Source: VietstockFinance

|

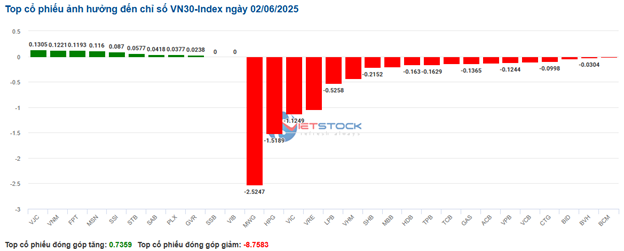

Large-cap stocks are exerting significant pressure on the market, with the VN30-Index down more than 14 points, or 1%, to 1,409.59. The duo of VIC and VHM are having the most negative impact, taking away more than 5 points from the VN-Index. Meanwhile, no stocks made a notable positive contribution. VJC, BSR, and PDR led the gains but contributed less than 1 point combined.

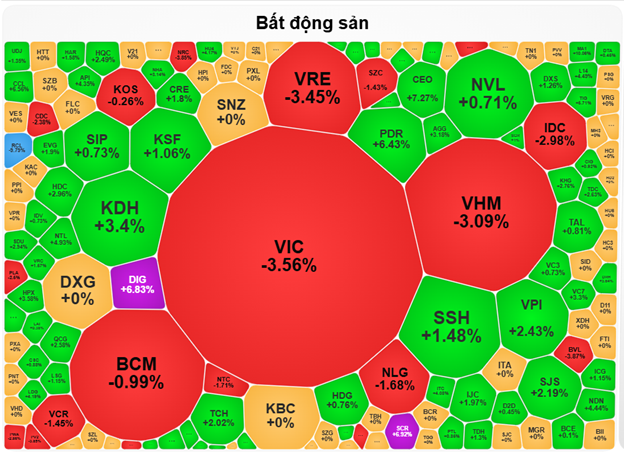

Most sectors were mixed within a narrow range, with red dominating. The real estate sector was the most prominent highlight of the morning session, with numerous stocks surging, such as DIG and SCR hitting the maximum daily limit, PDR (+6.43%), CEO (+7.27%), KDH (+3.4%), TCH (+2.02%), VPI (+2.43%), HDC (+2.96%), NTL (+4.93%), and KHG (+2.76%) among others. However, the sector index declined the most among all sectors, dragged down by the Vingroup trio of VIC (-3.56%), VHM (-3.09%), and VRE (-3.45%), which have dominant market capitalizations.

Source: VietstockFinance

|

The discretionary and telecom sectors also lost over 1%, mainly due to adjustments in large-cap stocks like VPL (-1.69%), MWG (-3.06%), PNJ (-5.58%), FRT (-2.14%); and VGI (-1.32%), CTR (-0.55%), FOX (-0.65%), respectively.

The financial sector continued to be mixed, with securities stocks attracting stronger buying interest compared to banks and insurance companies. VND, FTS, CTS, BSI, VDS, BVS, and AGR stood out with gains of over 1%.

On the upside, the energy sector outperformed the rest, thanks to significant contributions from BSR (+2.02%), PVS (+6.18%), PVD (+1.36%), PVC (+2.08%), POS (+2.82%), and PVB (+2.14%).

Foreign investors net sold over VND 283 billion on the HOSE in the morning session, focusing their selling on HPG (VND 94.32 billion) and VIC (VND 73.65 billion). Conversely, on the HNX, they net bought over VND 14 billion, with notable buying in CEO (VND 22.86 billion).

10:30 AM: Investor sentiment remains cautious, real estate sector volatile

Investor caution continued, leading to a strong tug-of-war around the reference level. As of 10:30 AM, the VN-Index was down 2.98 points, hovering around 1,329 points. The HNX-Index lost 1.97 points, trading around 225 points.

Breadth in the VN30 basket was mixed, with decliners slightly outnumbering advancers. Specifically, MWG, HPG, VIC, and VRE took away 2.52, 1.52, 1.12, and 1.04 points from the main index, respectively. On the other hand, VJC, VNM, FPT, and MSN remained in positive territory, but their impact was not significant.

Source: VietstockFinance

|

The discretionary sector remained lackluster, with large caps such as VPL down 0.22%, MWG down 2.58%, PNJ down 4.73%, and GEE down 2.25%…continuing to face selling pressure, while a small number of stocks like PLX (+0.72%), DGW (+0.61%), HHS (+1.7%), and PET (+1.29%) managed to stay in positive territory…

Next was the telecom sector, with most stocks painted in a rather pessimistic red. Specifically, VGI fell 0.88%, CTR lost 0.11%, FOX declined 1.19%, and VNZ was down 0.14%…

In contrast, the real estate sector performed well in the market, despite mixed performance, as the number of gainers still outnumbered decliners. Notably, KDH surged 4.76%, NVL rose 2.47%, DIG hit the daily limit, and CEO climbed 7.88%… However, large-cap stocks like VIC (-1.02%), VHM (-0.52%), VRE (-2.55%), and BCM (-0.33%) faced selling pressure, weighing on the sector’s overall performance.

Following was the industrials sector, which also attracted money flows, with ACV up 0.41%, HVN gaining 0.53%, VEA rising 0.51%, and VJC advancing 0.34%… On the downside, stocks like VEF, GMD, VTP, and PVT… were in the red, but the declines were not significant.

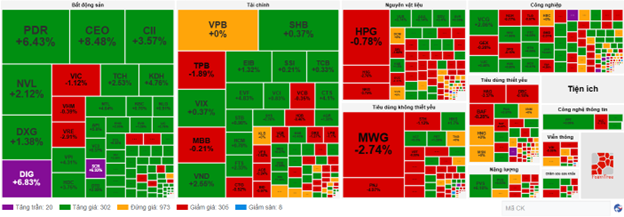

Compared to the opening, buying and selling forces were relatively balanced. There were 302 gainers and 305 losers.

Source: VietstockFinance

|

Opening: Mixed performance, PNJ paints a pessimistic picture

The market started with a highly mixed performance, with the red dominating. Within the VN30 basket, most stocks declined, except for FPT and PLX, which managed to stay slightly in positive territory, but their contribution to the index was insignificant.

The discretionary sector was the worst performer, down 0.91%. Large caps such as VPL (-1.24%), MWG (-1.13%), GEX (-0.71%), and PNJ (-5.45%) were in the red…

Next was the materials sector, which was also mixed, with sellers slightly outnumbering buyers. On the downside, HPG fell 0.97%, DGC lost 1.45%, MSR declined 1.65%, and NTP was down 1.59%… Only a few stocks managed to stay in positive territory, including GVR (+1.57%), KSV (+0.84%), and DPM (+0.15%)…

The Big Dip: Why Large-Cap Stocks are Taking a Tumble, While Small Real Estate Remains Resilient

The market opened the month of June with a steep decline in the VN30-Index, erasing 0.99% as large-cap stocks faced downward pressure. The VN-Index also took a hit, falling 0.62% due to losses in VIC and VHM. However, money continued to flow into mid-cap stocks, indicating a cautious but persistent appetite for opportunities in the market.

“Stock Picking Gets Tougher as History Suggests June May Not Bring Gains: Are Risks Rising?”

The stock market is poised for a significant differentiation, and the ability to pick the right stocks is diminishing, while risks are on the rise.

The Ultimate Penmanship: Crafting a Captivating Title

“The Penultimate Stroke: Unveiling the Intricacies of a 17-Million Share Trade”

The Vietnam Investment Group Joint Stock Company intends to sell 17 million VAB shares of VietABank through a matched or negotiated deal. This move is designed to comply with the Law on Credit Institutions 2024, which stipulates that institutional shareholders cannot own more than 10% of a bank’s charter capital.

Expert Insights: Tune in to the Market Rhythm and Seize Investment Opportunities in These Two Sectors

Stepping into June, market experts predict a period of consolidation for the first half of the month, with the index hovering around the 1,320-point mark for approximately 8-10 sessions.