No Wave Yet – But No Longer at the “Bottom”

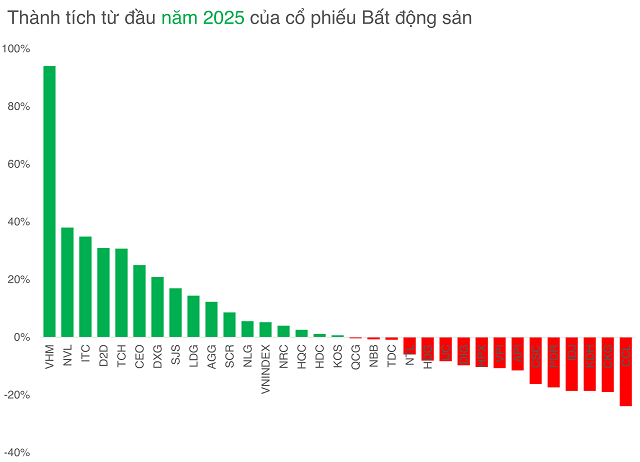

In the 2025 tariff shock, investors witnessed stock liquidation from the major players in the real estate sector, including PDR and DIG. However, the breadth of the real estate group, as measured by the performance of 32 stocks, did not revert to the “gloomy” phase of 2022-2023.

Correlation between VN-Index and Breadth of Real Estate Stocks

|

In fact, over 10% of the stocks maintained their long-term uptrend during the volatile sessions of April 2025. As the market rebounded, stocks such as VHM, NLG, NVL, DXG, ITC, and CEO successively broke out to new 2025 highs, with VHM boasting a remarkable 94% gain.

This recovery also attracted the attention of institutional investors. Recently, two funds managed by Vincapital purchased more than 270,000 shares of KDH between April 17 and May 16, 2025.

Meanwhile, the Dragon Capital group demonstrated strong accumulation of DXG stocks. From April 29 to May 22, they net bought nearly 12.7 million shares, increasing their ownership to 14.17% of the company’s capital.

However, the 2025 highs are still far from the all-time highs. VHM is currently trading at a 68% discount to its historical peak, NVL at 85%, TCH at 39%, and DXG at a 60% discount…

This indicates a price recovery and a resurgence of interest from large investors, but the momentum has not spread widely enough to confirm a traditional sectoral wave.

At the end of the last trading session of May 2025, 16 out of 32 real estate stocks exhibited a long-term uptrend, a status observed before the market’s sudden drop.

The New Cycle May Arrive When Least Expected

Mr. Nguyen The Minh, Director of Analysis at Yuanta Vietnam, shared his perspective: “While the real estate wave has not yet materialized, the fundamental conditions are gradually taking shape, reminiscent of the 2021 phase. The wave may emerge when the market expects it the least. If more stocks demonstrate improved long-term uptrends, investors will have to acknowledge the presence of a real estate wave. I anticipate stronger credit flows into this sector in the latter part of the year.”

Mr. Bui Van Huy, Investment Research Director at FIDT, offered a differentiated perspective: “The residential real estate segment is benefiting from supportive policies, low-interest rates, and public investment. However, not all companies will reap these advantages. Only those with clean legal records and those entering the new sales phase will generate cash flow and witness a positive impact on their stock prices. Businesses entangled in capital constraints, legal issues, or weak cash flow may lag, especially considering the slow recovery of home-buying demand and the potential impact of global trade tensions on the middle-class income, which constitutes the primary buying force in the market.”

In its latest assessment, VIS Rating reported a noticeable recovery in the residential real estate market during Q1 2025, attributed to robust policy support and bank credit. New supply in Hanoi and Ho Chi Minh City increased by 51% year-over-year, mainly in the mid-to-high-end segment, while the absorption rate reached 108%, surpassing the previous quarter’s 95%. Leading developers such as VHM and NLG witnessed remarkable sales growth, with increases of 116% and 120%, respectively.

In terms of legal framework, the issuance of Decrees 75 and 76 in early April 2025 untangled several bottlenecks related to licensing, land use fees, and land use conversion. This particularly benefited developers like NVL, Sovico, and Eurowindow, accelerating their project implementation.

Financially, the leverage ratio of the top 30 listed real estate enterprises with the highest revenue improved significantly. The industry’s EBITDA increased by 45% year-over-year, while total debt rose by only 16.2%. Consequently, the Debt/EBITDA ratio improved to 3.0x from 4.2x a year ago.

However, the sector’s most significant weakness remains its negative operating cash flow (CFO), which narrowed from -12 trillion VND in Q1/2024 to -2 trillion VND. A slight increase of 3% in advance payments from customers signals improvement, but it is insufficient to entirely reverse the cash flow deficit.

VIS Rating anticipates that supportive policies will continue to stabilize the market, leading to enhanced CFO and debt coverage ratios in the second half of 2025. Simultaneously, capital mobilization capabilities are expected to remain stable, particularly through bank credit channels.

– 08:03 02/06/2025

The Stock Market Slump: Shares Tumble Across the Board

The pressure to secure profits after a streak of consecutive gains, coupled with the fatigue of leading stocks, dragged the benchmark away from its previous peak. As the week’s final trading session concluded, the VN-Index witnessed a decline of over 9 points, with more than 230 stocks drowning in red.

The Real Estate Stock Surge: Novaland Skyrockets with “Buyout Frenzy”, What’s the Buzz?

The real estate market has been witnessing a surge in stock prices recently, owing to the revival of the property sector based on three fundamental factors: Legal, Interest Rates, and Infrastructure.

The Top 5 Industries Benefitting from Policy Changes and the Cooling of Trade Tariffs

In a climate of prevailing uncertainties, profit growth trends stabilizing, and discerning shifts in cash flows, the following sectors and stock groups are noteworthy for the upcoming period.