Vietnam Petroleum Group (Petrolimex, Stock Code: PLX, HoSE: PLX) has just announced the Resolution of the Board of Directors regarding the payment of dividends for the year 2024 to shareholders. The record date for entitlement is June 11, 2025.

Accordingly, Petrolimex plans to distribute dividends for the year 2024 to shareholders at a rate of 12%, meaning that for each share owned, shareholders will receive VND 1,200. The record date for entitlement is June 11, 2025, and the payment will be made on June 24, 2025.

With over 1.27 billion PLX shares currently circulating in the market, it is estimated that Petrolimex will have to spend more than VND 1,524.7 billion for this dividend payment.

Illustrative image

It is known that the above dividend payment plan was approved by Petrolimex’s shareholders at the Annual General Meeting (AGM) held on April 25, 2025, in Hanoi.

In addition, the meeting also approved the 2025 dividend payment plan with a rate of 10%, equivalent to an expected expenditure of nearly VND 1,270.6 billion.

In terms of business plans, in 2025, Petrolimex expects to achieve consolidated revenue of VND 248,000 billion, up 87% compared to the results of 2024; and consolidated pre-tax profit is estimated at VND 3,200 billion, an increase of 81%.

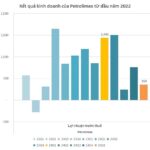

Regarding business performance, according to the consolidated financial statements for the first quarter of 2025, Petrolimex recorded revenue of over VND 67,861 billion, a decrease of 9.6% compared to the same period last year.

In this period, the company’s pre-tax accounting profit reached nearly VND 358.4 billion, down 75.1% year-on-year. After deducting tax and other expenses, the company reported a net profit of nearly VND 210.8 billion, a decrease of 81.4%.

With the above results, Petrolimex has achieved 27.4% of the planned revenue and 11.2% of the planned pre-tax profit.

As of March 31, 2025, Petrolimex’s total assets decreased slightly by 1.5% compared to the beginning of the year, to nearly VND 80,035.9 billion. Of which, cash and cash equivalents amounted to over VND 10,446.7 billion, accounting for 13.1% of total assets; long-term financial investments were nearly VND 20,016.4 billion, accounting for 25% of total assets; and inventories were nearly VND 15,677.5 billion, accounting for 19.6% of total assets.

On the liability side of the balance sheet, total liabilities stood at nearly VND 50,515.7 billion, a slight decrease of 1.3% compared to the beginning of the year. Of this, loans and finance lease obligations amounted to over VND 20,518.7 billion, accounting for 40.6% of total liabilities.

Dragon Vietnam Securities to Pay Stock Dividends: How Much Will Chairman Nguyen Mien Tuan Receive?

On June 11th, Rong Viet Securities will finalise its shareholder list for a 10:1 stock dividend payout. As the largest shareholder, Chairman Nguyen Mien Tuan will receive the most shares.

“Unanimous Shareholder Approval: ACV’s 96% Dividend Payout in Stock”

“As per the plans, ACV will allocate VND 7.13 trillion to the development investment fund, leaving approximately VND 14 trillion for dividend payout in shares. ACV expects to issue around 1.4 billion new shares, representing a ratio of 64.58% (for every 100 shares held, shareholders will receive 64.58 new shares).”

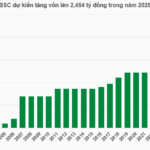

“BIDV Securities to Pay Stock Dividend of 22.3 Million Shares, Boosting Capital to VND 2,500 Billion”

On May 23, BIDV Securities Joint Stock Company (BSC, HOSE: BSI) announced a dividend payout of over 22.3 million shares, valuing more than VND 223 billion.