The VN-Index closed May 2025 at 1,332.6 points, a significant increase of 106.3 points or 8.67% from the previous month, with a slight decrease in liquidity (-7.3%) after three consecutive months of growth.

This recovery was largely supported by foreign investors’ net buying activities, focusing on Banking, Retail, Personal & Household Goods, and Real Estate sectors. Notably, Real Estate and Personal & Household Goods sectors outperformed the overall market with superior price gains.

The average matched transaction value on the HOSE reached VND 19,883 billion in the past month, a 36.7% increase compared to the 5-month average. In terms of capitalization, liquidity in the VN30 group witnessed a sharp decline in May, resulting in a considerable decrease in the allocation of funds into this group compared to April 2025. This shift indicates a growing attraction towards medium-capitalization (VNMID) and small-capitalization (VNSML) stocks, with a noticeable improvement in fund inflows.

The total average transaction value across the three exchanges reached VND 24,018 billion in May 2025. For matched transactions only, the average transaction value stood at VND 21,672 billion, a 6.9% decrease from the previous month but still 30.1% higher than the 5-month average.

Foreign investors net bought VND 914.1 billion, and their net buying value for matched transactions was VND 1,882 billion. Their main net buying sectors for matched transactions were Banking and Retail. The top stocks in their net buying list included MBB, MWG, NLG, PNJ, CTG, NVL, FUEVFVND, VIC, DXG, and HVN.

On the selling side, their net selling sectors for matched transactions were Food and Beverage. The top stocks in their net selling list included VHM, VCB, VRE, VNM, SSI, HPG, HAH, MSN, PVD.

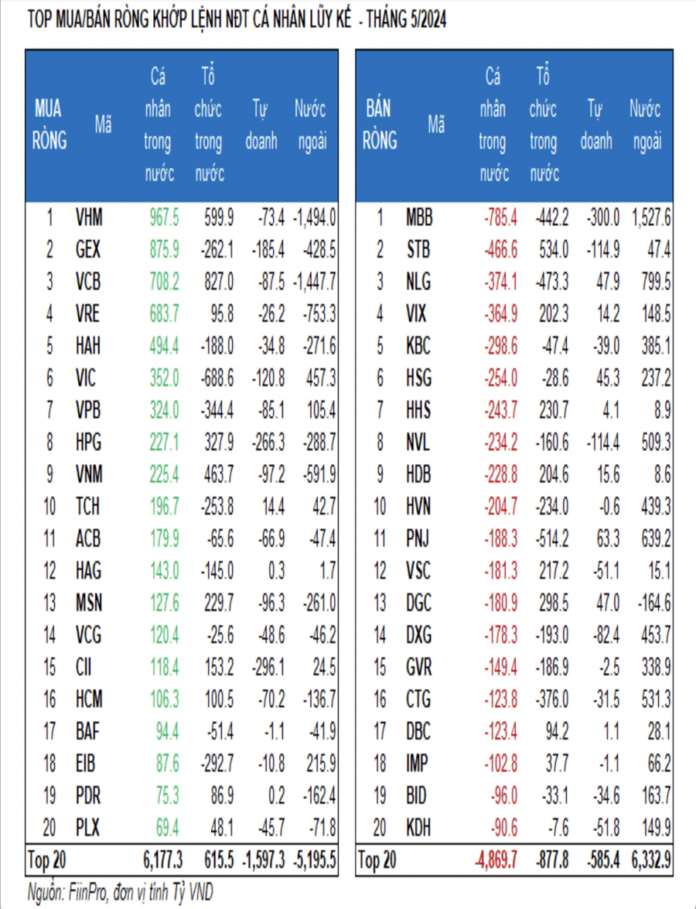

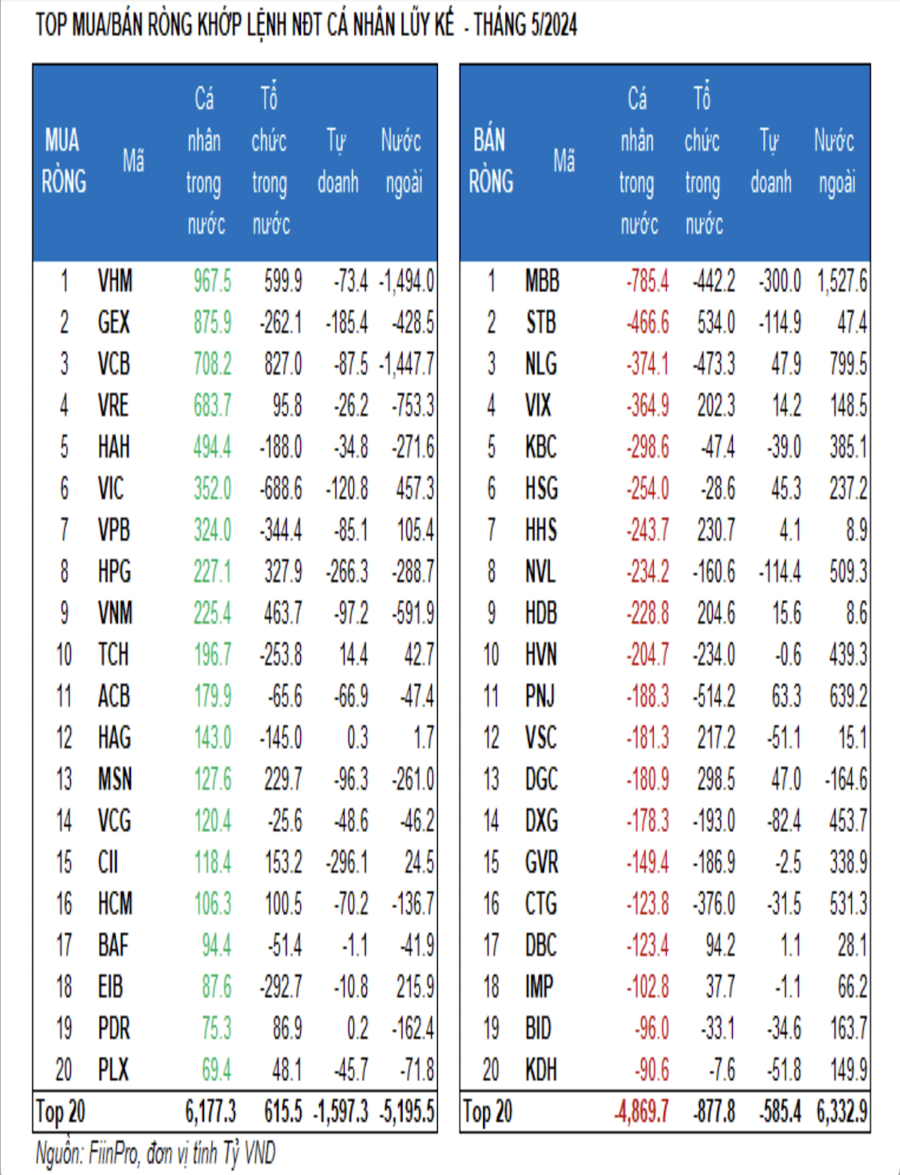

Individual investors net bought VND 2,128.6 billion, with a net buying value of VND 1,115.7 billion for matched transactions. For matched transactions, they net bought 6 out of 18 sectors, mainly in Industrial Goods & Services. Their top net buying list included VHM, GEX, VCB, VRE, HAH, VIC, VPB, HPG, VNM, and TCH.

For net selling, they sold 12 out of 18 sectors for matched transactions, mainly in Banking and Financial Services. The top net selling list included MBB, STB, NLG, VIX, KBC, HSG, NVL, HDB, and HVN.

Proprietary trading net sold VND 4,314.8 billion, and their net selling value for matched transactions was VND 3,616.4 billion. For matched transactions, proprietary trading net bought 3 out of 18 sectors. The top net buying sectors were Personal & Household Goods and Chemicals. The top stocks in their net buying list included E1VFVN30, PNJ, NLG, DGC, HSG, VHC, FUEKIV3O, SBT, PVT, and FUESSVFL. On the other hand, they net sold the Banking sector, with the top net sold stocks being TCB, FUEVFVND, MWG, MBB, CII, HPG, GEX, VIC, STB, and NVL.

Domestic institutional investors net bought VND 1,272.1 billion, with a net buying value of VND 618.7 billion for matched transactions. For matched transactions, domestic institutions net sold 7 out of 18 sectors, with the largest value in the Real Estate sector. The top net selling list included VIC, MWG, PNJ, NLG, MBB, CTG, VPB, EIB, GEX, and TCH.

The sector with the highest net buying value was Financial Services. The top net buying list included VCB, VHM, SSI, STB, VNM, TCB, HPG, DGC, HHS, and MSN.

On a monthly basis, fund allocation increased in Real Estate, Construction, Electrical Equipment, Power, Automotive, and Textile sectors, while it decreased in Banking, Securities, Steel, Information Technology, Retail, and Food & Beverage sectors.

In May, fund inflows continued in the Banking sector and returned strongly to the Real Estate sector, as indicated by the shift towards the positive zone (green). Conversely, Food & Beverage, Steel, and Retail (Specialized Distribution) sectors remained at the bottom in terms of fund inflows, with no significant improvement observed. Meanwhile, the Power and Oil & Gas sectors started to show signs of attracting fund inflows.

In terms of capitalization, liquidity in the large-cap VN30 group witnessed a sharp decline in May, resulting in a decrease in the allocation of funds into this group compared to April 2025. This shift indicates a growing attraction towards medium-capitalization (VNMID) and small-capitalization (VNSML) stocks, with a noticeable improvement in fund inflows.

Specifically, the average transaction value of the large-cap VN30 group decreased by VND 2,053 billion (-17.4%) in May 2025, causing the fund allocation to this group to drop to 49% from 55.3% in the previous month.

In contrast, liquidity in the medium- and small-cap groups improved positively, with VNMID increasing by VND 96 billion (+1.3%) and VNSML by VND 148 billion (+10%). Consequently, the fund allocation to these two groups increased to 38.2% and 8.2%, respectively.

In terms of price movements, the VN30 index rose by 8.7%, mainly driven by strong gains in Vingroup stocks such as VIC (+44.7%), VHM (+32.9%), and VRE (+16.3%), while most other stocks recovered slightly. In contrast, the growth of VNMID (+9.02%) and VNSML (+7.04%) reflected a more balanced improvement compared to the performance of large-cap stocks.

Market Pulse June 2nd: Energy Sector Surges, VN-Index Recaptures Green Territory

The trading session concluded with the VN-Index climbing 3.7 points (+0.28%), reaching 1,336.3. Meanwhile, the HNX-Index witnessed a rise of 2.95 points (+1.32%), ending at 226.17. The market breadth tilted towards gainers, as 438 stocks advanced against 323 decliners. Similarly, the VN30 basket saw a slight dominance of greens, with 16 gainers, 13 losers, and 1 stock remaining unchanged.

The Billion-Dollar Fund Management Industry: Unveiling the Bond Market’s Top Players

As of Q1 2025, the investment portfolio of the fund management industry – the primary source of revenue – stood at nearly VND 601 trillion, a modest 2% increase from the start of the year. The industry boasts 19 companies with portfolios worth thousands of billions of dong, one more than at the beginning of the year. Companies backed by the insurance industry continue to dominate in terms of the scale of entrusted assets.

Market Pulse June 2nd: Blue Chips Dive, VN-Index Down Over 8 Points

The heavy pressure from the pillar group is causing the VN-Index to gradually lose momentum in the late morning session. By the mid-session break, the VN-Index had dropped 0.62%, settling at 1,324.4 points. In contrast, the HNX-Index climbed 0.66% to reach 224.69 points. The market breadth was negative, with 353 declining stocks against 306 gainers.

The Big Dip: Why Large-Cap Stocks are Taking a Tumble, While Small Real Estate Remains Resilient

The market opened the month of June with a steep decline in the VN30-Index, erasing 0.99% as large-cap stocks faced downward pressure. The VN-Index also took a hit, falling 0.62% due to losses in VIC and VHM. However, money continued to flow into mid-cap stocks, indicating a cautious but persistent appetite for opportunities in the market.