Consumer demand in the first months of 2025 showed improvement from the previous quarter, supported by positive macroeconomic factors such as a 6.9% GDP growth year-over-year and a 10.6% increase in exports, boosting consumer income and purchasing power. As a result, the retail industry continued its recovery trend and recorded healthy revenue growth.

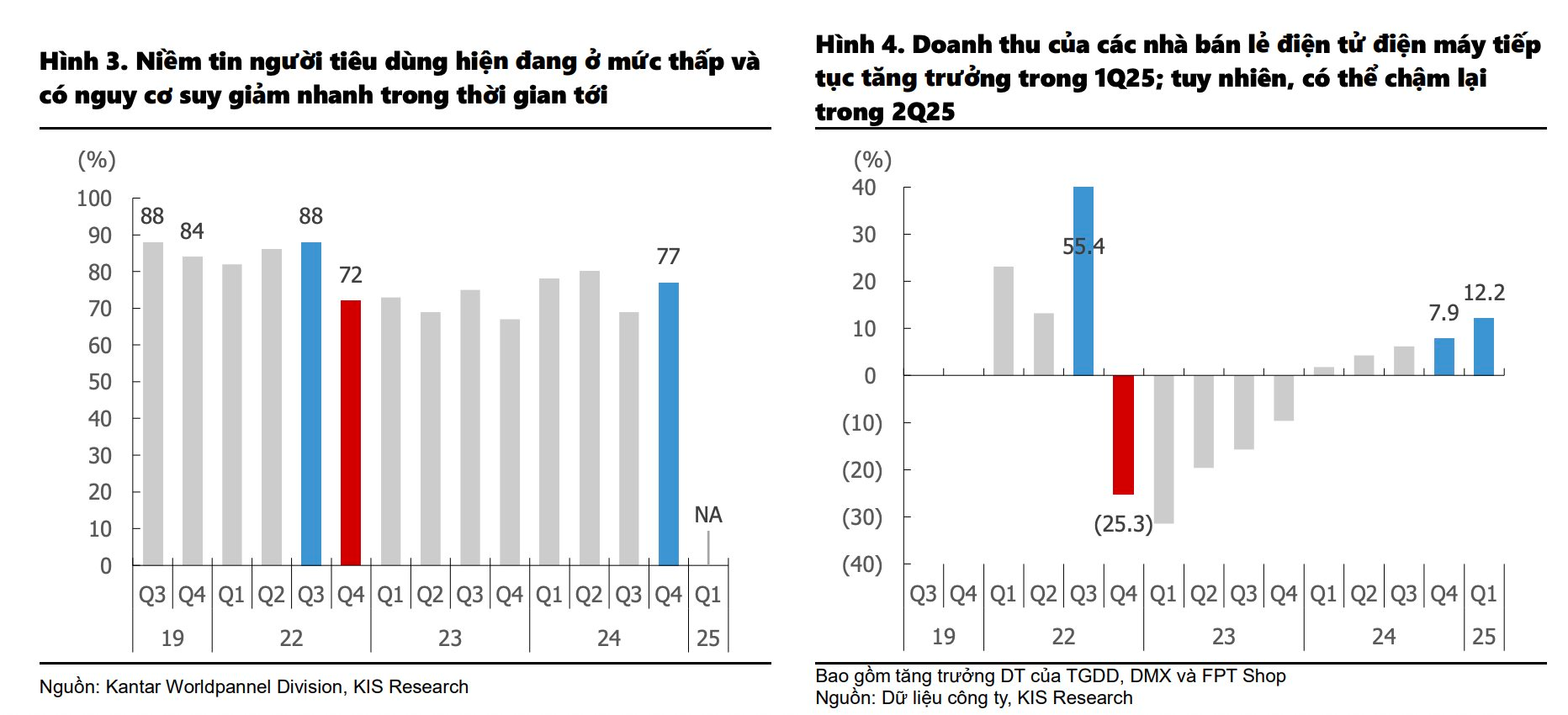

However, the latest report from KIS Securities suggests that consumer demand may remain weak or even decline further in the remaining months of 2025 due to the negative impact of tariff policies on the economy. According to KIS, spending trends could decrease as consumer confidence weakens amid an uncertain future. Additionally, purchasing power may diminish as industrial production slows down due to reduced export demand, leading to a decline in consumer income.

Non-essential consumption will be more severely impacted

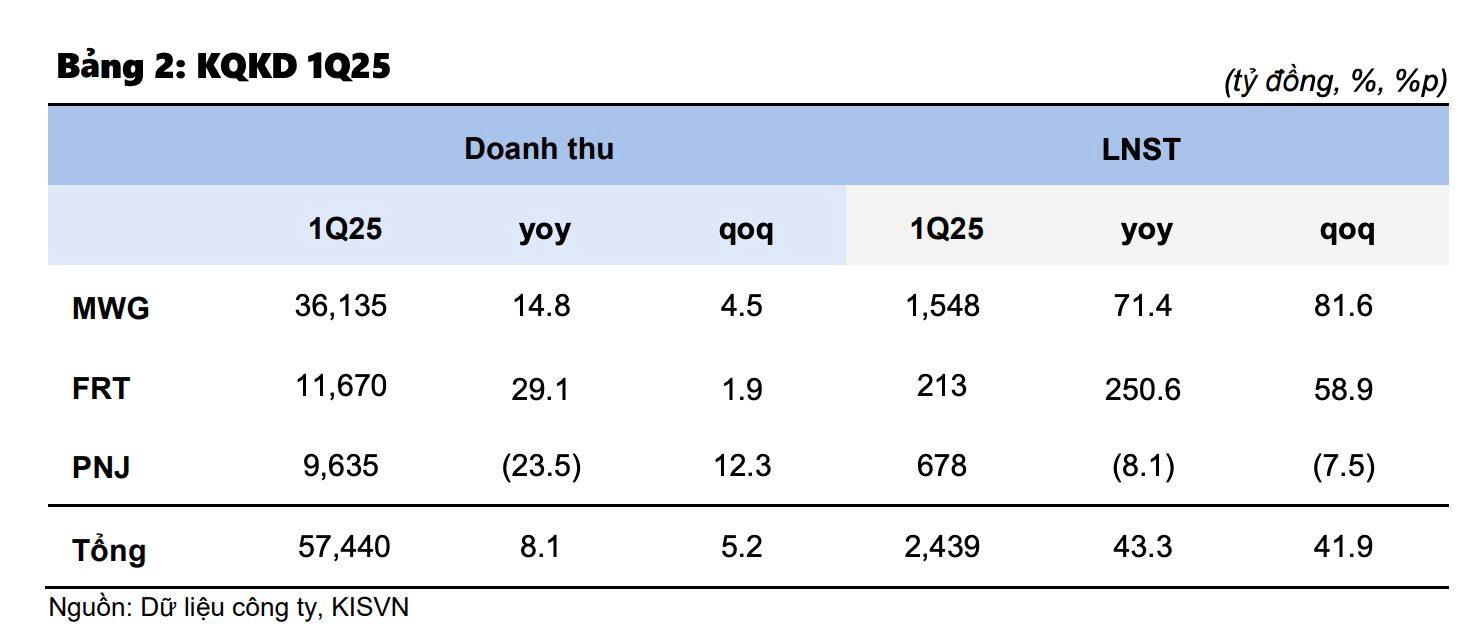

KIS notes that listed retail chains posted positive performance in Q1/2025. In the electronics and appliances sector, recovery trends varied among different chains. While overall revenue grew by 12.2%, the pace of recovery was uneven. Specifically, The Gioi Di Dong (TGDD) and Dien May Xanh (DMX) witnessed stronger rebounds with 22% and 10% year-over-year growth, respectively, while FPT Shop’s increase was more modest at 2.8%.

KIS attributes this disparity to MWG gaining additional market share. Looking ahead to Q2, overall demand for ICT-electronics and appliances is projected to remain weak as consumers tend to postpone purchases due to uncertainty about the future. This will slow down the recovery of listed ICT-CE retail chains. Moreover, whether weak demand persists into Q3 will largely depend on the actual impact of tariff policies on the economy.

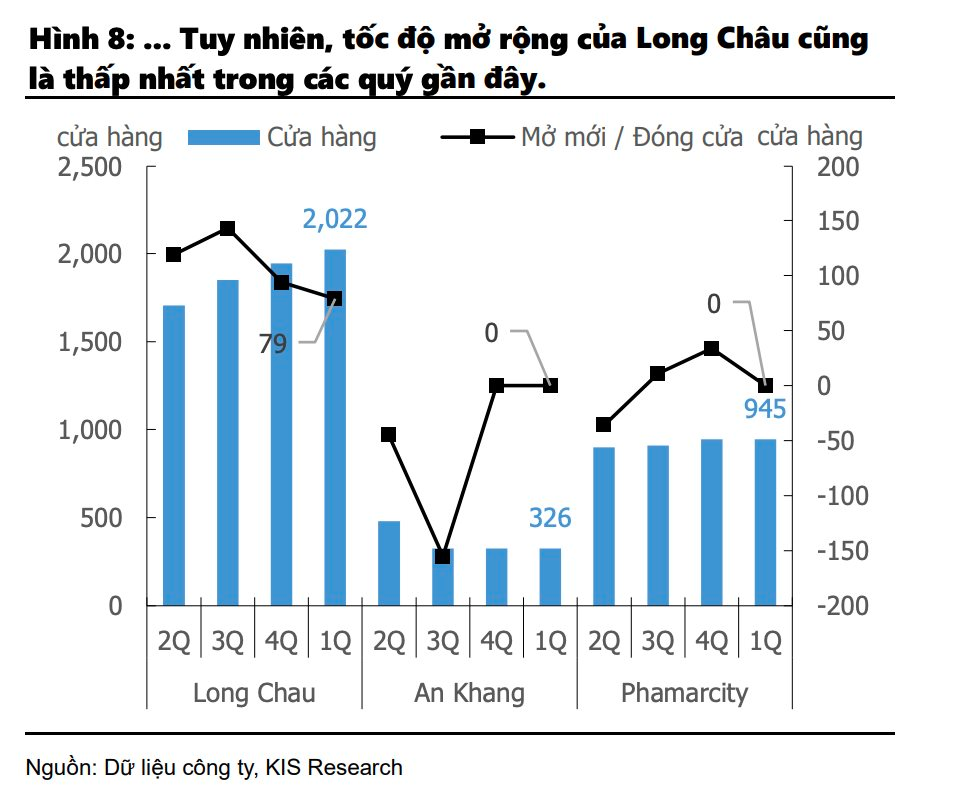

In the pharmaceutical retail segment, the number of modern drugstores increased by 79 in Q1, reaching a total of 3,293. This growth rate slowed compared to the addition of 131 stores in Q4 last year. The expansion was mainly driven by Long Chau, while An Khang and Pharmacity maintained their store counts. KIS assesses that the modern drugstore market has passed the rapid growth stage and entered a phase of market share consolidation, with overall market value increasing at a slower pace and market share concentrating among a few large chains. In Q2, KIS forecasts that Long Chau will continue to open approximately 80 drugstores, while Pharmacity’s expansion may slow, and An Khang will likely maintain its current store count to focus on achieving breakeven.

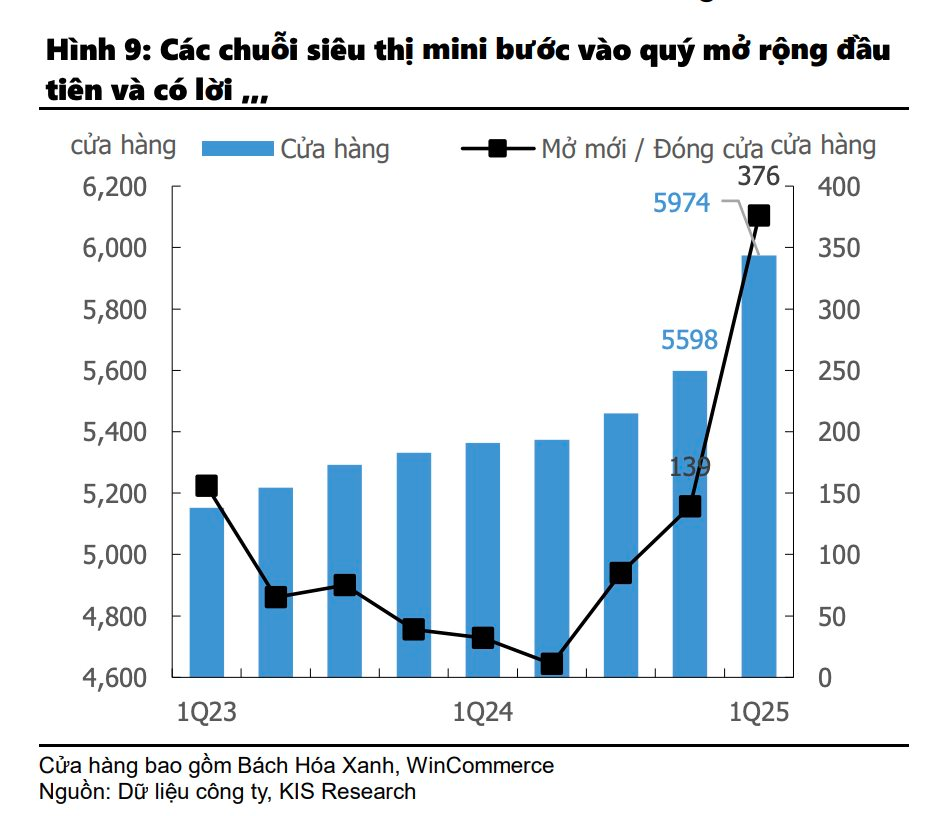

Regarding the hypermarket and supermarket mini-chain segment, KIS observes that this sector is entering an expansion phase. In Q1, two mini-supermarket chains (Bach Hoa Xanh and WinCommerce) embarked on their first expansion phase, opening 232 and 144 new stores, respectively, faster than expected. Both chains are also aggressively expanding in the Central region to capture market share, with approximately 70% of BHX’s new stores (~162 stores) and 45% of WCM’s (~64 stores) located in this region. Despite a decrease in net profit for BHX and WCM compared to the previous quarter, KIS believes this is not a negative sign as the chains prioritize store expansion to build a competitive advantage in scale. In Q2/2025, the two chains may continue their rapid expansion, but the pace could slow down if consumer demand is impacted.

MWG Pins Hope on Bach Hoa Xanh, FRT Profits from Pharmacy Sales, PNJ Faces Dual Pressure

Regarding the performance of retail businesses, for MWG, in Q2/2025, KIS Research anticipates that revenue growth for TGDD and DMX may not be as robust as in the first quarter due to the impact of tariffs on consumer demand, which, at the very least, affects consumers’ willingness to spend. Meanwhile, the number of stores is expected to remain at current levels.

Bach Hoa Xanh’s revenue rose to VND 3,900 billion due to the addition of 232 stores. Despite the rapid store opening pace, average revenue per store remained at VND 1.9-2.0 billion, thanks to strong same-store sales growth (SSSG) from existing stores and high revenue from new stores. Based on the average revenue per store, KIS estimates that Bach Hoa Xanh’s net profit was approximately VND 25-50 billion in Q1. This is a positive sign as the expansion pace exceeded expectations, and the chain continues to report positive net profit. In Q2/2025, Bach Hoa Xanh is expected to open an additional 200-250 stores and record a net profit of VND 50-100 billion (due to profits from stores opened in Q4/2024 and reduced losses from stores opened in Q1).

Overall, KIS believes that MWG’s net profit in Q2 will be lower than in Q1 due to the off-peak season. Typically, Q2 profit is about 20% lower than in Q1. Therefore, if demand does not weaken further due to tariff impacts, KIS expects MWG’s net profit to reach approximately VND 1,200 billion or higher. Conversely, if demand falls short of expectations, this figure could be lower.

For FPT Retail (FRT), Long Chau remains the primary driver of revenue and net profit growth, while FPT Shop’s recovery is slowing. The pace of expansion for the pharmacy chain is almost the slowest in recent quarters, while the number of vaccination centers increased slightly. In Q2, KIS believes that FRT’s revenue growth may decelerate (~80 Long Chau stores and about 20 vaccination centers). FPT Shop’s revenue will likely remain subdued (especially considering the impact of tariffs on consumer demand). Store closures may continue in the coming quarters but at a lower scale. Therefore, KIS expects FPT Shop to potentially record a small net loss as revenue may not fully cover fixed costs.

FRT’s net profit will continue to increase significantly, driven by contributions from existing pharmacies, while vaccination centers will remain in the breakeven phase.

For PNJ, in Q1/2025, PNJ faced dual pressure as not only did consumer demand weaken, but rising gold prices also negatively impacted the business, making jewelry more expensive and reducing consumer purchases, particularly affecting the supply of gold raw materials. In Q2, KIS believes that retail jewelry demand will depend on gold price movements, which will continue to fluctuate due to global macroeconomic conditions.

Additionally, 24K gold sales will likely continue to decline significantly compared to the high base in the same period last year. The high gold price has also increased raw material costs, negatively impacting the gross profit margin of the jewelry retail segment. In Q2/2025, KIS forecasts a slight decrease in PNJ’s net profit due to weak jewelry sales and the ongoing shortage of gold raw material supply.

“Retail Stock Valuations at Historic Highs: The Risk of a Sharp Correction Looms as Consumer Demand May Not Evenly Recover.”

The Retail stock group faces the risk of premium valuation compared to the broader market. This exposure could trigger a significant correction if the industry’s outlook is adversely affected, especially with the backdrop of uneven recovery in purchasing power.