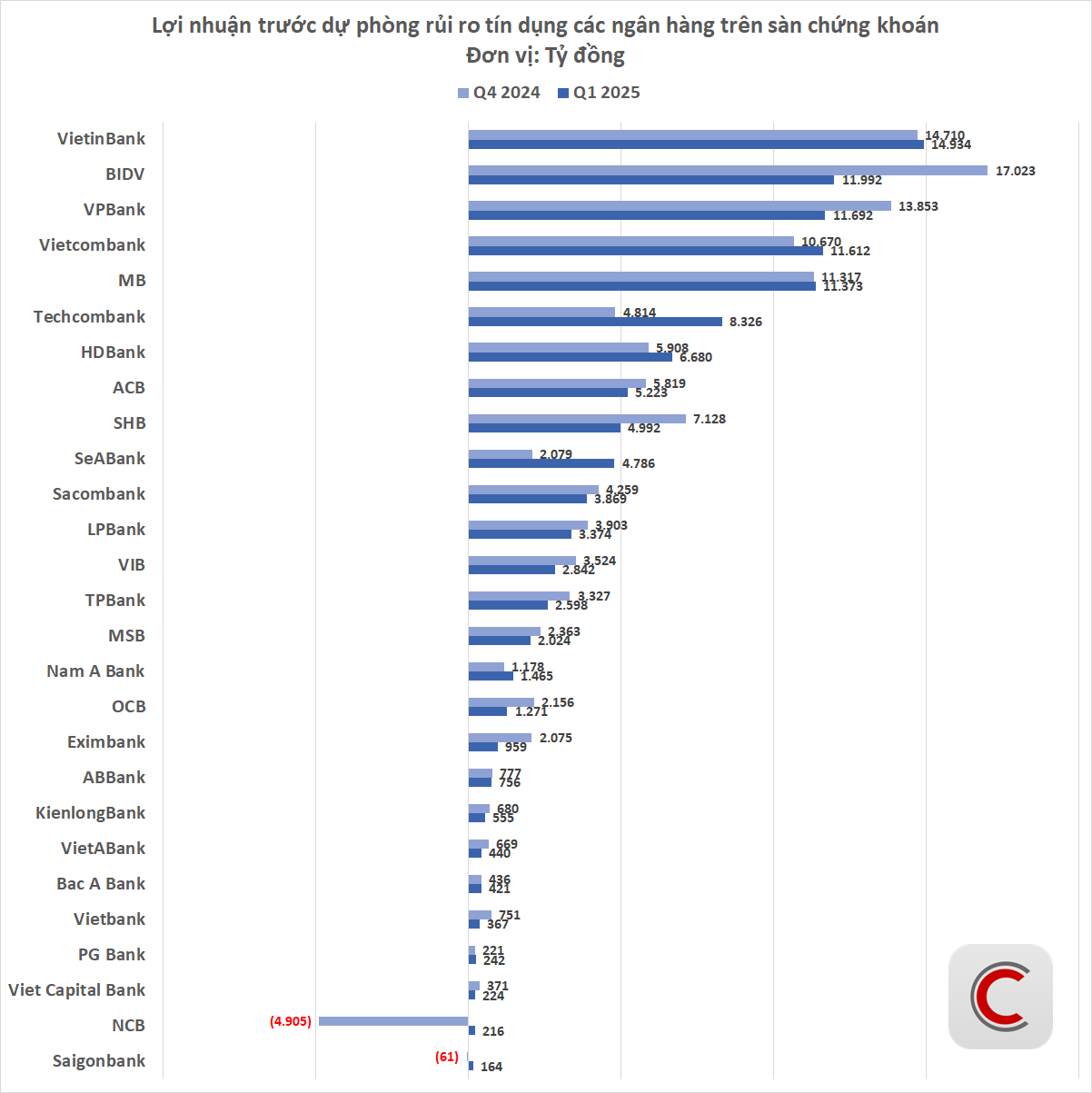

In Q1 2025, there was a shift in the rankings as VietinBank claimed the number one position with a pre-provision profit of VND 14,934 billion, a 1.5% increase from Q4 2024. Meanwhile, BIDV, traditionally the industry leader, dropped to second place with VND 11,992 billion, a significant 29.6% decrease from the previous quarter.

VPBank experienced the sharpest decline among the top performers, with its pre-provision profit falling by 15.6% to VND 11,692 billion. Despite this, VPBank maintained its third position, although the gap with its competitors has narrowed.

Vietcombank, in fourth place, posted an 8.8% growth to VND 11,612 billion, overtaking MB, which remained relatively stagnant this quarter.

Mid-tier banks: Techcombank, SeABank, and Nam A Bank shine

Techcombank was one of the brightest spots this quarter, with an impressive 73% growth in pre-provision profit, climbing from VND 4,814 billion to VND 8,326 billion. This propelled Techcombank three places up the rankings to sixth position, surpassing both ACB and SHB. Techcombank’s financial report attributed this surge primarily to a significant reduction in operating expenses, coupled with improvements across all business segments.

SeABank also recorded an extraordinary 130.2% growth in pre-provision profit, increasing from VND 2,079 billion to VND 4,786 billion. This remarkable performance was mainly due to a contribution of VND 2,607 billion in income from equity investments. As a result, SeABank climbed six places to reach the 10th position, its highest ranking in recent years.

Among the smaller banks, Nam A Bank also made notable improvements, increasing its profit by 24.1% and moving up to the 16th position.

Decline in profits for many banks

While 10 banks managed to increase their profits, 17 banks experienced a decline. BIDV saw the most significant drop among the large banks, causing it to fall one place in the rankings. Additionally, SHB, LPBank, VIB, TPBank, and MSB all reported profit decreases of over 10%.

The banks with the most considerable declines this quarter were Eximbank (-53.8%), OCB (-41%), Bac A Bank (-34.2%), and Vietbank (-51.2%).

According to SSI Research, the banking industry is expected to face challenges in 2025, including slower credit growth, rising non-performing loan pressures, and tighter capital adequacy regulations. However, banks that maintain diverse income structures and strong risk management will continue to lead and have long-term growth potential.

Unleashing the Power of Digital Transformation: Techcombank Introduces Revolutionary Solutions at the 2025 Banking Industry Digital Transformation Event.

“At the 2025 Banking Digital Transformation event, themed ‘Smart Digital Ecosystem in the New Era’, Techcombank reaffirmed its pioneering position by offering comprehensive digital solutions for corporate customers through its digital banking application. By accelerating its digital transformation and maintaining its market leadership, the bank demonstrated its strong commitment to accompanying the nation in its journey towards a new era of prosperity.”

“Collaborating to Develop Solutions for the Da Nang Free Trade Zone”

On May 23, 2025, the city of Da Nang, Vietnam, witnessed a significant development with the signing of a Memorandum of Understanding between the People’s Committee of Da Nang City and the Bank for Investment and Development of Vietnam (BIDV). This milestone agreement paves the way for a strategic collaboration to create innovative financial technology solutions for the Da Nang Free Trade Zone.

The Billionaire’s Assets Surge to Unprecedented Heights

“Vingroup’s stock surge: VHM and VIC soar to new heights. In a thrilling rally, Vingroup’s stocks witnessed a substantial surge with VHM and VIC reaching their peak. This exhilarating performance has propelled billionaire Pham Nhat Vuong’s net worth to a record-breaking $10.2 billion, according to the latest updates from Forbes.”