On June 6, 2025, FTSE will announce the constituent stocks of the FTSE Vietnam Index. On June 13, 2025, MarketVector will announce the MarketVector Vietnam Local Index.

June 20, 2025, is expected to be the day for the completion of the restructuring of the portfolios of ETFs referencing these indices. BSC forecasts changes in the composition of the above indices as follows: There will be no changes in this review period for the FTSE Vietnam Index (Xtracker ETF reference) and MarketVector Vietnam Local Index (VanEck Vectors Vietnam ETF reference).

Note that for the FTSE Vietnam Index: SIP is close to the minimum trading value threshold as per the index regulations and may be removed if it fails to meet this criterion.

On the other hand, due to the strong price increase of large-cap stocks in the index basket (VIC, VHM, VRE) in Q2 2025, DIG, DPM, FTS, HSG, PDR, PVD, TCH, VCG, VPI, and VTP may not meet the minimum capitalization value condition to remain in the basket, referencing the provisions of Section 5.8, Chapter 5 of the FTSE Vietnam Index Regulations published by FTSE).

For the MarketVector Vietnam Local Index: HDG is close to the accumulated capitalization value threshold for stocks in the index basket.

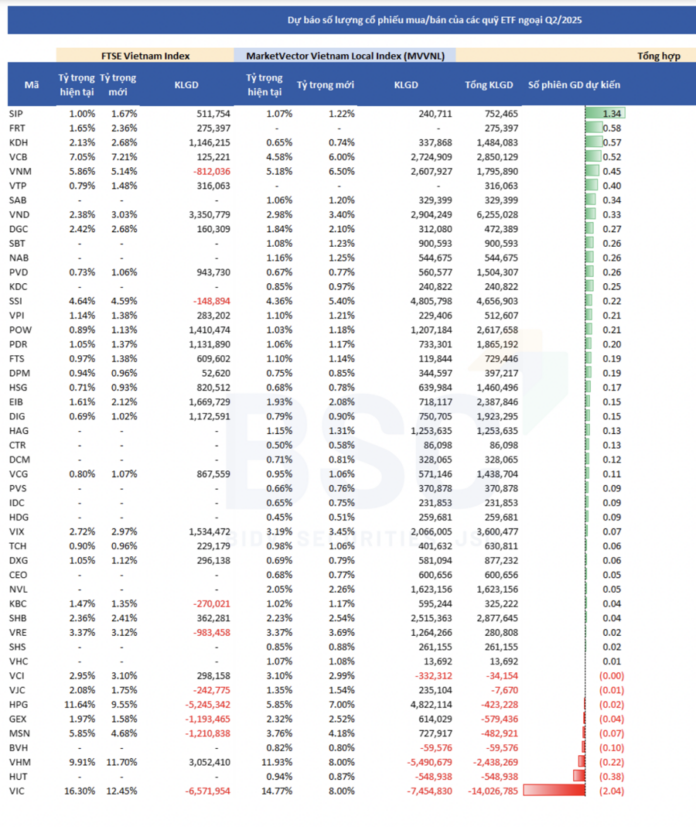

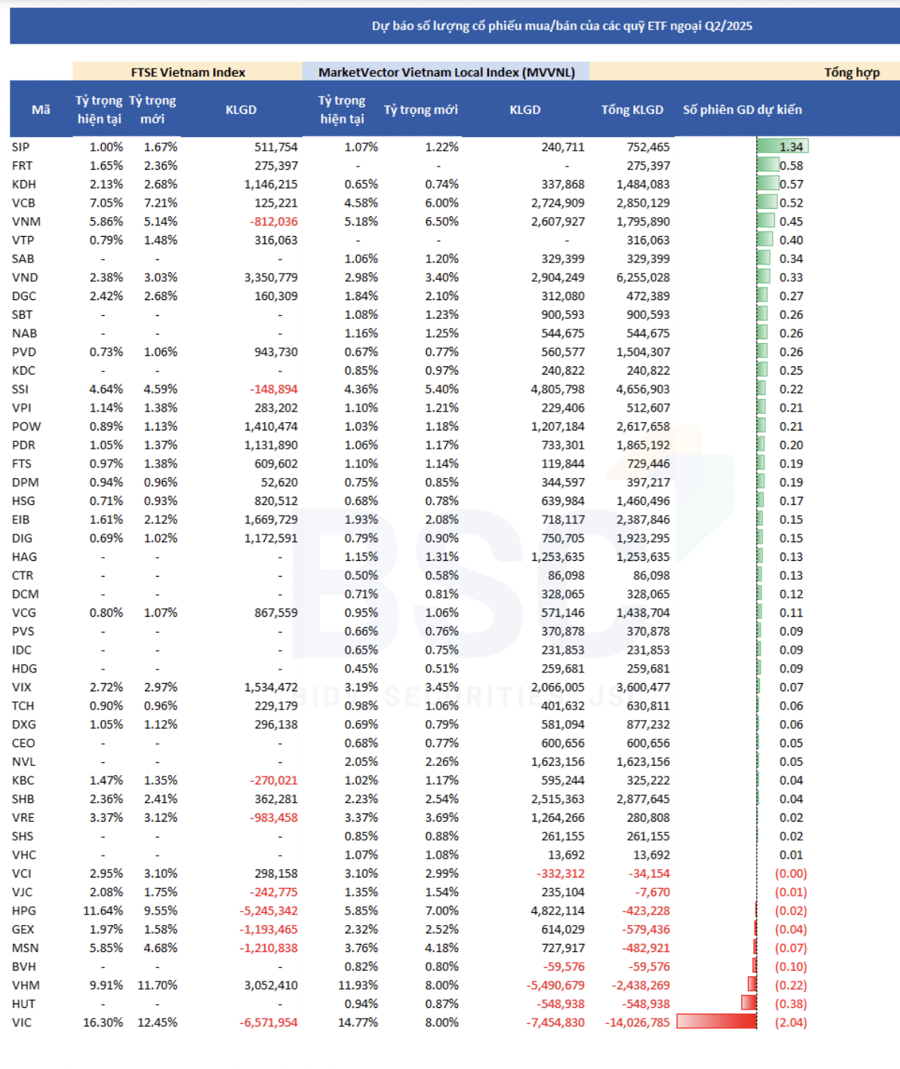

BSC forecasts the number of stocks to be bought/sold for ETFs referencing these indices. Specifically, for the Xtracker ETF, the highest number of additional purchases will be 3.3 million VND stocks, 3 million VHM stocks, 1.6 million EIB stocks, 1.5 million VIX stocks, and 1.4 million POW stocks. KDH will also buy 1.14 million shares. On the opposite direction, VIC was the most sold off, with 6.5 million shares sold, followed by HPG with 5.2 million shares sold; 1.2 million shares of MSN were sold; and GEX sold 1.19 million shares.

For VanEck Vectors Vietnam ETF, the fund will also sell 7.4 million VIC shares, 2.4 million VHM shares, and hundreds of thousands of other shares such as HUT, MSN, GEX, and HPG. In the opposite direction, the fund will additionally purchase 6 million VND shares, 4.6 million SSI shares, 3.6 million VIX shares, 2.6 million POW shares, 2.8 million SHB shares, 2.8 million VCB shares, 1.4 million KDH shares, and 1.4 million VCG shares…

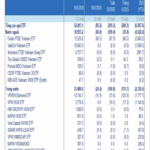

Previously, Yuanta Securities also forecasted for the FTSE Vietnam Index (FTSE Vietnam ETF reference) that there would be no new additions or removals of stocks in this restructuring period. However, the fund still makes significant adjustments to the proportions of some stocks.

It is expected that SHB will be the most actively purchased, with a volume of up to 17.7 million shares, followed by EIB with about 8.3 million shares bought. On the other hand, many large-cap stocks will face selling pressure, including HPG, which is expected to sell more than 4.9 million shares, SSI about 4.2 million shares, and VCI nearly 2.4 million shares.

For the MarketVector Vietnam Local Index (VNM ETF reference), Yuanta Securities also believes that there will be no changes in the stock composition. However, adjustments to weights are still being made.

SHB continues to be the focus of buying with about 4 million shares, along with codes such as SSI (4.3 million shares), SBT (3.3 million), POW (3.1 million), and VNM (2.9 million). On the selling side, two large real estate stocks, VIC and VHM, are expected to reduce their holdings significantly, with corresponding sales volumes of 7.3 million and 4.6 million shares, respectively. In addition, codes such as VCI, MSN, BVH, and HUT are also on the sell list in this restructuring.

The First Time Since Early 2025: Vietnam Equity-Focused ETFs See Inflows

Vietnam-focused equity ETFs witnessed their first net inflows since the start of 2025, attracting nearly VND 216 billion.

The Evolution of HOSE: Crafting a Robust Index System for the Stock Market

The evolution of the stock index system at HOSE over the past 25 years has been a remarkable journey. What started as a solitary VN-Index has now blossomed into a comprehensive ecosystem of indices. These indices have become the market’s guiding compass, providing direction and facilitating the development of a diverse range of financial products. They have played a pivotal role in enhancing investment tools and risk management strategies, shaping the financial landscape in Vietnam.