Market liquidity decreased compared to the previous trading session, with the matched trading volume of the VN-Index reaching over 860 million shares, equivalent to a value of more than 18.6 trillion VND. The HNX-Index reached over 95.6 million shares, equivalent to a value of more than 1.6 trillion VND.

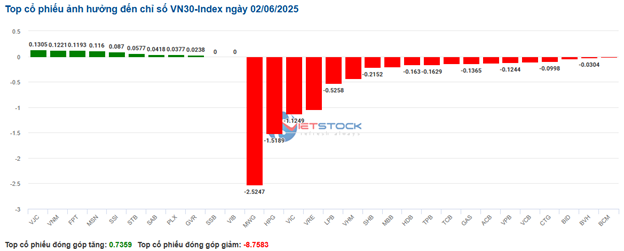

VN-Index opened the afternoon session with a strong comeback from buyers, helping the index quickly recover and surpass the reference mark while maintaining its green color at the close. In terms of impact, TCB, GVR, STB, and BSR were the codes that had the most positive impact on the VN-Index, with an increase of more than 2.1 points. On the contrary, VPL, VHM, BID, and VRE are the codes that are still under selling pressure, taking away more than 2 points from the general index.

| Top 10 stocks with the strongest impact on the VN-Index session 02/06/2025 |

Similarly, the HNX-Index also had a fairly optimistic performance, with the index positively impacted by codes such as PVS (+9.82%), CEO (+8.48%), HUT (+4.72%), and SHS (+2.29%)…

|

Source: VietstockFinance

|

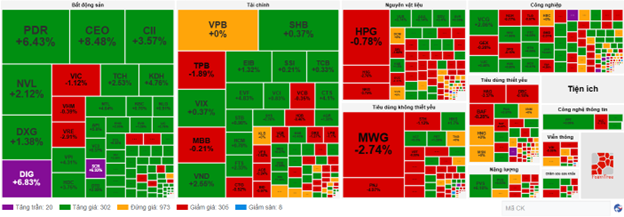

The energy sector was the group with the strongest increase of 4.44%, mainly due to codes such as PVS (+9.82%), PVD (+4.36%), PVC (+5.21%), and PVB (+5.34%). This was followed by the industry and utilities sectors, with increases of 0.82% and 0.72%, respectively. On the contrary, the non-essential consumer goods sector was the group with the largest decrease in the market, with a drop of 0.81%, mainly due to codes such as VPL (-1.69%), MWG (-1.77%), GEX (-1.27%), and PNJ (-5.21%).

In terms of foreign trading, foreigners continued to sell more than 205 billion VND on the HOSE, focusing on HPG (136.06 billion), VIC (78.97 billion), MSB (77.17 billion), and VRE (69.27 billion). On the HNX, foreigners bought a net amount of more than 41 billion VND, focusing on the code CEO (32.09 billion), LAS (7.2 billion), PVS (4.93 billion), and VFS (2.95 billion).

| Foreign Trading Buying – Selling Session |

Morning session: Pillar stocks plunge, VN-Index loses more than 8 points

The heavy pressure from the pillar group is causing the VN-Index to gradually lose momentum in the late morning session. At the mid-session break, the VN-Index decreased by 0.62%, stopping at 1,324.4 points. Meanwhile, the HNX-Index still increased by 0.66%, to 224.69 points. The market breadth recorded 353 decreasing codes and 306 increasing codes.

Source: VietstockFinance

|

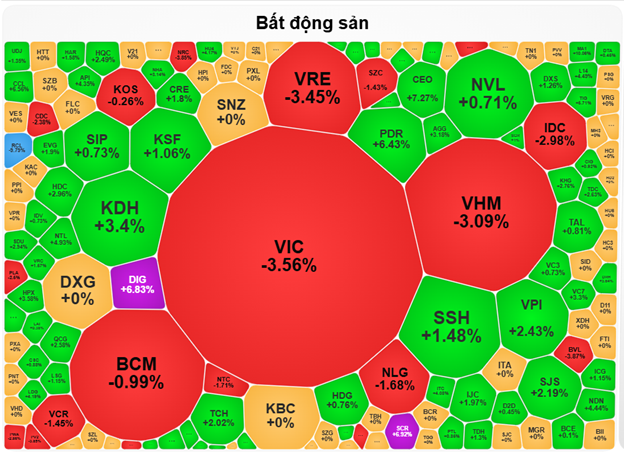

The group of pillar stocks is putting great pressure on the market, with the VN30-Index decreasing by more than 14 points, equivalent to 1%, to 1,409.59 points. The duo of VIC and VHM is currently having the most negative impact, taking away more than 5 points from the VN-Index. Meanwhile, there are no codes that contribute significantly in the opposite direction. VJC, BSR, and PDR are leading, but they bring back a total of less than 1 point.

Most industry groups are fluctuating within a narrow range, with red dominating. The real estate group is the most notable highlight of the market this morning, with a series of codes breaking through strongly, such as DIG and SCR, increasing the limit, PDR (+6.43%), CEO (+7.27%), KDH (+3.4%), TCH (+2.02%), VPI (+2.43%), HDC (+2.96%), NTL (+4.93%), and KHG (+2.76%) … However, the general index of this industry is currently decreasing the most in the market, with a decrease of 1.63%, due to heavy pressure from the Vingroup trio, including VIC (-3.56%), VHM (-3.09%), and VRE (-3.45%).

Source: VietstockFinance

|

The non-essential consumer goods and telecommunications groups also lost more than 1%, mainly affected by the adjustment of large-cap codes such as VPL (-1.69%), MWG (-3.06%), PNJ (-5.58%), and FRT (-2.14%); VGI (-1.32%), CTR (-0.55%), and FOX (-0.65%).

The financial group continued to fluctuate when securities stocks attracted stronger buying power than banks and insurance. VND, FTS, CTS, BSI, VDS, BVS, and AGR stood out with an increase of more than 1%.

On the increasing side, the energy group is currently outperforming the rest, thanks to the large contribution of BSR (+2.02%), PVS (+6.18%), PVD (+1.36%), PVC (+2.08%), POS (+2.82%), and PVB (+2.14%).

Foreigners net sold more than 283 billion VND on the HOSE in the morning session, with selling pressure concentrated in HPG (94.32 billion) and VIC (73.65 billion) stocks. Conversely, on the HNX, foreigners net bought more than 14 billion VND, with notable buying power in CEO (22.86 billion) stock.

10:30 am: Investor sentiment is uncertain, and the real estate group is making waves.

Investor sentiment of uncertainty continues, causing the main indexes to fluctuate strongly around the reference mark. As of 10:30 am, the VN-Index decreased slightly by 2.98 points, trading around 1,329 points. The HNX-Index decreased by 1.97 points, trading around 225 points.

The breadth in the VN30 basket was mixed, with decreasing codes outnumbering increasing ones. Specifically, MWG, HPG, VIC, and VRE took away 2.52 points, 1.52 points, 1.12 points, and 1.04 points from the general index, respectively. Conversely, VJC, VNM, FPT, and MSN were among the codes that remained in the green but did not significantly impact the index.

Source: VietstockFinance

|

The non-essential consumer goods group continued to perform poorly, with large-cap stocks such as VPL down 0.22%, MWG down 2.58%, PNJ down 4.73%, and GEE down 2.25%…continuously facing selling pressure, while a small number of remaining codes such as PLX increased by 0.72%, DGW increased by 0.61%, HHS increased by 1.7%, and PET increased by 1.29%…

Next was the telecommunications group, with most codes covered in a rather pessimistic red. Specifically, VGI decreased by 0.88%, CTR decreased by 0.11%, FOX decreased by 1.19%, and VNZ decreased by 0.14%…

In contrast, the real estate group is currently performing well in the market, although it is still fluctuating, with the number of increasing stock codes dominating. Notably, KDH increased by 4.76%, NVL by 2.47%, DIG by the limit, and CEO by 7.88%… Meanwhile, large-cap codes such as VIC decreased by 1.02%, VHM by 0.52%, VRE by 2.55%, and BCM by 0.33% are still under selling pressure, hindering the group’s overall upward momentum.

Following was the industry group, which also attracted money flow with ACV up 0.41%, HVN up 0.53%, VEA up 0.51%, and VJC up 0.34%… On the decreasing side, codes such as VEF, GMD, VTP, and PVT… were in the red, but the decrease was not significant.

Compared to the beginning of the session, buyers and sellers were relatively balanced. There were 302 increasing codes and 305 decreasing codes.

Source: VietstockFinance

|

Opening: Mixed performance at the beginning of the session, PNJ drowns in pessimism

The market started with a strong mixed performance, with the red dominating. In particular, the VN30 index had the most negative impact, with most of the stock codes in this group decreasing. Only FPT and PLX remained slightly in the green, with an insignificant contribution.

The non-essential consumer goods group currently has the largest decrease of 0.91%. Large-cap stocks such as VPL down 1.24%, MWG down 1.13%, GEX down 0.71%, and PNJ down 5.45%… are in the red.

Next was the materials sector, which was also mixed, with sellers dominating. Decreasing codes included HPG down 0.97%, DGC down 1.45%, MSR down 1.65%, and NTP down 1.59%… Only a few codes remained in the green, such as GVR up 1.57%, KSV up 0.84%, and DPM up 0.15%…

In contrast, the energy sector was more optimistic, with oil and gas giants in the green, such as PVS up 4%, PVD up 1.36%, and PVB up 1.07%…

– 15:30 02/06/2025

The Billion-Dollar Fund Management Industry: Unveiling the Bond Market’s Top Players

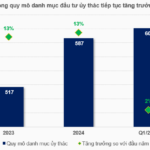

As of Q1 2025, the investment portfolio of the fund management industry – the primary source of revenue – stood at nearly VND 601 trillion, a modest 2% increase from the start of the year. The industry boasts 19 companies with portfolios worth thousands of billions of dong, one more than at the beginning of the year. Companies backed by the insurance industry continue to dominate in terms of the scale of entrusted assets.

Market Pulse June 2nd: Blue Chips Dive, VN-Index Down Over 8 Points

The heavy pressure from the pillar group is causing the VN-Index to gradually lose momentum in the late morning session. By the mid-session break, the VN-Index had dropped 0.62%, settling at 1,324.4 points. In contrast, the HNX-Index climbed 0.66% to reach 224.69 points. The market breadth was negative, with 353 declining stocks against 306 gainers.

The Big Dip: Why Large-Cap Stocks are Taking a Tumble, While Small Real Estate Remains Resilient

The market opened the month of June with a steep decline in the VN30-Index, erasing 0.99% as large-cap stocks faced downward pressure. The VN-Index also took a hit, falling 0.62% due to losses in VIC and VHM. However, money continued to flow into mid-cap stocks, indicating a cautious but persistent appetite for opportunities in the market.